There is now a rethink on significant capital commitments as hundreds of Indian families are seen affected.

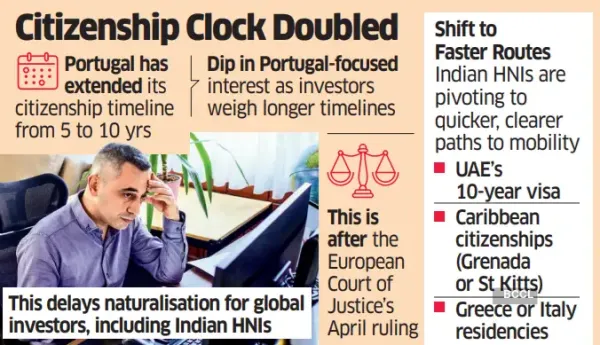

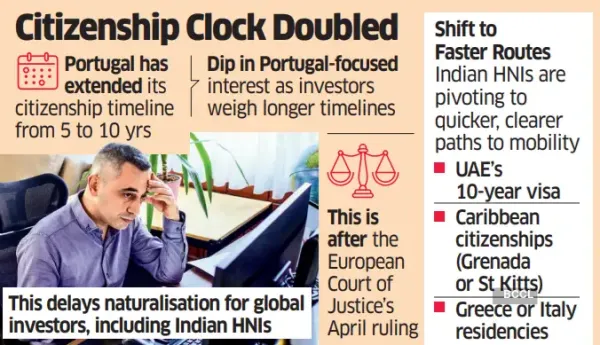

Portugal's move to double the time required for foreigners to acquire citizenship to 10 years has not only prolonged the wait for an EU passport for affluent Indians but also underlines a key symbol of Europe's changing attitude toward investment-driven migration.

The European Court of Justice's April ruling against Malta's "citizenship-for-sale" model and the continent's growing rightward shift have together turned what was once a smooth path to European residency into a more complex maze for global investors, said experts.

For Indian high-net worth individuals (HNIs), Portugal, through its golden visa programme, had long offered a relatively accessible gateway to European mobility-minimal stay requirements, realty-linked investments and eventual Schengen access.

Sentiment has since cooled as Lisbon tightened rules, making otherwise level-headed HNIs jittery, pushing them to scout for alternative destinations.

(Join our ETNRI WhatsApp channel for all the latest updates)

"Portugal's decision to extend its citizenship timeline from five to up to 10 years has delayed naturalisation plans for many Indian investors," said Gopal Kumar, founder of borderless.VIP, a global citizenship and residency advisory firm. "Around 10-12 clients in my current pipeline are directly affected, representing roughly 10 million euros in capital." While residency-focused applicants remain steadfast in their pursuit of Portugal's golden visa, Kumar said, "Citizenship-oriented investors are already shifting to faster jurisdictions."

While residency-focused applicants remain steadfast in their pursuit of Portugal's golden visa, Kumar said, "Citizenship-oriented investors are already shifting to faster jurisdictions."

The broader reordering is visible in the foreign destinations being chased by wealthy Indians currently.

Public Sentiment

Kumar said clients are pivoting to the UAE’s 10-year residency route, Caribbean citizenship programmes, such as Grenada and St. Kitts, and the US EB-5, or Greece for residency.

“Since the ECJ ruling, Portugal-focused inquiries have fallen by 30–40%, while interest in the UAE and Caribbean has risen,” he said.

According to Kunal Sharma, founder, Taraksh Lawyers & Consultants, “roughly 300–500 Indian families” may be caught in the transition, representing 150–250 million euros in committed capital.

“Many applicants built their plans around a five-year passport horizon—that timeline is now effectively doubled,” he said.

Experts noted that rising housing costs and the spectre of the emerging far-right have made the Portuguese government more sensitive to public sentiment against passports for sale.

“The decision to double the residency period is as much about optics and compliance with EU norms as it is about tightening migration control,” said Sharma.

“The underlying message is clear: citizenship will follow meaningful integration, not merely investment,” he added.

According to Andri Boiko, founder of Garant In, a global residency and citizenship provider, the tightening is part of a wider European recalibration.

“A more fragmented government in Portugal and a growing far-right presence have pushed citizenship and migration to the forefront of political debate,” he said. “Across Europe, governments are under pressure to prove that citizenship must be earned through genuine connection, not financial contribution alone.”

Sharma noted that investor caution started in mid-2023 when Portugal scrapped its real estate route, a sentiment magnified by the ECJ’s stance against commercialised citizenship.

“Inquiries for EU programmes from Indian clients have dropped noticeably, while interest in UAE and Caribbean options has grown by at least 20–30% over the past two quarters,” he added.

The uncertainty has also rattled those still in the pipeline for Portuguese citizenship.

Boiko said that his company is seeing a rush among Indian applicants to “lock in” under the old regime before the final implementation date, even as prospective clients turn to Greece, Italy, and France for quicker, clearer paths to a Schengen visa.

For Indian wealth managers, the message is clear — diversify or risk obsolescence.

“Those further down the line will weigh whether the time and financial commitment is worthwhile,” said Keshav Singhania, head of private client practice at law firm Singhania & Co.

He said many investors are now turning to venture capital and private equity funds targeting sustainable sectors such as renewable energy and cultural heritage projects, areas that contribute to socio-economic value beyond financial returns.

The European Court of Justice's April ruling against Malta's "citizenship-for-sale" model and the continent's growing rightward shift have together turned what was once a smooth path to European residency into a more complex maze for global investors, said experts.

For Indian high-net worth individuals (HNIs), Portugal, through its golden visa programme, had long offered a relatively accessible gateway to European mobility-minimal stay requirements, realty-linked investments and eventual Schengen access.

Sentiment has since cooled as Lisbon tightened rules, making otherwise level-headed HNIs jittery, pushing them to scout for alternative destinations.

(Join our ETNRI WhatsApp channel for all the latest updates)

"Portugal's decision to extend its citizenship timeline from five to up to 10 years has delayed naturalisation plans for many Indian investors," said Gopal Kumar, founder of borderless.VIP, a global citizenship and residency advisory firm. "Around 10-12 clients in my current pipeline are directly affected, representing roughly 10 million euros in capital."

The broader reordering is visible in the foreign destinations being chased by wealthy Indians currently.

Public Sentiment

“Since the ECJ ruling, Portugal-focused inquiries have fallen by 30–40%, while interest in the UAE and Caribbean has risen,” he said.

According to Kunal Sharma, founder, Taraksh Lawyers & Consultants, “roughly 300–500 Indian families” may be caught in the transition, representing 150–250 million euros in committed capital.

“Many applicants built their plans around a five-year passport horizon—that timeline is now effectively doubled,” he said.

Experts noted that rising housing costs and the spectre of the emerging far-right have made the Portuguese government more sensitive to public sentiment against passports for sale.

“The decision to double the residency period is as much about optics and compliance with EU norms as it is about tightening migration control,” said Sharma.

“The underlying message is clear: citizenship will follow meaningful integration, not merely investment,” he added.

According to Andri Boiko, founder of Garant In, a global residency and citizenship provider, the tightening is part of a wider European recalibration.

“A more fragmented government in Portugal and a growing far-right presence have pushed citizenship and migration to the forefront of political debate,” he said. “Across Europe, governments are under pressure to prove that citizenship must be earned through genuine connection, not financial contribution alone.”

Sharma noted that investor caution started in mid-2023 when Portugal scrapped its real estate route, a sentiment magnified by the ECJ’s stance against commercialised citizenship.

“Inquiries for EU programmes from Indian clients have dropped noticeably, while interest in UAE and Caribbean options has grown by at least 20–30% over the past two quarters,” he added.

The uncertainty has also rattled those still in the pipeline for Portuguese citizenship.

Boiko said that his company is seeing a rush among Indian applicants to “lock in” under the old regime before the final implementation date, even as prospective clients turn to Greece, Italy, and France for quicker, clearer paths to a Schengen visa.

For Indian wealth managers, the message is clear — diversify or risk obsolescence.

“Those further down the line will weigh whether the time and financial commitment is worthwhile,” said Keshav Singhania, head of private client practice at law firm Singhania & Co.

He said many investors are now turning to venture capital and private equity funds targeting sustainable sectors such as renewable energy and cultural heritage projects, areas that contribute to socio-economic value beyond financial returns.