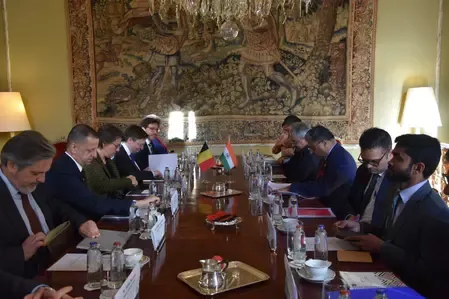

Mumbai: Belgium, a hub of several Indian diamond merchants and the residence of the fugitive Mehul Choksi, will share all 'old' information with India on 'criminal tax matters'.

This new provision, along with other procedures to salvage tax, is incorporated in the revised India-Belgium tax treaty which was notified by the finance ministry on Monday.

Under the amended treaty, Belgium would share data pertaining to even those issues that date back to the period before the agreement between the two countries came into force.

Criminal tax matters relate to issues involving 'intentional conduct' which are liable to prosecution under criminal and tax laws in India.

Information like old transaction records with overseas banks, account opening forms, offshore trust deeds, date of incorporation of foreign companies and their original shareholdings help the Income tax (I-T) department to build their cases against suspected tax offenders.

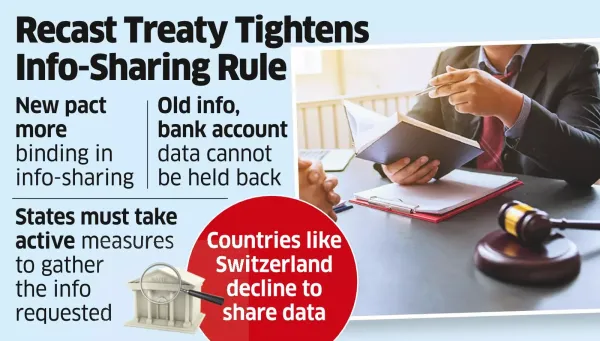

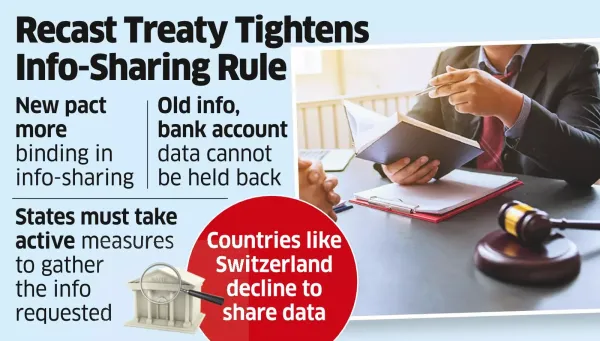

However, the cut-off date before which countries are reluctant to share information has been a vexed issue. For instance, India has been inundated with data on Swiss bank accounts and their beneficiaries, Switzerland is unwilling to part with information prior to April 1, 2011, when the protocol to amend the India-Switzerland double taxation avoidance Treaty came into effect.

Asked whether a similar clause could be introduced in the treaty with Switzerland, Ashish Mehta, partner at Khaitan & Co, said, "Indian tax administration has been very active in utilizing these avenues of seeking information from various nations and one can expect similar changes being proposed and negotiated with other treaty countries as well. Continuous steps are being taken globally to facilitate and ease sharing of information amongst nations. The amendment of the tax treaty with Belgium is one more step in that direction."

The treaty with Belgium was signed in April '93 and the protocol leading to the current gazette notification was initiated in March 2017. "It marks a defining point in India's treaty framework as it's for the first time, a tax treaty explicitly articulates the concept of 'criminal tax matters', which until now was largely confined to standalone Tax Information Exchange Agreements. Equally significant are the far-reaching changes to the exchange of information and tax collection articles," said Ashish Karundia, founder of the CA firm Ashish Karundia & Co.

Some of the stipulations of the amended treaty are: a contracting state cannot decline to supply information solely because it has no domestic interest in such information; information cannot be held back on the grounds that it is held by a bank or financial institution or nominees or person acting in a fiduciary capacity; and, the state which receives request or tax claim must take "measures conservancy" - like freezing assets - even if it is owed by a person who has the right to prevent its collection.

"With all this, the revised provisions eliminate previous limitations linked to the scope of taxes covered, obligating both jurisdictions to exchange information even in the absence of domestic tax interest. The removal of banking and fiduciary secrecy, along with the extension of mutual assistance in tax collection to non-residents and third-country taxpayers, represents a major step towards aligning India's treaty practice with global transparency norms," said Karundia.

While the information can be used for purposes like collection and enforcement of specific laws, the treaty allows the information to be disclosed in public court proceedings. Such disclosures may pave the way for other agencies like the Enforcement Directorate to step in.

This new provision, along with other procedures to salvage tax, is incorporated in the revised India-Belgium tax treaty which was notified by the finance ministry on Monday.

Under the amended treaty, Belgium would share data pertaining to even those issues that date back to the period before the agreement between the two countries came into force.

Criminal tax matters relate to issues involving 'intentional conduct' which are liable to prosecution under criminal and tax laws in India.

Revised treaty opens access to old offshore data for tax probes

Information like old transaction records with overseas banks, account opening forms, offshore trust deeds, date of incorporation of foreign companies and their original shareholdings help the Income tax (I-T) department to build their cases against suspected tax offenders.

However, the cut-off date before which countries are reluctant to share information has been a vexed issue. For instance, India has been inundated with data on Swiss bank accounts and their beneficiaries, Switzerland is unwilling to part with information prior to April 1, 2011, when the protocol to amend the India-Switzerland double taxation avoidance Treaty came into effect.

Asked whether a similar clause could be introduced in the treaty with Switzerland, Ashish Mehta, partner at Khaitan & Co, said, "Indian tax administration has been very active in utilizing these avenues of seeking information from various nations and one can expect similar changes being proposed and negotiated with other treaty countries as well. Continuous steps are being taken globally to facilitate and ease sharing of information amongst nations. The amendment of the tax treaty with Belgium is one more step in that direction."

The treaty with Belgium was signed in April '93 and the protocol leading to the current gazette notification was initiated in March 2017. "It marks a defining point in India's treaty framework as it's for the first time, a tax treaty explicitly articulates the concept of 'criminal tax matters', which until now was largely confined to standalone Tax Information Exchange Agreements. Equally significant are the far-reaching changes to the exchange of information and tax collection articles," said Ashish Karundia, founder of the CA firm Ashish Karundia & Co.

Some of the stipulations of the amended treaty are: a contracting state cannot decline to supply information solely because it has no domestic interest in such information; information cannot be held back on the grounds that it is held by a bank or financial institution or nominees or person acting in a fiduciary capacity; and, the state which receives request or tax claim must take "measures conservancy" - like freezing assets - even if it is owed by a person who has the right to prevent its collection.

"With all this, the revised provisions eliminate previous limitations linked to the scope of taxes covered, obligating both jurisdictions to exchange information even in the absence of domestic tax interest. The removal of banking and fiduciary secrecy, along with the extension of mutual assistance in tax collection to non-residents and third-country taxpayers, represents a major step towards aligning India's treaty practice with global transparency norms," said Karundia.

While the information can be used for purposes like collection and enforcement of specific laws, the treaty allows the information to be disclosed in public court proceedings. Such disclosures may pave the way for other agencies like the Enforcement Directorate to step in.

( Originally published on Nov 11, 2025 )