Applied Materials, Inc. (AMAT) stock fell over 4% in Thursday’s extended session, despite the chip-equipment maker's upbeat fourth-quarter report. Management commentary that demand is expected to take off only in the second half of fiscal year 2026, as well as weakening China revenue, weighed on AMAT stock.

For the year-to-date period, Applied Materials stock has gained more than 38%.

Santa Clara, California-based Applied Materials reported year-over-year (YoY) declines in both adjusted earnings per share (EPS) and revenue, even as CEO Gary Dickerson sounded upbeat about artificial intelligence (AI)-related demand.

Here’s how the key quarterly numbers stack up:

Among segments, semiconductor systems revenue, accounting for 70% of total revenue, declined 8% YoY, while Applied Global Services revenue remained nearly flat at $1.63 billion.

Dickerson said, “As AI adoption drives substantial investment in advanced semiconductors and wafer fab equipment, Applied Materials delivered its sixth consecutive year of growth in fiscal 2025.”

During the earnings call, CFO Brice Hill stated that China revenue declined to 29% of total revenue, significantly below the 45% peak in the first quarter of fiscal 2024, according to a Koyfin transcript.

The company guided first-quarter adjusted EPS to $2.18 ± $0.20 and revenue to $6.85 billion ± $500 million. Analysts, on average, estimate the metrics at $2.15 and $6.80 billion, respectively.

Citing conversations with customers and partners, CFO Hill stated that the company is preparing to support higher demand, starting in the second half of calendar year 2026. “We have targeted our R&D investments to create new products and technologies that will enable even faster and more energy-efficient transistors, chips, and systems and drive our growth in the years ahead.”

On the earnings call, Hills stated that the adjusted gross margin is expected to be 48.4% in the first quarter and remain at that level until volumes increase to support higher demand in the second half of the next fiscal year.

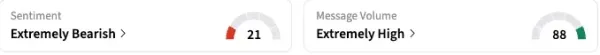

On Stocktwits, retail sentiment toward AMAT stock plunged to ‘extremely bearish’ as of late Thursday, from ‘neutral’ a day before. Retail chatter on the stream climbed to ‘extremely high’ levels amid the earnings release, with the message volume rising by about 2,300% over the 24 hours leading up to late Thursday.

A watcher predicted that the stock would pull back toward $200 on Friday.

Another user expressed concern about the company’s declining revenue in China.

Applied Materials stock has traded in a 52-week range of $123.74-$242.50, with the high set on Oct. 30. The stock settled down 3.25% in Thursday's session to $223.23 amid the broader market meltdown. The stock’s all-time high of $255.89 was scaled in July 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<