Over 23 years from March 2002 to September 2025, a study by DSP Mutual Fund shows that the 3-year rolling return of aggressive hybrid funds—represented by the benchmark CRISIL Hybrid 35+65 – Aggressive Index— delivered an average return of 12.9%.

As equity markets struggle to find momentum with the Nifty hovering around all-time highs, investors are preferring to tread on the side of caution. Financial advisers say demand is rising for equity oriented products that offer greater predictability in returns.

Aggressive hybrid funds, a category that bets on both equity and debt, is one such product that’s finding takers as category returns have been quite similar to those of plain-vanilla equity but with much lower volatility.

Over 23 years from March 2002 to September 2025, a study by DSP Mutual Fund shows that the 3-year rolling return of aggressive hybrid funds—represented by the benchmark CRISIL Hybrid 35+65 – Aggressive Index— delivered an average return of 12.9%.

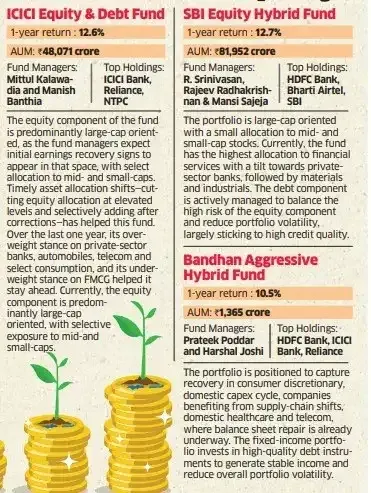

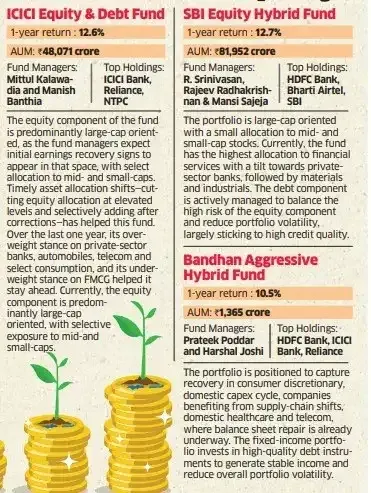

In comparison, the Nifty Total Returns Index (TRI) delivered 13.8%. Aggressive hybrid funds had a far lower standard deviation of 7.2% compared to 11.8% for equity funds. They also help rich investors looking for tax efficiency, as such schemes do not incur any capital gains tax during the rebalance of equity and debt, which gives better post-tax returns. A look at the top-performing schemes in the category:

Aggressive hybrid funds, a category that bets on both equity and debt, is one such product that’s finding takers as category returns have been quite similar to those of plain-vanilla equity but with much lower volatility.

Over 23 years from March 2002 to September 2025, a study by DSP Mutual Fund shows that the 3-year rolling return of aggressive hybrid funds—represented by the benchmark CRISIL Hybrid 35+65 – Aggressive Index— delivered an average return of 12.9%.

Best MF to invest

Looking for the best mutual funds to invest? Here are our recommendations.

In comparison, the Nifty Total Returns Index (TRI) delivered 13.8%. Aggressive hybrid funds had a far lower standard deviation of 7.2% compared to 11.8% for equity funds. They also help rich investors looking for tax efficiency, as such schemes do not incur any capital gains tax during the rebalance of equity and debt, which gives better post-tax returns. A look at the top-performing schemes in the category: