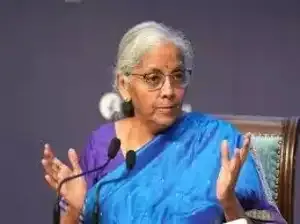

Finance minister Nirmala Sitharaman on Tuesday said the recent goods and services tax (GST) rate rationalisation has "largely corrected" the inverted duty structure faced by several industries, and assured that any remaining cases flagged by the industry would be addressed.

Replying to the discussion in the Rajya Sabha on the Manipur Goods and Services Tax (Second Amendment) Bill, 2025, she said the overhaul has ensured that all essential items now attract either zero or the lowest 5% GST rate, while eligible sectors continue to receive input tax credit.

She criticised the Opposition for "shedding crocodile tears" on Manipur and staging a walkout instead of participating in the debate. The Manipur GST (Second Amendment) Bill, 2025, gives effect to decisions of the 56th GST Council meeting. With the state under President's Rule, an Ordinance was promulgated on October 7 to implement the amendments. Following the minister's reply, the Upper House returned the bill to the Lok Sabha through a voice vote.

Replying to the discussion in the Rajya Sabha on the Manipur Goods and Services Tax (Second Amendment) Bill, 2025, she said the overhaul has ensured that all essential items now attract either zero or the lowest 5% GST rate, while eligible sectors continue to receive input tax credit.

She criticised the Opposition for "shedding crocodile tears" on Manipur and staging a walkout instead of participating in the debate. The Manipur GST (Second Amendment) Bill, 2025, gives effect to decisions of the 56th GST Council meeting. With the state under President's Rule, an Ordinance was promulgated on October 7 to implement the amendments. Following the minister's reply, the Upper House returned the bill to the Lok Sabha through a voice vote.