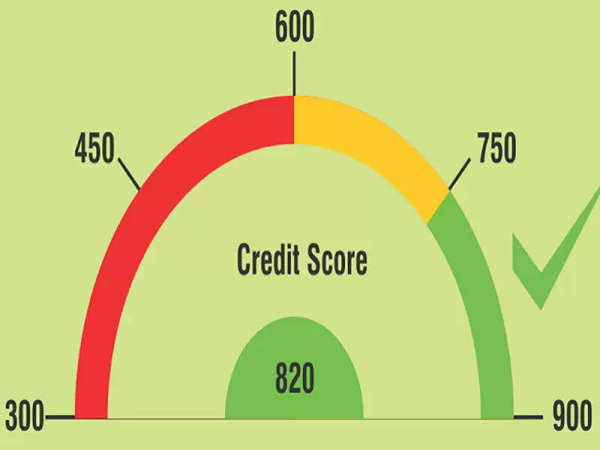

While taking a loan, every bank asks for your CIBIL score. CIBIL score tells you your repayment history. Although this score ranges from 300 to 900, a CIBIL score of 750 or above is considered good. You can improve it by doing transactions in a better way. But have you ever wondered how the CIBIL score is calculated? Let us know.

1- Payment history

Whether you have paid your old loan on time or not, this plays the biggest role in the calculation of your credit score. It sees how many payments you made on time, if late, then how many times you were late and it also sees how many times you have missed payment or EMI.

2- Credit Exposure

Apart from this, it is also seen how much credit i.e. loan is available in your name and how much of it you have used.

3- Credit history

This is also a big parameter in the calculation of CIBIL score. Credit history means the longer your loan is, the higher your CIBIL score will be. However, keep in mind that this loan should not be very big.

4- Credit type

While calculating the CIBIL score, it is also seen how many loans you have and what type they are. In this, it is checked how many are unsecured loans and how many are secured loans. The more secured loans you have, the better your CIBIL score will be.

5- Loan-related activities

In this calculation, all your loan-related activities are checked. It is seen whether you have taken too many loans recently because it means that the burden of the loan will increase on you. At the same time, it is also checked how many times you have inquired for a loan, because it is believed that you can take many loans in the future, due to which your liability will increase significantly.

Disclaimer: This content has been sourced and edited from ZEE Business Hindi. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.