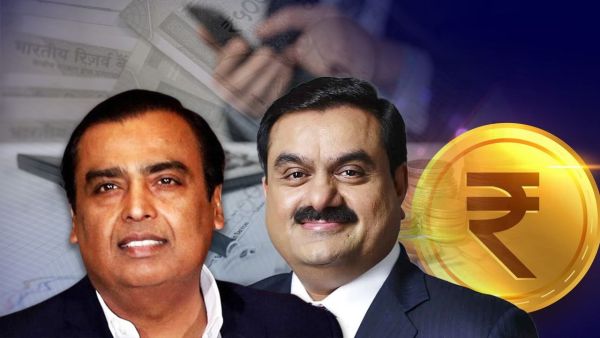

Trump's havoc has not appeared only on the billionaires of China and Europe. Rather, its impact has appeared on all the veterans around the world. If we talk about India, then in the year 2025, the wealth of the top legendary billionaires of the country has reduced 30.5 billion dollars i.e. 2.6 lakh crores. Most of this is due to US President Donald Trump's aggressive tariff policy, which has increased global trade stress and has created instability in the market. This financial devastation in the stock market has affected some of India's most influential billionaires, including Mukesh Ambani, Gautam Adani, Shiv Nadar, Savitri Jindal, Dilip Sanghvi and Azim Premji. Let us also tell you how much wealth has reduced in the wealth of which veteran of the country?

India's richest businessman Mukesh Ambani's net worth has fallen by $ 3.42 billion this year. Ambani is currently ranked 17th with assets of $ 87.2 billion. This year, Reliance Industries shares declined by about 0.1 per cent, while Geo Financial Services fell by 24 per cent. Gautam Adani's assets declined by $ 6.05 billion in 2025, as this giant group has faced important challenges due to total negative market sentiments. The group's leading company Adani Enterprises has suffered a loss of about 9% this year.

Savitri Jindal's wealth has fallen by $ 2.4 billion. Shiv Nadar, the founder of HCL Technologies, has lost the most assets of $ 10.5 billion among the billionaires of India. Indian markets have received significant corrections in 2025, in which benchmark indices like Sensex and Nifty have fallen by 4.5 per cent so far this year. Index such as BSE midcap and smallcap has fallen by more than 14% and 17% respectively.

One of the major reasons for this decline has been selling in the stock market of foreign institutional investors on a large scale. FIIs have sold from India's stock market amid the possibility of recession in high stock valuation, global economy. The aggressive tariff policies of US President Donald Trump have also increased global trade tension. These disruptions have negatively affected emerging markets like India, which has reduced the trust of investors and declined in export sector. Geophysical uncertainties have further influenced India's economic approach.

Many major areas including pharmaceuticals in India have recorded less corporate income than expected in recent times. Similarly, the wealth of Dilip Sanghvi, founder of Sun Pharma, has fallen by $ 3.34 billion this year. The pharmaceutical sector has faced regulatory pressures and tough competition, which has affected the stock performance of Sun Pharma. This year Sun Pharma has lost 10 percent.

India's GDP growth rate has come down significantly in FY 2024-25. According to the report, India's growth estimate has been reduced from 7 percent to 6.6 percent. Sluggish industrial production, decrease in rural expenditure and increasing inflation have eliminated the optimism of investors. Now the biggest question is what the coming year is. The Indian stock market is expected to fluctuate due to some other domestic factors such as global economic conditions and interest rates. However, analysts say that along with a decrease in inflation trend, measures to increase domestic consumption are good signs for markets.