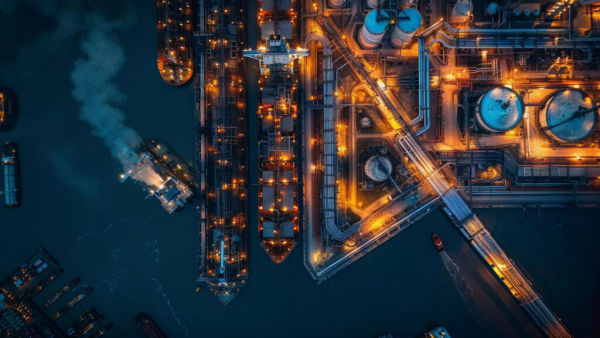

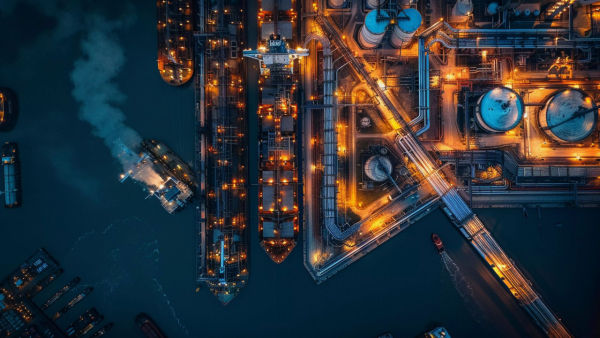

Iran israel conflict impact on Indian economy: After the increasing tension in West Asia and the attack on Iran’s nuclear bases by the US-Israel, there has been a sharp jump in crude oil prices in the international market. The price of Brent crude rose by 2% to $ 78.53 per barrel on Monday, the highest rate since January this year. Also, the approval of the Iranian Parliament to close the Straight of Hormuz has increased the risk of disrupting global supply.

India, which meets about 85% of its oil needs through imports, is directly affected by this increase. Increasing crude oil prices have a profound impact on India’s inflation, fiscal deficit, current account deficit and the domestic budget of the common man.

The first effect of increase in oil prices is seen on inflation. Crude oil is used in both transport and production, which makes essential items like petrol, diesel and LPG expensive. As a result, transportation and production costs increase, which directly affects the wholesale price index (WPI) and Consumer Price Index (CPI). Currently, India’s retail inflation rate is 2.82% according to the May 2025 data.

The Government of India gives subsidy on essential products like LPG and fertilizer so that common people can be saved from international prices. But when oil prices climb, the government either has to increase subsidy or cut tax, which leads to a decline in revenue or increase in expenditure. Currently, India’s fiscal deficit is 4.8% or ₹ 15.77 lakh crore of GDP, which is 100.5% of the revised target of FY26.

The current account deficit (CAD) also increases due to increasing oil import bill of India. If export does not increase at the same speed, then the country’s foreign exchange reserves decrease and the trust of investors starts to waver.

Currently the current account deficit is $ 11.5 billion in the October-December 2024 quarter or 1.1% of GDP.

Rupee is pressurized due to increasing demand for dollars for oil imports. The weakening of the rupee against the dollar not only makes oil more expensive but also makes other imports expensive, which increases imported inflation in India. On Monday, June 23, the rupee fell 17 paise to 86.72 per dollar.

When LPG and petrol and diesel are expensive, people have a direct impact on the monthly budget. Due to high spending on fuel, people reduce spending on other goods and services, which reduces demand in the market. It affects areas such as retail, travel and FMCG.

Increasing war clouds and crude oil prices in West Asia are pointing to challenging time for India. If the oil rates remain high in this way, then it will affect not only the government balance sheet but also the pocket of the common consumers.