Tiruppur is slowly moving towards uncharted territories of MMF apparel in which China takes the top spot.

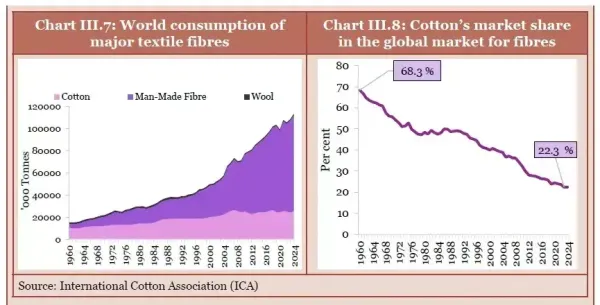

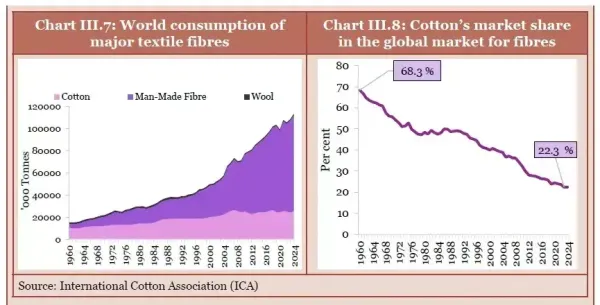

As the world embraces fast fashion, the demand for man-made fibre (MMF) is growing. To set the stage, more than 70% of the people worldwide currently wear garments made from MMF. “It is early days,” says Siva Subramaniam, a second-generation manufacturer and exporter of inner wear, T-shirts and sweaters, sitting in his factory office in Tiruppur. However, he firmly believes that “this is the future path for the industry”.

“We should think about the world market and how the demand is evolving,” says Subramaniam, the Founder & CEO of Raft Garments.

It has been two years since Raft Garments started using polyester spandex fabric for manufacturing underwear, a shift from their previous use of only cotton spandex. Reason: “It is anti-sweat and more durable,” he says, as he displays some of the new polyester pieces now produced at his manufacturing unit in Tiruppur.

The exporter currently has a portfolio consisting of 85% cotton-based garments and 15% MMF, compared to an earlier portfolio that was entirely cotton-based (100%). In the coming years, Subramaniam intends to increase the share of MMF to 50% as he bets big on MMF.

He says that the domestic market is increasingly favouring synthetics while noting that growth is occurring at a steady rate. “Especially in the sports segment, cotton is almost disappearing, and everyone is showing an inclination towards polyester. We cannot always rely only on cotton and have to look at newer avenues as well. While it is a small percentage right now, gradually the shift can take place with adequate support from the government to make this segment evolve,” he says.

Is MMF the right path forward for them?

Also Read: From dirty to dazzling: Why Tiruppur is recycling 130 million litres water everyday

For those who might not be aware, MMF is usually produced through chemical processes or by modifying natural fibres, resulting in materials like polyester, nylon, and rayon. With advantages like durability, ease of care, and resistance to wear and tear, these materials are well-suited for various applications. Currently, China leads in MMF production, with an estimated global market share of 72%.

A recent report from the Ministry of Textiles on MMF reveals that India’s per capita fibre consumption is 5.5 kg; of this, MMF accounts for 3.1 kg, which is among the lowest globally, even below Africa. This indicates there is a huge potential to enhance India’s per capita MMF fibre consumption. The textile industry anticipates that India's exports of MMF textiles will rise by 75%, reaching $11.4 billion in 2030, up from around $6.5 billion in 2021-22.

However, it is easier said than done. Factors such as raw material costs, quality, capacity, and technological advancements make it difficult for Indian exporters to compete with their global counterparts. Tiruppur, the Knitwear Capital of India, is also facing similar challenges as a cluster as it is slowly moving towards uncharted territories of MMF apparel.

However, it is easier said than done. Factors such as raw material costs, quality, capacity, and technological advancements make it difficult for Indian exporters to compete with their global counterparts. Tiruppur, the Knitwear Capital of India, is also facing similar challenges as a cluster as it is slowly moving towards uncharted territories of MMF apparel.

Aligning with global demand

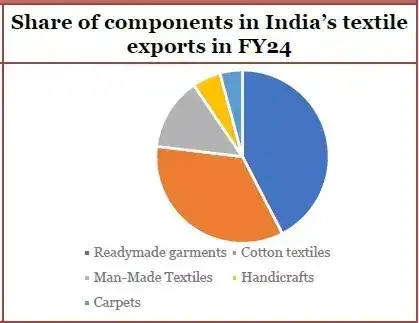

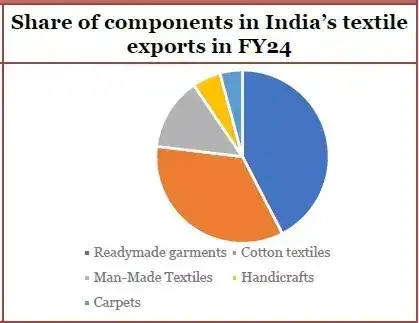

Tiruppur holds a prominent position globally as a knitwear exporter, catering to the demand of major markets, including Europe and the USA. It exports cotton and cotton-blend T-shirts, dresses, sweatshirts, and other knitted clothes to global markets. Tiruppur’s close proximity to Coimbatore, a major textile hub, has also helped it emerge as a globally recognised garment manufacturing hub. In FY25, exports from Tiruppur scaled to Rs 40,000 crore, while the domestic consumption numbers also showed good performance at Rs 30,000 crore. In fact, the cluster accounts for more than 90% of India’s cotton knitwear exports. More than 25,000 MSMEs, specialising in dyeing, knitting, embroidery, garment making and exports, operate in the Tiruppur cluster, employing directly over 800,000 workers.

A case study by B2K Analytics, a boutique advisory firm, states that the economic activity of the entire town revolves around the manufacture of cotton knitwear for use as vests (mostly sold in the Indian market) and T-shirts (mostly exported).

India, as a nation, has traditionally been focused on cotton textiles, with clusters like Tiruppur taking the lead. Currently, MMF consumption is dominant globally, as per B2K Analytics. “Hence, in order to move towards a higher global MMF share, it is essential to simultaneously focus on MMF along with cotton textiles,” it says.

But what is driving up demand for MMF? The steady rise in the share of MMF in textiles can be attributed to several factors, including its cost-effectiveness, durability, and changing consumer preference influenced by fast fashion. Additionally, the limited availability and constraints of cotton and other natural fibres, along with the growing emphasis on sustainability in business, have further fuelled this trend. Through various policies, the government is also promoting MMF.

India currently holds a mere 9.2% share of global MMF production, which offers it a huge opportunity to close the gap with the global leaders, such as China, Vietnam, and Taiwan. “India has a great opportunity to align with the evolving global shifts in apparel demand,” states the report by the textile ministry.

According to a report by iMarc Group, the size of the Indian synthetic fibres (also known as MMF) market reached $3.24 billion in 2024. It estimates that the market will reach $6.53 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 7.50% from 2025 to 2033.

The Economic Survey 2024-25 also advocated for the MMF sector to pursue vertical integration and invest significantly in research and development to enhance the quality of its offering in line with competitors. “MMF-based products range from yoga pants and athleisure wear to technical textiles in aviation, aerospace and automobiles. By tapping into the MMF value chain, India will benefit from the steady rise in global MMF demand,” the Survey states.

Challenges at play

So, what is really holding us back from going all out in this domain, more specifically in clusters like Tiruppur, which has a bustling textile industry at the heart of it?

ET Digital’s interactions with exporters in Tiruppur revealed that India has not been able to play catch-up so far to the prowess of China in this segment. While some firms have started to tailor products on MMF buoyed by the spike in global demand, the majority continue to be dominated by cotton-based products.

Kumar Duraiswamy, Joint Secretary of the Tiruppur Exporters’ Association (TEA), says that the industry has been concentrating more on MMF in the past five years due to fluctuations in the cotton market. But this shift has encountered several bottlenecks. “China, Korea and Taiwan are leading in this segment (MMF). It is difficult for us to import fabric from China due to Quality Control Orders (QCOs) and the duty structures. So, people try not to import and do it only if necessary. So, it is manufactured in India, but technological challenges persist. Hence, we are asking for government help to upgrade tech for man-made fibres,” he says.

According to him, the existing schemes, such as the Production Linked Incentive (PLI) scheme for textiles that came up to promote the production of MMF apparel and MMF fabrics, miss the point of including smaller players in their purview as well. “The schemes need to be in accordance with the needs of the MSME players. We have been advocating for a PLI scheme where the threshold limit is Rs 10 crore,” he says.

Also, it is important to note that Tiruppur has traditionally focused on cotton and has only recently begun to venture into the MMF segment. So, there will be some initial challenges. “Fibre availability, quality of fibre, and technical expertise—we are lacking in such crucial aspects. We don’t want to import from China, but we do want international buyers. However, the quality of fibre one gets from China or Taiwan does not match that of India. Fibre itself is a problem,” highlights Duraiswamy.

Chip and polymers form the basis of MMF production. In India, the cost of polymer is higher than in China, which experts identify as another obstacle for exporters to transition to MMF. “Besides this, very advanced technology is needed for MMF production, and hence technological upgradation is the need of the hour for us to move forward in this direction,” Subramaniam emphasises.

While India is exploring advancement in this space, MMF cannot replace cotton-rich products, says Arul Saravaran, Chief Marketing Officer of SCM Garments, a medium-sized garment manufacturer in Tiruppur. “In categories such as sportswear, people will look at synthetic nets, but there are still a lot of activities that need cotton-rich products. A baby cannot wear 100% polyester, for instance, and neither can a child’s T-shirt be like that,” he says. The industry is increasingly discussing MMF, as it envisions a future where natural fibres may go down, Saravaran notes.

While India is exploring advancement in this space, MMF cannot replace cotton-rich products, says Arul Saravaran, Chief Marketing Officer of SCM Garments, a medium-sized garment manufacturer in Tiruppur. “In categories such as sportswear, people will look at synthetic nets, but there are still a lot of activities that need cotton-rich products. A baby cannot wear 100% polyester, for instance, and neither can a child’s T-shirt be like that,” he says. The industry is increasingly discussing MMF, as it envisions a future where natural fibres may go down, Saravaran notes.

India still has a long way to go in this sector, he says. “We are 20 years behind China in terms of the kind of components and fabrics that they can make, the machineries, and the advancements that they have made in terms of production. It is a totally different ballgame,” he says, candidly acknowledging the difference.

Gearing up for the future

Meanwhile, exporters in Tiruppur are striving to take things up a notch for themselves in this segment. Small exporters are investing to the tune of Rs 2-3 crore to facilitate a gradual shift towards MMF. “We have invested Rs 3-4 crore in MMF production. The market globally is showing a clear preference for MMF. We want to compete for that share,” says Subramaniam.

Additionally, the cluster is also focusing on skill development to enhance its capability for MMF. For this, it has partnered with the governments of Assam and Odisha, who are working closely with TEA to facilitate the processes.

On the brighter side, bigger exporters are making the shift a little more seamlessly. Medium-sized exporters, however, are gradually seeking to expand their portfolio of MMF. Saravaran of SCM Garments says that they aim to increase the contribution of MMF to 10%. “One has to gear up for it and to invest in it to make it very price competitive. We need to invest in machines and process the fabric here. Enterprises who are unable to invest can work with active mills who supply fabric in India itself. So, they can manufacture it in India,” he says.

Anand Ramanathan, Partner and Leader, Consumer Products & Retail Sector, South Asia, Deloitte India, notes that to truly scale, it is essential to have a presence in MMF and across every segment of that particular market to achieve dominance. “In the case of cotton, factors like its seasonality, global commodity status, and a lot of uncertainty around it bring in a downside to the business in terms of risk. The textile business is all about cost, so for MMF, the questions to consider are whether there is even any new technology being incorporated and how efficiently it is being produced. Another key question is that it requires a great level of automation,” he explains.

It all comes down to the manufacturing factors of production—land, labour and capital, he says. “We have to be competitive in all these aspects. MMF is an important segment, and there must be something which incentivises people to look beyond cotton.”

He suggests that while the Indian industry is quite competent to enter this segment, everything cannot be done through the MSME sector. “Right now, we will need larger players who are already in the export value chain to come in—a lot of investment has to play out, and they can use a bunch of ancillary ecosystems to upgrade and contract manufacture. So, the big-ticket investment has to come from large industry houses for things to step up,” he adds.

On the policy front, there have been some changes, including the government’s notification of a uniform GST tax rate of 12% on MMF, MMF yarn, MMF fabrics and apparel, which addressed the inverted tax structure in the MMF textile value chain, helping players in the space. Previously, the GST rates on MMF, MMF yarn, and MMF fabrics were 18%, 12%, and 5%, respectively, which caused compliance issues with the tax regime.

While these have been steps in the right direction, more needs to be done to support the sector and propel it to greater heights where it can compete with global players.

In the case of Tiruppur, the combined efforts of local exporters and government support can significantly help the cluster in transitioning to a new and unexplored terrain more seamlessly, especially with technological advancements. This will help Tiruppur in safeguarding itself against global headwinds in the case of cotton-based products while also exploring alternative revenue streams more effectively.

The industry and the government need to collectively step up to make this possible and bring in innovation for a cluster that has the potential and capability to take MMF production to the next level.

“We should think about the world market and how the demand is evolving,” says Subramaniam, the Founder & CEO of Raft Garments.

It has been two years since Raft Garments started using polyester spandex fabric for manufacturing underwear, a shift from their previous use of only cotton spandex. Reason: “It is anti-sweat and more durable,” he says, as he displays some of the new polyester pieces now produced at his manufacturing unit in Tiruppur.

MMF is usually produced through chemical processes or by modifying natural fibres, resulting in materials like polyester, nylon, and rayon.

The exporter currently has a portfolio consisting of 85% cotton-based garments and 15% MMF, compared to an earlier portfolio that was entirely cotton-based (100%). In the coming years, Subramaniam intends to increase the share of MMF to 50% as he bets big on MMF.

He says that the domestic market is increasingly favouring synthetics while noting that growth is occurring at a steady rate. “Especially in the sports segment, cotton is almost disappearing, and everyone is showing an inclination towards polyester. We cannot always rely only on cotton and have to look at newer avenues as well. While it is a small percentage right now, gradually the shift can take place with adequate support from the government to make this segment evolve,” he says.

Is MMF the right path forward for them?

Also Read: From dirty to dazzling: Why Tiruppur is recycling 130 million litres water everyday

For those who might not be aware, MMF is usually produced through chemical processes or by modifying natural fibres, resulting in materials like polyester, nylon, and rayon. With advantages like durability, ease of care, and resistance to wear and tear, these materials are well-suited for various applications. Currently, China leads in MMF production, with an estimated global market share of 72%.

A recent report from the Ministry of Textiles on MMF reveals that India’s per capita fibre consumption is 5.5 kg; of this, MMF accounts for 3.1 kg, which is among the lowest globally, even below Africa. This indicates there is a huge potential to enhance India’s per capita MMF fibre consumption. The textile industry anticipates that India's exports of MMF textiles will rise by 75%, reaching $11.4 billion in 2030, up from around $6.5 billion in 2021-22.

Aligning with global demand

Tiruppur holds a prominent position globally as a knitwear exporter, catering to the demand of major markets, including Europe and the USA. It exports cotton and cotton-blend T-shirts, dresses, sweatshirts, and other knitted clothes to global markets. Tiruppur’s close proximity to Coimbatore, a major textile hub, has also helped it emerge as a globally recognised garment manufacturing hub. In FY25, exports from Tiruppur scaled to Rs 40,000 crore, while the domestic consumption numbers also showed good performance at Rs 30,000 crore. In fact, the cluster accounts for more than 90% of India’s cotton knitwear exports. More than 25,000 MSMEs, specialising in dyeing, knitting, embroidery, garment making and exports, operate in the Tiruppur cluster, employing directly over 800,000 workers.

A case study by B2K Analytics, a boutique advisory firm, states that the economic activity of the entire town revolves around the manufacture of cotton knitwear for use as vests (mostly sold in the Indian market) and T-shirts (mostly exported).

India, as a nation, has traditionally been focused on cotton textiles, with clusters like Tiruppur taking the lead. Currently, MMF consumption is dominant globally, as per B2K Analytics. “Hence, in order to move towards a higher global MMF share, it is essential to simultaneously focus on MMF along with cotton textiles,” it says.

Factors such as raw material costs, quality, capacity, and technological advancements make it difficult for Indian exporters to compete with global counterparts in the MMF category.

But what is driving up demand for MMF? The steady rise in the share of MMF in textiles can be attributed to several factors, including its cost-effectiveness, durability, and changing consumer preference influenced by fast fashion. Additionally, the limited availability and constraints of cotton and other natural fibres, along with the growing emphasis on sustainability in business, have further fuelled this trend. Through various policies, the government is also promoting MMF.

India currently holds a mere 9.2% share of global MMF production, which offers it a huge opportunity to close the gap with the global leaders, such as China, Vietnam, and Taiwan. “India has a great opportunity to align with the evolving global shifts in apparel demand,” states the report by the textile ministry.

According to a report by iMarc Group, the size of the Indian synthetic fibres (also known as MMF) market reached $3.24 billion in 2024. It estimates that the market will reach $6.53 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 7.50% from 2025 to 2033.

The Economic Survey 2024-25 also advocated for the MMF sector to pursue vertical integration and invest significantly in research and development to enhance the quality of its offering in line with competitors. “MMF-based products range from yoga pants and athleisure wear to technical textiles in aviation, aerospace and automobiles. By tapping into the MMF value chain, India will benefit from the steady rise in global MMF demand,” the Survey states.

Challenges at play

So, what is really holding us back from going all out in this domain, more specifically in clusters like Tiruppur, which has a bustling textile industry at the heart of it?

ET Digital’s interactions with exporters in Tiruppur revealed that India has not been able to play catch-up so far to the prowess of China in this segment. While some firms have started to tailor products on MMF buoyed by the spike in global demand, the majority continue to be dominated by cotton-based products.

Kumar Duraiswamy, Joint Secretary of the Tiruppur Exporters’ Association (TEA), says that the industry has been concentrating more on MMF in the past five years due to fluctuations in the cotton market. But this shift has encountered several bottlenecks. “China, Korea and Taiwan are leading in this segment (MMF). It is difficult for us to import fabric from China due to Quality Control Orders (QCOs) and the duty structures. So, people try not to import and do it only if necessary. So, it is manufactured in India, but technological challenges persist. Hence, we are asking for government help to upgrade tech for man-made fibres,” he says.

According to him, the existing schemes, such as the Production Linked Incentive (PLI) scheme for textiles that came up to promote the production of MMF apparel and MMF fabrics, miss the point of including smaller players in their purview as well. “The schemes need to be in accordance with the needs of the MSME players. We have been advocating for a PLI scheme where the threshold limit is Rs 10 crore,” he says.

Also, it is important to note that Tiruppur has traditionally focused on cotton and has only recently begun to venture into the MMF segment. So, there will be some initial challenges. “Fibre availability, quality of fibre, and technical expertise—we are lacking in such crucial aspects. We don’t want to import from China, but we do want international buyers. However, the quality of fibre one gets from China or Taiwan does not match that of India. Fibre itself is a problem,” highlights Duraiswamy.

Chip and polymers form the basis of MMF production. In India, the cost of polymer is higher than in China, which experts identify as another obstacle for exporters to transition to MMF. “Besides this, very advanced technology is needed for MMF production, and hence technological upgradation is the need of the hour for us to move forward in this direction,” Subramaniam emphasises.

Source: Ministry of Textiles

India still has a long way to go in this sector, he says. “We are 20 years behind China in terms of the kind of components and fabrics that they can make, the machineries, and the advancements that they have made in terms of production. It is a totally different ballgame,” he says, candidly acknowledging the difference.

Gearing up for the future

Meanwhile, exporters in Tiruppur are striving to take things up a notch for themselves in this segment. Small exporters are investing to the tune of Rs 2-3 crore to facilitate a gradual shift towards MMF. “We have invested Rs 3-4 crore in MMF production. The market globally is showing a clear preference for MMF. We want to compete for that share,” says Subramaniam.

Additionally, the cluster is also focusing on skill development to enhance its capability for MMF. For this, it has partnered with the governments of Assam and Odisha, who are working closely with TEA to facilitate the processes.

On the brighter side, bigger exporters are making the shift a little more seamlessly. Medium-sized exporters, however, are gradually seeking to expand their portfolio of MMF. Saravaran of SCM Garments says that they aim to increase the contribution of MMF to 10%. “One has to gear up for it and to invest in it to make it very price competitive. We need to invest in machines and process the fabric here. Enterprises who are unable to invest can work with active mills who supply fabric in India itself. So, they can manufacture it in India,” he says.

Anand Ramanathan, Partner and Leader, Consumer Products & Retail Sector, South Asia, Deloitte India, notes that to truly scale, it is essential to have a presence in MMF and across every segment of that particular market to achieve dominance. “In the case of cotton, factors like its seasonality, global commodity status, and a lot of uncertainty around it bring in a downside to the business in terms of risk. The textile business is all about cost, so for MMF, the questions to consider are whether there is even any new technology being incorporated and how efficiently it is being produced. Another key question is that it requires a great level of automation,” he explains.

It all comes down to the manufacturing factors of production—land, labour and capital, he says. “We have to be competitive in all these aspects. MMF is an important segment, and there must be something which incentivises people to look beyond cotton.”

He suggests that while the Indian industry is quite competent to enter this segment, everything cannot be done through the MSME sector. “Right now, we will need larger players who are already in the export value chain to come in—a lot of investment has to play out, and they can use a bunch of ancillary ecosystems to upgrade and contract manufacture. So, the big-ticket investment has to come from large industry houses for things to step up,” he adds.

On the policy front, there have been some changes, including the government’s notification of a uniform GST tax rate of 12% on MMF, MMF yarn, MMF fabrics and apparel, which addressed the inverted tax structure in the MMF textile value chain, helping players in the space. Previously, the GST rates on MMF, MMF yarn, and MMF fabrics were 18%, 12%, and 5%, respectively, which caused compliance issues with the tax regime.

While these have been steps in the right direction, more needs to be done to support the sector and propel it to greater heights where it can compete with global players.

In the case of Tiruppur, the combined efforts of local exporters and government support can significantly help the cluster in transitioning to a new and unexplored terrain more seamlessly, especially with technological advancements. This will help Tiruppur in safeguarding itself against global headwinds in the case of cotton-based products while also exploring alternative revenue streams more effectively.

The industry and the government need to collectively step up to make this possible and bring in innovation for a cluster that has the potential and capability to take MMF production to the next level.