The process of filing Income Tax Return (ITR) for the financial year 2024-25 (Assessment Year 2025-26) has started. Many people have also filed their returns. If you work in a company, then Form 16 is required to file ITR.

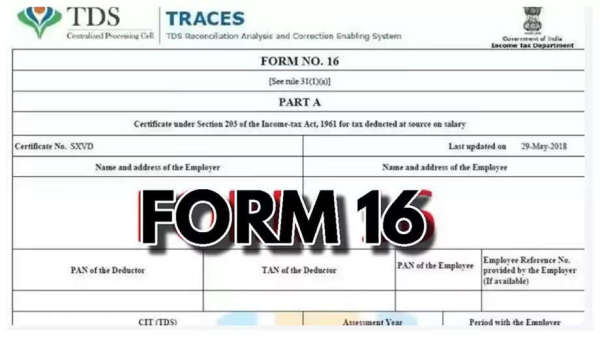

Form 16 is a certificate. This is given by the employer (company) to its salaried employee. It contains information about the tax deducted from the salary (TDS). It contains information about the employee's income, TDS, and exemptions available under the Income Tax Act. This document is very important for people who receive a salary. This makes it easier to file ITR.

Can ITR be filed without Form 16?

Form 16 makes it easier to file ITR, but it is not necessary. If you have not received Form 16, you can still file ITR. For this, you can use documents like a salary slip, Annual Information Statement (AIS), and Form 26AS. These will give you information about income and TDS. You will get AIS and Form 26AS from the Income Tax Department's website incometax.gov.in. If you are going to file ITR for the first time, then you will have to register by visiting the Income Tax Department's website.

Can Form 16 be downloaded from the website?

Salary earners cannot download Form 16 directly from the Income Tax Department's website. PAN number cannot be used for this. Only the company (where the employee works) can download Form 16 from the TRACES portal. Then it gives it to the employee.

When is this form available?

According to the income tax rules, the company has to file an e-TDS return of the previous quarter (January-March) by 31 May. After this, they have to give Form 16 to their employees within 15 days. This means that the last date for giving Form 16 is 15 June. If you have not received Form 16 from the company yet, then talk to the HR or accounts department of the company for this.

Is it necessary for all employees?

No, the company doesn't need to give Form 16 to all the employees. Form 16 is issued only when the company deducts TDS from the employee's salary. Under the new tax system, if the taxable income is up to Rs 7 lakh, then no tax is deducted. Whereas under the old tax system, if the taxable income is up to Rs 5 lakh, then TDS is not levied. Therefore, if no tax has been deducted due to low taxable income or the chosen tax system, then the employer i.e., the company cannot issue Form 16.

Disclaimer: This content has been sourced and edited from Navbharat Times. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.