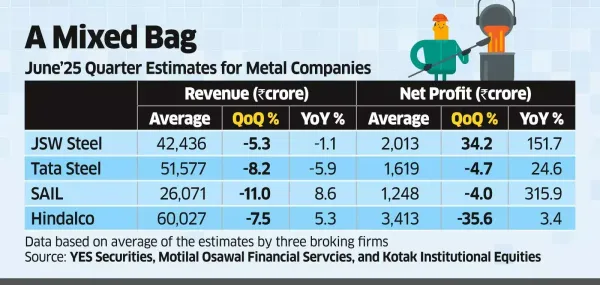

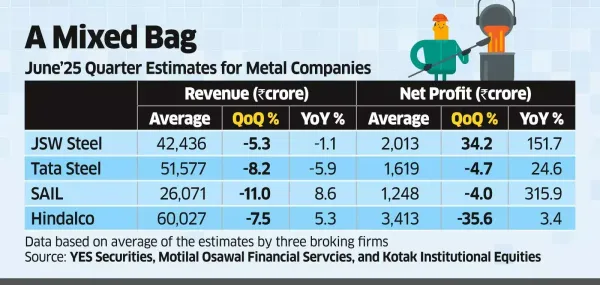

ET Intelligence Group: Steelmakers are expected to post sequential rise in profits in the fiscal first quarter, as a sharp rebound in domestic steel prices and lower coking coal costs is likely to outweigh sluggish sales. Analysts estimate aggregate earnings before interest, taxes, depreciation, and amortisation (Ebitda) for ferrous companies to rise by 2-16% quarter-on-quarter despite a 11-12% decline in sales volume in the three months ended June.

In contrast, producers of non-ferrous metals like aluminium, zinc, copper, and lead are likely to show a muted performance last quarter amid weaker commodity prices and softer volumes. Their aggregate revenue and Ebitda are projected to decline by 8% and 18%, respectively. "During the June 2025 quarter, domestic steel prices increased by ₹3,104 per tonne driven by implementation of safeguard duty. This, along with a decline in coking coal prices, is expected to support sequential expansion in Ebitda per tonne for steel companies," said IDBI Capital Markets in a report.

The average price of coking coal, a major raw material, fell by 2% sequentially. Domestic iron ore prices rose by 4% to an average of ₹7,335 per tonne, before declining to ₹6,900 per tonne by June-end. Hot-rolled (HR) coil prices increased by 6.4% to an average of ₹51,673 per tonne, before easing to ₹50,700 per tonne according to IDBI Capital.

Motilal Oswal Financial Services expects Ebitda of ferrous companies under its coverage to rise 2% sequentially and 11% YoY in the June quarter.

Brokerages are predicting an 11-12% sequential decline in steel volumes, citing the early onset of monsoon and a high base in the fourth quarter of FY25. However, volumes are expected to rise 1.8-6% year-on-year.

The non-ferrous metal sector faces a more challenging environment since global prices of aluminium and zinc fell significantly during the quarter. This coupled with potentially muted volumes in some segments is expected to put pressure on revenues and margins for non-ferrous producers.

Aluminium and zinc prices fell 7.1% and 7.3% sequentially, while alumina prices crashed 32% squeezing margins, according to Motilal Oswal. "Non-ferrous companies under our coverage are expected to post sequential aggregate revenue and Ebitda declines of 8% and 18%, respectively," the brokerage said in a report. Motilal however expects 5% and 2% year-on-year growth in revenue and Ebitda, respectively.

In contrast, producers of non-ferrous metals like aluminium, zinc, copper, and lead are likely to show a muted performance last quarter amid weaker commodity prices and softer volumes. Their aggregate revenue and Ebitda are projected to decline by 8% and 18%, respectively. "During the June 2025 quarter, domestic steel prices increased by ₹3,104 per tonne driven by implementation of safeguard duty. This, along with a decline in coking coal prices, is expected to support sequential expansion in Ebitda per tonne for steel companies," said IDBI Capital Markets in a report.

The average price of coking coal, a major raw material, fell by 2% sequentially. Domestic iron ore prices rose by 4% to an average of ₹7,335 per tonne, before declining to ₹6,900 per tonne by June-end. Hot-rolled (HR) coil prices increased by 6.4% to an average of ₹51,673 per tonne, before easing to ₹50,700 per tonne according to IDBI Capital.

Motilal Oswal Financial Services expects Ebitda of ferrous companies under its coverage to rise 2% sequentially and 11% YoY in the June quarter.

Brokerages are predicting an 11-12% sequential decline in steel volumes, citing the early onset of monsoon and a high base in the fourth quarter of FY25. However, volumes are expected to rise 1.8-6% year-on-year.

The non-ferrous metal sector faces a more challenging environment since global prices of aluminium and zinc fell significantly during the quarter. This coupled with potentially muted volumes in some segments is expected to put pressure on revenues and margins for non-ferrous producers.

Aluminium and zinc prices fell 7.1% and 7.3% sequentially, while alumina prices crashed 32% squeezing margins, according to Motilal Oswal. "Non-ferrous companies under our coverage are expected to post sequential aggregate revenue and Ebitda declines of 8% and 18%, respectively," the brokerage said in a report. Motilal however expects 5% and 2% year-on-year growth in revenue and Ebitda, respectively.