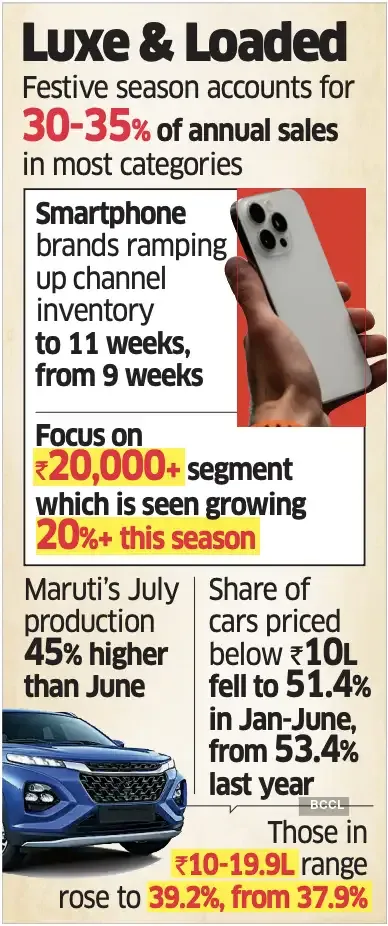

Consumer electronics, smartphone and automobile companies plan to produce 10-20% more premium products in the July-September quarter compared to last year, ahead of the crucial festive season when they expect high-end models to outsell entry-level ones, multiple industry executives said.

This includes smartphones and tablets priced above ₹20,000, frost-free refrigerators, fully automatic washing machines, 4K televisions, and mostly SUVs in cars.

The push reflects increasing preference for feature-rich products even among middle-class customers and those from small towns.

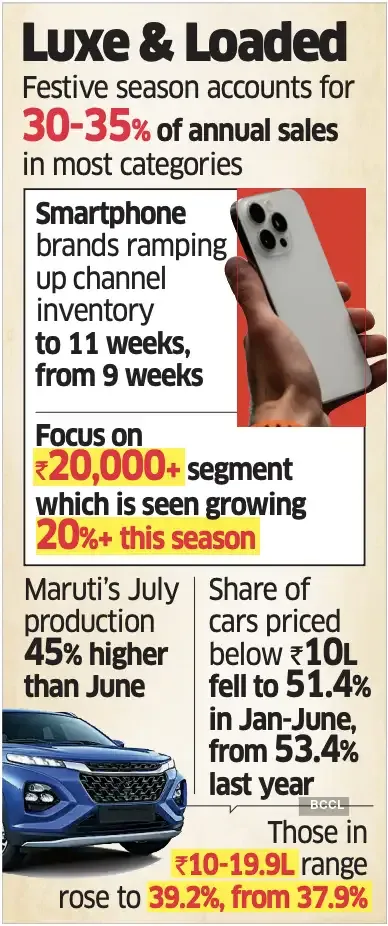

The country’s largest car manufacturer Maruti Suzuki will make 185,000-190,000 cars in July, 45% more than last month, to build festive stock, an industry executive said. The production is skewed in favour of pricier SUVs and multi-purpose vehicles (MPVs), the person added.

India’s largest homegrown consumer electronic contract manufacturer Dixon Technologies’ order book for this quarter is mostly up in double digits compared to last year as brands build their festive pipeline, its managing director Atul B Lall said. Most of the inventory buildup is for the premium range, he added.

Dixon manufactures for top smartphone brands like Samsung, Motorola, Oppo, Xiaomi and Vivo.

Top executives of home appliance brands like Haier and Havells said there is a 15-20% jump in festive production, with a skew towards premium range. However, the industry has stopped air-conditioner production as early monsoon rains hit summer sales, leading to an inventory pileup. Companies hope to liquidate the stocks by the December quarter, before winter sets in.

“This year, summer was one of the worst sales for the industry, but we have seen in such years the festive period business zooms,” Haier India president Satish NS said. “Hence, we are taking all the risks expecting a turnaround in demand.”

Haier has already started overtime in its factories and will soon start double shifts, he said.

Havells India chairman and managing director Anil Rai Gupta said that while it’s difficult to say whether there are green shoots in demand, he is positive of a buoyant festive season.

Sales of electronic products and cars have remained dull for the past 6-8 quarters as high inflation and muted salary and income growth impacted most middle-class consumers.

The government has cut income-tax rates, inflation has eased, and the central bank has lowered lending rates, but these measures are yet to boost consumer demand.

The electronic industry reported its worst June quarter in over a decade. Car sales declined in May and June, pulled down by a sharp drop in small car demand.

Industry executives are betting on a rebound in the festive season, driven by the premium segment. They expect middle-class customers to upgrade their purchases to premium products, aided by wide availability of consumer finance.

Smartphone researcher Counterpoint’s director Tarun Pathak said brands are boosting production to increase channel inventory from nine weeks’ average demand now to almost 11 weeks ahead of the festive season.

This includes smartphones and tablets priced above ₹20,000, frost-free refrigerators, fully automatic washing machines, 4K televisions, and mostly SUVs in cars.

The push reflects increasing preference for feature-rich products even among middle-class customers and those from small towns.

The country’s largest car manufacturer Maruti Suzuki will make 185,000-190,000 cars in July, 45% more than last month, to build festive stock, an industry executive said. The production is skewed in favour of pricier SUVs and multi-purpose vehicles (MPVs), the person added.

Premium skew

Maruti declined to comment citing the silent period ahead of its first-quarter results.India’s largest homegrown consumer electronic contract manufacturer Dixon Technologies’ order book for this quarter is mostly up in double digits compared to last year as brands build their festive pipeline, its managing director Atul B Lall said. Most of the inventory buildup is for the premium range, he added.

Dixon manufactures for top smartphone brands like Samsung, Motorola, Oppo, Xiaomi and Vivo.

Top executives of home appliance brands like Haier and Havells said there is a 15-20% jump in festive production, with a skew towards premium range. However, the industry has stopped air-conditioner production as early monsoon rains hit summer sales, leading to an inventory pileup. Companies hope to liquidate the stocks by the December quarter, before winter sets in.

“This year, summer was one of the worst sales for the industry, but we have seen in such years the festive period business zooms,” Haier India president Satish NS said. “Hence, we are taking all the risks expecting a turnaround in demand.”

Haier has already started overtime in its factories and will soon start double shifts, he said.

Havells India chairman and managing director Anil Rai Gupta said that while it’s difficult to say whether there are green shoots in demand, he is positive of a buoyant festive season.

Sales of electronic products and cars have remained dull for the past 6-8 quarters as high inflation and muted salary and income growth impacted most middle-class consumers.

The government has cut income-tax rates, inflation has eased, and the central bank has lowered lending rates, but these measures are yet to boost consumer demand.

The electronic industry reported its worst June quarter in over a decade. Car sales declined in May and June, pulled down by a sharp drop in small car demand.

Industry executives are betting on a rebound in the festive season, driven by the premium segment. They expect middle-class customers to upgrade their purchases to premium products, aided by wide availability of consumer finance.

Smartphone researcher Counterpoint’s director Tarun Pathak said brands are boosting production to increase channel inventory from nine weeks’ average demand now to almost 11 weeks ahead of the festive season.