Tata group nearly doubled revenue, and more than tripled net profit and market cap over the past five years, when it spent ₹5.5 lakh crore to be “future fit,” said Tata Sons chairman N Chandrasekaran, in the latest annual report. The group has sought to alter strategies that “may have aged poorly with time and changing economic conditions.”

Group revenue from all listed and unlisted entities was Rs 15.34 lakh crore in FY25, with net profit at Rs 1.13 lakh crore and market cap at Rs 37.84 lakh crore, according to the Tata Sons report.

“Tata group has been on a transformational journey towards financial and strategic fitness,” Chandrasekaran said in the report reviewed by ET. “It is my deep conviction that we must be fit to perform. To do that, we must be honest that some decisions that might have appeared ideal when they were taken may have aged poorly... As a result, our mantra in the last few years was ‘fitness first, velocity next’.”

Some of the businesses have been cyclical, while uncertain geopolitics and economics have also been challenges.

TCS continues to be the group profit engine. It accounted for 43% of group net profit in FY25.

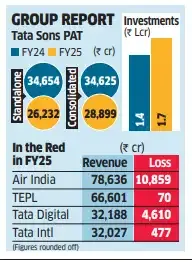

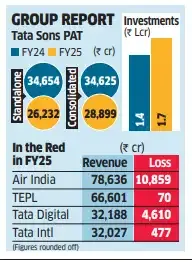

Tata Sons posted a 24% rise in FY25 revenue to Rs 5.92 lakh crore, while net profit fell 17% to Rs 28,898 crore from a year ago. There was no explanation given for the decline.

Tata Sons dividend, however, doubled to Rs 1,414.5 crore from Rs 707.2 crore in FY24. The holding company had 323 subsidiaries, 39 associates and 32 joint ventures in FY25.

On a standalone basis, revenue fell 12% to Rs 38,834.6 crore in FY25, from Rs43,893 crore in the previous year. That FY24 number had included a profit of Rs 9,375.7 crore from the sale of investments. Profit after tax fell 24% to Rs 26,231.7 crore in FY25.

“Financial discipline is vital, as mistakes are costly distractions from our purpose. Even as parts of Tata group drive unprecedented ambition in new industries, I stay committed to driving predictability in the rest of our portfolio,” said Chandrasekaran, who drew a remuneration of Rs 155.61 crore, including commission, during FY25, a 15% jump from the year before, putting him among India's highest paid CEOs.

Group revenue from all listed and unlisted entities was Rs 15.34 lakh crore in FY25, with net profit at Rs 1.13 lakh crore and market cap at Rs 37.84 lakh crore, according to the Tata Sons report.

“Tata group has been on a transformational journey towards financial and strategic fitness,” Chandrasekaran said in the report reviewed by ET. “It is my deep conviction that we must be fit to perform. To do that, we must be honest that some decisions that might have appeared ideal when they were taken may have aged poorly... As a result, our mantra in the last few years was ‘fitness first, velocity next’.”

Some of the businesses have been cyclical, while uncertain geopolitics and economics have also been challenges.

TCS continues to be the group profit engine. It accounted for 43% of group net profit in FY25.

Tata Sons posted a 24% rise in FY25 revenue to Rs 5.92 lakh crore, while net profit fell 17% to Rs 28,898 crore from a year ago. There was no explanation given for the decline.

Tata Sons dividend, however, doubled to Rs 1,414.5 crore from Rs 707.2 crore in FY24. The holding company had 323 subsidiaries, 39 associates and 32 joint ventures in FY25.

On a standalone basis, revenue fell 12% to Rs 38,834.6 crore in FY25, from Rs43,893 crore in the previous year. That FY24 number had included a profit of Rs 9,375.7 crore from the sale of investments. Profit after tax fell 24% to Rs 26,231.7 crore in FY25.

“Financial discipline is vital, as mistakes are costly distractions from our purpose. Even as parts of Tata group drive unprecedented ambition in new industries, I stay committed to driving predictability in the rest of our portfolio,” said Chandrasekaran, who drew a remuneration of Rs 155.61 crore, including commission, during FY25, a 15% jump from the year before, putting him among India's highest paid CEOs.