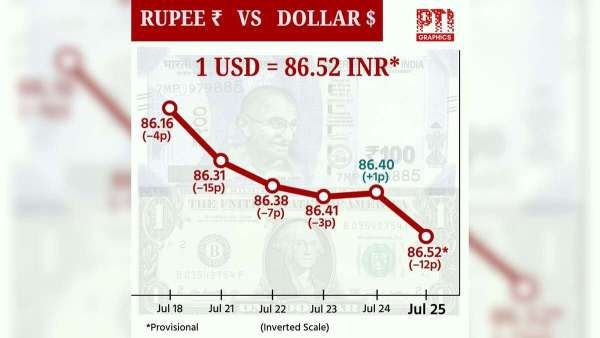

Mumbai: The rupee declined 12 paise to settle at 86.52 against the US dollar on Friday, tracking negative domestic equity markets and surging global crude oil prices.

A strengthening American currency overseas and foreign fund outflows further weighed on the local unit, forex traders said.

At the interbank foreign exchange, the domestic unit opened at 86.59 and hit the lowest level of 86.63 against the greenback. The unit touched the intra-day peak of 86.47 before ending the session at 86.52, registering a loss of 12 paise from its previous closing level.

On Thursday, the rupee saw some initial recovery but ended the session just 1 paisa higher at 86.40 against the US dollar.

Anuj Choudhary, Research Analyst at Mirae Asset Sharekhan, said the rupee weakened due to a surge in crude oil prices and weakness in the domestic markets, which also fuelled the withdrawal of foreign institutional investors.

He said the rupee is expected to trade with a slight negative bias amid uncertainty ahead of the August 1 trade deal deadline and geopolitical tensions between Thailand and Cambodia.

“Traders may take cues from the durable goods orders data from the US. Investors may remain cautious ahead of the US Federal Reserve and Bank of Japan’s monetary policy decisions next week. USD-INR spot price is expected to trade in a range of Rs 86.30 to Rs 86.90,” Choudhary added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.33 per cent to 97.44.

Analysts attributed the recovery in the dollar index to favourable employment data in the US.

Brent crude, the global oil benchmark, went up by 0.42 per cent to USD 69.47 per barrel in futures trade, as developing trade agreements have supported the upward movement in Brent oil prices.

Forex traders said the uncertainty over the India-US trade deal has been an overhang for the forex market.

If the discussions fail or get delayed, Indian exporters could face fresh pressure — adding to the rupee’s challenges.

However, if a deal is reached, it could offer a much-needed breather. Until then, the uncertainty is likely to keep market participants cautious.

Meanwhile, in the domestic equity market, Sensex crashed 721.08 points or 0.88 per cent to 81,463.09, while Nifty tanked 225.10 points or 0.90 per cent to 24,837.

Foreign institutional investors (FIIs) offloaded equities worth Rs 1,979.96 crore on a net basis on Friday, according to exchange data.

The latest RBI data released on Friday showed India’s forex reserve declined by USD 1.183 billion to USD 695.489 billion during the week ended July 18.