Intel Corp.’s (INTC) participation in the U.S. CHIPS Act has garnered attention after a research note from Bernstein questioned the terms of the program.

The firm argues that what was expected to be a $10.9 billion government grant now risks turning into a less favorable equity arrangement for the chipmaking giant, as per TheFly. Instead of receiving the funds as initially anticipated, Intel may be offering up a 10% ownership stake to the federal government in exchange for funding.

Bernstein thinks this trade-off is “worse” for the chipmaker and raised concerns over shareholder value. “Funding a build-out with no customers probably won't end well for shareholders,” the firm remarked, noting that capital alone will not resolve Intel’s deeper challenges.

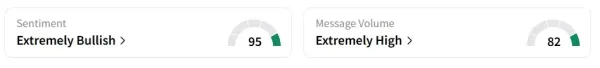

Intel stock traded 5% higher in Tuesday’s pre-market session. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ (95/100) territory amid ‘extremely high’ (82/100) message volume levels.

The Intel stock witnessed an 880% surge in user message count in 24 hours on Stocktwits. One user pointed out that this is not a bailout, but that the semiconductor industry creates jobs.

The firm has maintained a ‘Market Perform’ rating on Intel stock and reaffirmed a price target of $21. It also expressed concern that the proposed equity swap does not equate to a smart trade for the company or its investors.

On Monday, Masayoshi Son-led SoftBank Group (SFTBY) said it has finalized an agreement to invest $2 billion in Intel. The deal involves SoftBank acquiring common shares of Intel. The Japanese investment firm has agreed to pay $23 per share for Intel stock, with the transaction still subject to standard regulatory approvals.

Intel stock has gained 18% in 2025 and over 9% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<