KeyBanc Capital Markets has boosted its price forecast for Nvidia Corp. (NVDA), anticipating strong results from the chipmaker ahead of its upcoming second quarter (Q2) earnings report.

The firm now expects Nvidia’s stock to reach $215, up from its previous $190 target, while maintaining an ‘Overweight’ rating, as per TheFly.

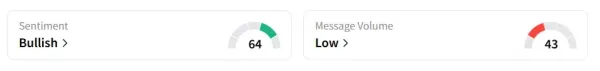

Nvidia stock inched 0.9% lower on Wednesday afternoon. On Stocktwits, retail sentiment around the stock improved to ‘bullish’ from ‘neutral’ territory the previous day amid ‘low’ message volume levels.

A bullish Stocktwits user said they bought more shares ahead of the earnings.

The revised projection comes as KeyBanc predicts a strong performance for Nvidia’s Q2. However, the firm expects third-quarter (Q3) guidance to fall slightly short of Wall Street’s current expectations due to ongoing licensing delays in China.

The firm points to Nvidia’s continued rollout of its Blackwell platform and the upcoming ramp-up of Blackwell Ultra in Q3 as primary contributors to earnings strength. Additionally, KeyBanc highlighted improving manufacturing yields for Nvidia’s GB200 data center racks as a positive signal for supply chain efficiency and future earnings momentum.

Earlier on Wednesday, Wedbush’s Daniel Ives said that with Nvidia’s chips demand outpacing supply by as much as 10 to 1, the imbalance could be a major tailwind for the stock and reinforce the bullish thesis that demand for AI infrastructure remains strong globally.

The chip behemoth sees Q2 revenue of $45 billion, plus or minus 2%. As per Fiscal AI data, analysts expect Nvidia’s Q2 revenue to be $45.8 billion and earnings per share (EPS) to hit $1.00. The company is expected to release the results on August 27.

Nvidia’s stock has gained 29% year-to-date and over 36% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<