Hewlett Packard Enterprise Co. (HPE) received a bullish endorsement from Morgan Stanley on Thursday, as the firm upgraded the stock to ‘Overweight’ from ‘Equal Weight’ and raised its price target to $28, up from $22.

The firm sees overlooked upside in the company’s recent acquisition strategy and AI-driven demand environment, as per TheFly. In its latest note to investors, Morgan Stanley argued that the market has yet to reflect potential earnings benefits from HPE’s acquisition of Juniper Networks Inc. (JNPR). If the stock were valued similarly to peers, the firm estimates shares could reach $39 in its more optimistic scenario.

In July, HPE finalized its $14 billion acquisition of Juniper Networks, an AI-native networking company, marking a major shift in its strategy toward hybrid cloud and artificial intelligence solutions.

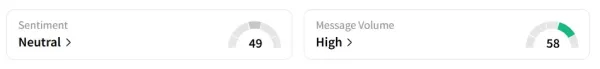

Hewlett-Packard Enterprise stock traded over 3% higher on Thursday, after the morning bell. On Stocktwits, retail sentiment around the shares remained in ‘neutral’ territory with the message volume improving to ‘high’ from ‘normal’ levels in 24 hours.

A bullish Stocktwits user called the stock ‘super cheap’.

Another user called the stock a ‘value play in the tech sector’.

Morgan Stanley forecasts a strong third quarter (Q3) for HPE, supported by broader strength in enterprise hardware. Strong demand for AI-related infrastructure and solid performance in PC sales during the second quarter are likely to contribute to an earnings beat, the firm said.

The company is expected to report Q3 earnings on September 3. HPE expects Q3 revenue in the range of $8.2 billion and $8.5 billion, against an estimate of $8.87 billion, as per Fiscal AI data. It sees an adjusted earnings per share (EPS) range of $0.40 to $0.45, versus an estimate of $0.41.

HPE stock gained 0.8% in 2025 and over 13% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<