India’s automobile market is gearing up for a major shift as the government’s new GST structure, dubbed GST 2.0, comes into effect from September 22, 2025. The new taxation system is set to bring down the prices of both small cars and large SUVs, offering relief to buyers ahead of the festive season. Popular models from Maruti, Hyundai, Volkswagen, Mahindra, and Toyota will see price reductions ranging from 3% to nearly 9%.

What’s Changing with GST 2.0?Under the previous system, all ICE (internal combustion engine) vehicles attracted a 28% GST rate, plus an additional compensation cess ranging from 1% to 22%. The cess varied depending on the vehicle type, size, and engine capacity, making SUVs and luxury cars significantly more expensive.

With GST 2.0, the government has simplified the tax structure by eliminating the cess altogether. Now, ICE vehicles will fall under just two slabs:

18% slab – covering small cars, hatchbacks, compact sedans, and compact SUVs.

40% slab – covering larger SUVs, MUVs, and premium vehicles.

This restructuring has resulted in substantial price cuts across categories.

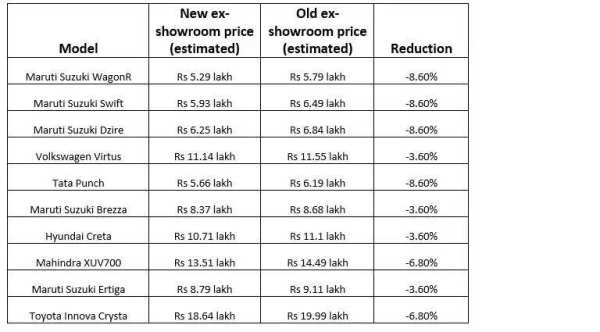

According to Crisil Intelligence estimates, Maruti Suzuki’s popular budget models will become more affordable:

Maruti WagonR (Base Variant): Price to drop by 8.6%, now expected at ₹5.29 lakh (ex-showroom).

Maruti Swift: Nearly the same reduction as WagonR, revised ex-showroom price at ₹5.93 lakh.

Maruti Dzire: Post-tax revision, the price is expected to be around ₹6.25 lakh.

These reductions are significant for middle-class buyers, as these models account for a large share of India’s car sales.

Discounts on Creta, Brezza, and VirtusThe mid-segment cars will also see notable adjustments:

Hyundai Creta (Base Variant): Price reduced by 3.6%, now ₹10.71 lakh.

Maruti Brezza: New ex-showroom price ₹8.37 lakh.

Volkswagen Virtus: Expected price after cut is ₹11.14 lakh.

These reductions make some of the best-selling SUVs more competitive in their segments.

Mahindra XUV700 and Toyota Innova Crysta Become CheaperBigger vehicles are also set to benefit. The Mahindra XUV700, one of India’s most popular SUVs, will start at ₹13.51 lakh, while the Toyota Innova Crysta’s new base price is projected at ₹18.64 lakh. Both will see price cuts of up to 6.8%.

This is particularly good news for families and buyers looking for spacious utility vehicles, as these models previously faced the highest cess rates.

No Change in EV GST, But FCEVs Get ReliefWhile ICE cars benefit from GST 2.0, electric vehicles remain unchanged at a 5% tax rate, ensuring continued government support for EV adoption. However, there is a significant update for hydrogen fuel cell vehicles (FCEVs). Their tax rate has been reduced from 12% to 5%, which experts believe could encourage adoption of alternative clean technologies.

Why This Matters for Car BuyersThe elimination of compensation cess is expected to reduce car prices by up to 9% in certain categories. For Indian consumers, who often compare domestic prices with international markets, this move bridges the gap and makes vehicles more affordable.

Automobile experts suggest that the timing of this tax reform is crucial. With GST 2.0 rolling out on September 22 – the first day of Sharadiya Navratri, the festive season demand is likely to surge. Dealers and manufacturers are expecting higher bookings for both small cars and premium SUVs as buyers rush to take advantage of lower prices.

Final WordThe GST 2.0 reform signals a significant shift in India’s automobile taxation policy. By scrapping the cess and rationalizing GST rates, the government has created a more transparent and consumer-friendly structure. From budget-friendly hatchbacks like WagonR and Swift to premium SUVs like XUV700 and Innova Crysta, nearly every buyer segment will benefit.

For anyone planning to buy a car, the post-September 22 period could be the best time to make the purchase.