Vedanta shares fell over 2% on Monday after the company reportedly outbid Adani Group with a ₹17,000 crore offer for Jaiprakash Associates (JAL).

The Anil Agarwal-led company emerged as the top bidder by offering a payment of ₹12,505 crore based on a Net Present Value (NPV) basis. The other bidders in fray include Adani, Dalmia, Jindal Power and PNC Infratech.

According to reports, brokerage firm Nuvama considers this a negative for minority shareholders and warns that raising the entire required capital will be difficult, potentially restricting the possibility of the stock being re-rated upward.

SEBI-registered investment advisor Trade Bond noted that this move pushes Vedanta into cement, infra, real estate & hospitality, which is far beyond its metals & mining roots.

In the near-term, they expect this move to place immediate strain on Vedanta’s balance sheet, with approximately ₹4,000 crore upfront payment and the remainder staggered over years. The company will also face significant execution challenges in reviving stalled projects such as Jaypee Wishtown and Sports City, which have been an overhang within the acquired assets.

Over the long term, this diversification could unlock substantial growth for Vedanta if these assets are successfully revived, according to Trade Bond. The demand for cement and infrastructure remains strong in India, and bodes well for the acquisition.

However, Trade Bond cautions that Vedanta’s venture into unrelated sectors may dilute its core strategic focus and could limit the potential for the stock to be re-rated by the market.

Overall, they see this as a high-risk, high-reward move. The actual impact will hinge on clarity around integration plans and financing of the deal.

What Is The Retail Mood?

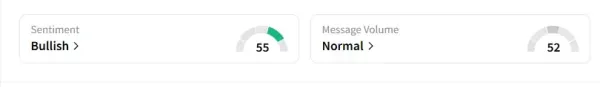

However, data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter.

Vedanta shares have declined 2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com<