Indian equity markets opened on a positive note as hopes of improved ties between the US and India revived investor sentiment. US President Donald Trump said that there is "nothing to worry about" regarding the U.S.-India relationship, stating he will always remain friends with Prime Minister Modi. India echoed this sentiment.

At 10:00 a.m. IST, the Nifty 50 traded 75 points higher at 24,815, while the Sensex was up 212 points at 80,923. Broader markets held the ground, with the Nifty Midcap index rising 0.6% and the Smallcap index trading 0.4% higher.

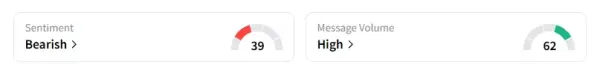

However, the retail sentiment on Stocktwits for Nifty remained ‘bearish’ at market open.

Stock Watch

Sectorally, barring consumer durables, all sectors traded in the green, with autos, energy, real estate, and PSU banks leading the charge.

The auto sector was the top gainer, with Tata Motors and M&M rising over 2%. This is after both companies, along with Hyundai India, reduced car prices to pass on the GST benefit to customers. The revised GST rates come into effect from September 22.

Metals were trading higher as well. Tata Steel and JSW Steel rose 2% on an upgrade by Morgan Stanley, along with target price revisions on SAIL and JSPL. They have taken a constructive stance on the Indian steel sector.

Vedanta shares fell 2% after the company reportedly emerged as the highest bidder for Jaiprakash Associates.

Adani Power rose 2% after it signed a pact with Bhutan’s DGPC to set up a 570 MW hydroelectric project at Wangchhu through a joint venture.

SpiceJet tanked 5% after reporting a loss of ₹233.8 crore in the June quarter, compared to a profit of ₹158.3 crore in the same quarter last year.

Stock Calls

Analyst Palak Jain has flagged a potential breakout opportunity in National Securities Depository (NSDL), following the formation of a triangle pattern. She added that the largest depository in India, with robust digital and fintech expansion, makes NSDL stock attractive for long-term growth

Analyst Vinayak Gautam shared three stock recommendations for Monday with a 1-week timeframe:

M&M: Buy at ₹3,561, with target price at ₹3,660, and stop loss of ₹3,520

BHEL: Buy at ₹212, with a target price of ₹240, and stop loss at ₹202

BEML: Buy at ₹4,083, with target price of ₹4,250, and stop loss at ₹4,000

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Pradeep Carpenter noted that a friendly tone from US President Trump and Indian Prime Minister Modi has lifted sentiment, keeping trade worries in check. He identified Nifty support at 24,700, with resistance at 24,900–25,000. For Bank Nifty, support is seen at 54,000, and resistance at 54,300–54,600. He concluded that while the market mood is optimistic, Foreign Institutional Investors (FIIs) hold the key. If they cover shorts, Nifty could move past 25,000 soon.

Prabhat Mittal pegged Nifty support at 24,600, with resistance at 24,900. For Bank Nifty, he sees support at 53,700, and resistance at 54,500.

Ashish Kyal noted that if the Nifty index closed above 24,820 on a 15-minute timeframe, it can provide a scalping opportunity for a move towards 24,890-24,920 levels. On the downside, support is seen near 24,690, and a break below this can take prices to 24,630 levels.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices inched higher after the OPEC+ chose to boost October production at a slower pace than in previous months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<