Major cryptocurrencies advanced in early trading on Thursday, ahead of the crucial inflation report scheduled for later in the day.

Bitcoin was up 2.4% to $114,174 at the time of writing, while Ethereum rose 2.8% to $4,415.34 and XRP rose 1.7% to $3 over the past 24 hours, according to CoinGecko data. Among other coins, Solana was up 1.8% to $222.15, scaling back some of the gains achieved earlier.

According to data from SoSoValue, Bitcoin spot ETFs logged their best day since July after raking in $757 million of net inflows on Wednesday. Fidelity’s FBTC ETF recorded the largest single-day inflow of $299 million, while BlackRock’s IBIT ETF attracted $211 million.

Ether, the second-largest cryptocurrency in terms of valuation, also saw renewed interest among investors after a tepid start to the month. Ether ETFs record $171 million inflows on Wednesday, with BlackRock’s ETHA booking $74.5 million and Fidelity’s FETH with $49.5 million.

“U.S. inflation cooled, job data revised sharply lower, and the Fed may pivot sooner than expected. Crypto markets are responding to the shift in macro tone,” BTC Markets analyst Rachael Lucas said.

On Wednesday, official U.S. data showed that the producer price index, a gauge of prices that producers receive for their goods and services in the open market, edged lower by 0.1% in August, after rising 0.9% in July. The tepid data implied a weakening of domestic demand, days after the Bureau of Labor Statistics significantly revised U.S. jobs data.

Most traders have priced in a 25-basis-point interest rate cut by the U.S. Federal Reserve next week, according to CME Group’s FedWatch tool. The focus now shifts to U.S. core inflation data.

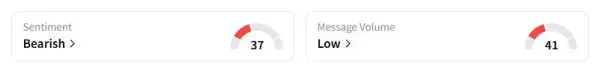

Retail sentiment on Stocktwits for the iShares Bitcoin ETF remained in the ‘bearish’ territory at the time of writing.

Solana’s Epic Run To Continue

Earlier in the day, Solana hit $225 for the first time in over seven months. Bitwise Chief Investment Officer Matt Hougan, in a weekly note, said that the token will benefit from the probable listing of multiple Solana ETFs before the end of the fourth quarter, alongside corporate treasury purchases.

“Solana’s big calling card is that it’s able to process significantly more transactions per second than Ethereum, while doing so cheaply,” Hougan added.

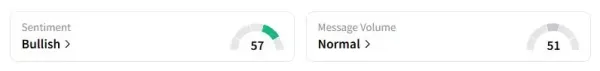

Traders on Stocktwits were ‘bullish’ about the token, whose market capitalization has grown to over $121 billion.

Separately, on Thursday, the first-ever Dogecoin ETF is expected to begin trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<