Finance enthusiasts are increasingly taking up the role of mutual fund distributor and using their stock market chops to help consumers invest, drawn by the surge in individual investors as well as assets under management in the country.

Bengaluru-based Manisha Singla, for instance, set up Pecuniaryadvantage and became a mutual fund distributor (MFD) after spending years in the education sector. While Singla had been managing assets for a few of her colleagues and friends informally before turning a professional, Sumant Tripathy, from Bhubaneswar, started True Value Invest as an MFD five years ago after spending nearly a decade managing client relationships for a few of the largest banks in the country.

According to industry data, the number of such individual MFDs, licensed to act as intermediaries between investors and asset management companies, has grown to about 170,000. The number needs to expand to at least 500,000, according to industry estimates, given that there are more than 54 million unique mutual fund investors in the country.

Revenue generation a challenge

While former bankers, finance professionals and chartered accountants are joining the segment with enthusiasm, revenue generation remains a challenge. Prudent Corporate Advisory, which manages around 34,000 distributors and has AUM of Rs 1 lakh crore, has a yield of 0.9%. Other platforms get yields of 0.8% to 0.95%, according to industry insiders.

Distributors, who work with these platforms, get a share of this yield, which hovers between 0.4% and 0.5% after taking goods and services tax (GST) and income tax expenses out of their gross earnings.

“We need to pay 18% GST on the fees we earn, plus there is income tax depending on the income bracket. So, overall, a distributor only manages to make around 0.4% to 0.5% of the assets managed,” said a distributor, who did not wish to be identified.

So, for a distributor managing Rs 10 crore, the annual income works out at Rs 4-5 lakh. But there is significant upside opportunity in a growing market, which is driving people to this profession.

Startups to the rescue

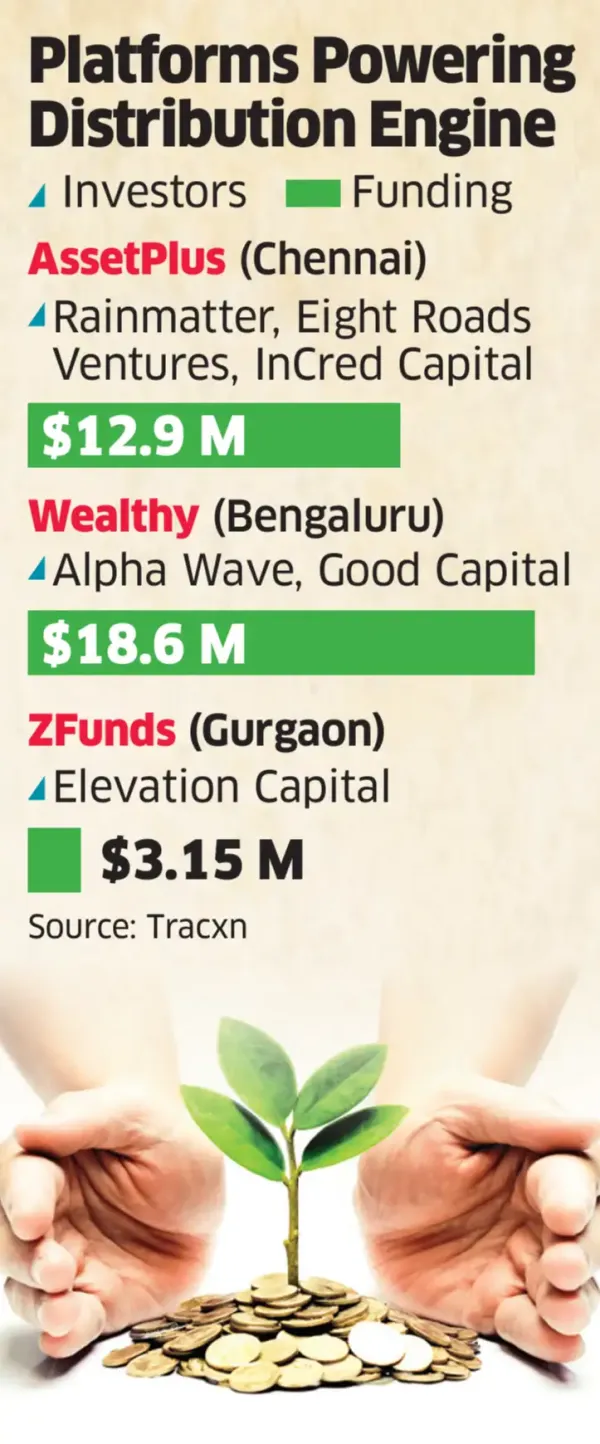

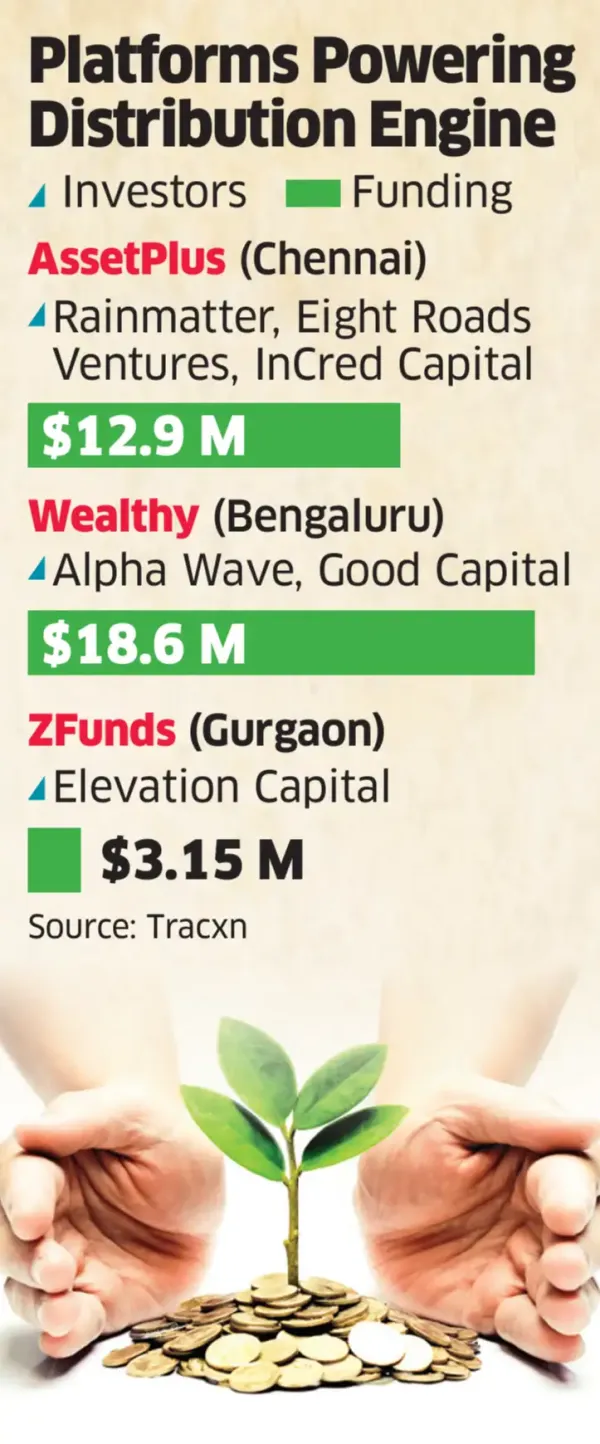

Platforms such as AssetPlus, Wealthy and ZFunds, are helping these retail distributors with technology support so they can pitch to their clients better and offer a more comprehensive financial advisory service from investments to insurance.

“An MFD is actually working to acquire investors, offering the best investment options to keep clients happy, managing the compliance burden, plus competing with direct mutual fund platforms for a share of the market,” said Vishranth Suresh, cofounder, AssetPlus.

The support of platforms like AssetPlus helps distributors remain competitive in the market, he said.

The Chennai-based startup, which is backed by Zerodha’s Rainmatter, caters to about 6,000 MFDs managing AUM of Rs 6,500 crore. The platform offers only mutual funds, and term and health insurance.

Aditya Agarwal, cofounder of Bengaluru-based Wealthy, said distributors from smaller cities and towns prefer to use the digital platforms since they can help process small-value UPI (Unified Payments Interface) payments and recurring SIP (systematic investment plan) transactions, and offer digital KYC (know your customer). All these features make lives easier for MFDs.

“We have a calculator feature which our distributors can show to their clients, helping them plan their financial needs. We have an app for their clients too, which makes managing a portfolio easier,” said Agarwal.

Wealthy, backed by Alpha Wave Global, manages about 4,500 distributors.

All these startups have raised funding from venture capital investors, who believe that the next round of growth in the wealth management segment will come only from these distributors.

Besides, given the proliferation of 'finfluencers', or unregulated financial advisors operating across social media platforms, the need for such regulated distributors has never been higher, according to industry executives.

Understanding the tailwinds

Multiple pro-investor regulatory changes, coupled with the boom in the larger asset-management industry, has helped the mutual fund sector grow over the past few years.

According to data from the Association of Mutual Funds in India, the industry AUM stood at Rs 75 lakh crore at the end of August, a sharp increase from Rs 27.5 lakh crore five years ago.

“After 2023, the wealth management market started growing exponentially. Then the number of people seeking investment advice also went up, so there was a demand for such advisors,” said Suresh of Assetplus.

In addition, regulatory changes made moving assets from banks to other platforms very easy, which encouraged bankers to quit their jobs and take their clients with them in their new firm, he said.

“A distributor has a vital role to play for expansion of the investment market to small towns and cities. Given how the MF market is growing, the upside is huge, and that is what we distributors are striving to grab a share of,” said Tripathy of True Value Invest.

Bengaluru-based Manisha Singla, for instance, set up Pecuniaryadvantage and became a mutual fund distributor (MFD) after spending years in the education sector. While Singla had been managing assets for a few of her colleagues and friends informally before turning a professional, Sumant Tripathy, from Bhubaneswar, started True Value Invest as an MFD five years ago after spending nearly a decade managing client relationships for a few of the largest banks in the country.

According to industry data, the number of such individual MFDs, licensed to act as intermediaries between investors and asset management companies, has grown to about 170,000. The number needs to expand to at least 500,000, according to industry estimates, given that there are more than 54 million unique mutual fund investors in the country.

Revenue generation a challenge

While former bankers, finance professionals and chartered accountants are joining the segment with enthusiasm, revenue generation remains a challenge. Prudent Corporate Advisory, which manages around 34,000 distributors and has AUM of Rs 1 lakh crore, has a yield of 0.9%. Other platforms get yields of 0.8% to 0.95%, according to industry insiders.

Distributors, who work with these platforms, get a share of this yield, which hovers between 0.4% and 0.5% after taking goods and services tax (GST) and income tax expenses out of their gross earnings.

“We need to pay 18% GST on the fees we earn, plus there is income tax depending on the income bracket. So, overall, a distributor only manages to make around 0.4% to 0.5% of the assets managed,” said a distributor, who did not wish to be identified.

So, for a distributor managing Rs 10 crore, the annual income works out at Rs 4-5 lakh. But there is significant upside opportunity in a growing market, which is driving people to this profession.

Startups to the rescue

Platforms such as AssetPlus, Wealthy and ZFunds, are helping these retail distributors with technology support so they can pitch to their clients better and offer a more comprehensive financial advisory service from investments to insurance.

“An MFD is actually working to acquire investors, offering the best investment options to keep clients happy, managing the compliance burden, plus competing with direct mutual fund platforms for a share of the market,” said Vishranth Suresh, cofounder, AssetPlus.

The support of platforms like AssetPlus helps distributors remain competitive in the market, he said.

The Chennai-based startup, which is backed by Zerodha’s Rainmatter, caters to about 6,000 MFDs managing AUM of Rs 6,500 crore. The platform offers only mutual funds, and term and health insurance.

Aditya Agarwal, cofounder of Bengaluru-based Wealthy, said distributors from smaller cities and towns prefer to use the digital platforms since they can help process small-value UPI (Unified Payments Interface) payments and recurring SIP (systematic investment plan) transactions, and offer digital KYC (know your customer). All these features make lives easier for MFDs.

“We have a calculator feature which our distributors can show to their clients, helping them plan their financial needs. We have an app for their clients too, which makes managing a portfolio easier,” said Agarwal.

Wealthy, backed by Alpha Wave Global, manages about 4,500 distributors.

All these startups have raised funding from venture capital investors, who believe that the next round of growth in the wealth management segment will come only from these distributors.

Besides, given the proliferation of 'finfluencers', or unregulated financial advisors operating across social media platforms, the need for such regulated distributors has never been higher, according to industry executives.

Understanding the tailwinds

Multiple pro-investor regulatory changes, coupled with the boom in the larger asset-management industry, has helped the mutual fund sector grow over the past few years.

According to data from the Association of Mutual Funds in India, the industry AUM stood at Rs 75 lakh crore at the end of August, a sharp increase from Rs 27.5 lakh crore five years ago.

“After 2023, the wealth management market started growing exponentially. Then the number of people seeking investment advice also went up, so there was a demand for such advisors,” said Suresh of Assetplus.

In addition, regulatory changes made moving assets from banks to other platforms very easy, which encouraged bankers to quit their jobs and take their clients with them in their new firm, he said.

“A distributor has a vital role to play for expansion of the investment market to small towns and cities. Given how the MF market is growing, the upside is huge, and that is what we distributors are striving to grab a share of,” said Tripathy of True Value Invest.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!