Corteva (CTVA) stock slipped 1% in premarket trading on Friday after a Wall Street analyst downgraded the company's shares due to concerns over its proposed split.

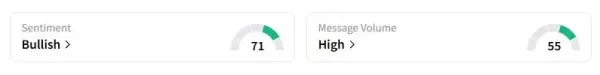

According to TheFly, KeyBanc downgraded Corteva stock to ‘Sector Weight’ from ‘Overweight’ without revealing a new price target. Retail sentiment on Stocktwits about the stock was still in the ‘bullish’ territory at the time of writing.

Earlier this week, Corteva announced plans to divide its operations into two standalone public companies, each focused on a distinct segment of the agriculture industry: crop protection and seed genetics. The move, approved unanimously by its board of directors, is expected to be finalized in the latter half of 2026 and is intended to be a tax-free transaction for U.S. shareholders.

The brokerage reportedly struggled to see the positives arising from the breakup. In addition, KayBanc analysts noted that the management described a more challenging crop protection environment in the medium term, "which also makes us pause."

Corteva has been facing intense competition from the likes of Bayer and Syngenta in its key markets, amid uncertainty over global crop demand due to uncertain tariff policies.

KeyBanc noted that it would maintain its rating till receiving additional details and clarity regarding the planned spin-off transaction.

The concerns of KeyBanc analysts echo the question marks raised by Citi analysts earlier this week. The brokerage downgraded the stock after noting a challenging 2026 setup for the shares, as it does not believe the separation will unlock additional shareholder value. The move brings more uncertainty amid an uncertain macro backdrop, the brokerage noted.

Corteva stated that its crop protection division is expected to generate approximately $7.8 billion in net sales in 2025, accounting for around 44% of the company's total net sales. At the same time, the seeds unit’s 2025 net sales are forecasted to reach $9.9 billion, representing 56% of the company’s current sales.

Corteva stock has gained 11.7% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<