Apple Inc. (AAPL) shares hit a fresh all-time high of $264.38 on Monday on optimism surrounding its iPhone 17 series sales following an upgrade from Loop Capital which raised its rating on the stock to ‘Buy’ from ‘Hold’.

The firm also increased its price target to $315, up from $226, citing strong iPhone shipment momentum expected to carry through the next several years, according to TheFly.

The upgrade comes as Loop Capital’s supply chain checks suggest iPhone volumes will grow steadily through 2027, fueled by new design updates and product refresh cycles.

According to the market research firm Counterpoint, iPhone 17 shipments were strong in two of Apple’s key markets, the U.S. and China, heading into the key holiday selling season.

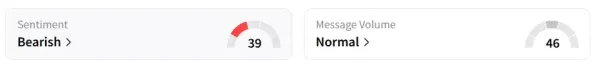

At the time of writing, the stock pared some of the gains and traded over 4% higher. However, on Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

Loop Capital said it expects “material upside” to Wall Street’s iPhone shipment forecasts through 2027. According to the firm, Apple may be entering a three-year stretch of record-setting iPhone sales.

Counterpoint said the initial demand for the iPhone 17 lineup outpaced last year’s iPhone 16 models in key global markets. Sales during the first 10 days of availability in China and the U.S. were 14% higher than the comparable launch period for the iPhone 16.

The base model has been particularly successful in China, where buyers nearly doubled unit sales compared to its predecessor. Discounts and promotional offers from sales channels have amplified the appeal, driving a notable shift toward the entry-level model.

Apple stock has gained over 4% year-to-date and 11% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<