The study suggests granting more green cards to Indians, limiting visa issuances to people from other countries for at least 10 years so that the backlog of Indian immigrants clears up first.

US President Donald Trump and his MAGA base may be hounding Indian and Indian-origin professionals in the US but the truth is they are most valuable to Trump among all immigrant groups by country in achieving his stated goal of bringing down the national debt. Ironically, Trump wants the very immigrants who have the biggest positive fiscal impact out of the US.

This fact was brought forth by recent research by an American economist. Amid anti-Indian rhetoric on social media triggered by Diwali celebrations in the US and the recent California crash caused by an Indian driver, Daniel Di Martino, a researcher of the Manhattan Institute, claimed that Indians are the best major country of origin group of immigrants. "Crazy people on X are bashing Indian immigrants, but my new research published today finds that Indians are the best major country of origin group of immigrants," he wrote on X. "The average Indian immigrant and his or her descendants will save the federal government $1.7 million over 30 years," the researcher said.

"The much-discussed H-1B visa is the best single visa type in terms of economic impact, with an average H-1B visa holder reducing the debt by $2.3 million over 30 years and expanding GDP by $500,000," Di Martino said.

(Join our ETNRI WhatsApp channel for all the latest updates)

His research shows South Asians are the most economically positive immigrant group, followed by Western Europeans who are also better than East Asians. Only Mexicans and Central Americans are net negative.

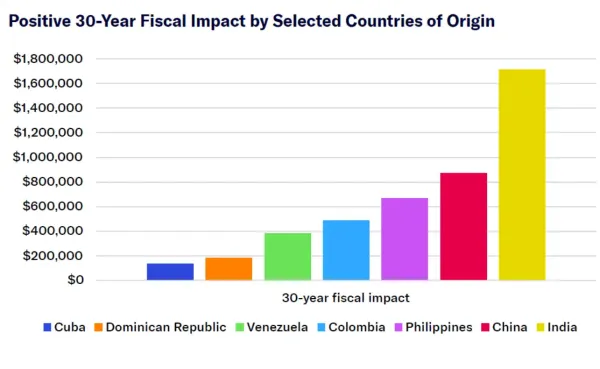

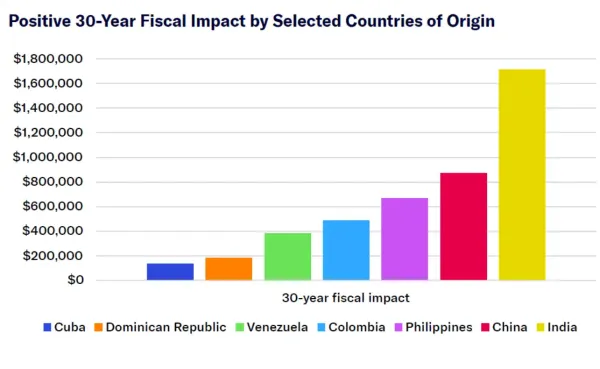

Estimating the fiscal impact specific by major countries, he found that Indians are the most economically positive major immigrant group. "Looking at specific national origin fiscal impact estimates, it becomes clear that among large immigrant groups, Indian immigrants are the most economically beneficial immigrant group in the U.S., with an average Indian immigrant reducing the national debt by over $1.6 million over 30 years and increasing GDP more than immigrants from any other country," the study says.

"Behind Indian immigrants are the Chinese, who reduce the debt by over $800,000 over 30 years. Next, Filipinos reduce the debt by over $600,000. Colombians and Venezuelans reduce the debt by $500,000 and $400,000, respectively. The most fiscally burdensome immigrants are Salvadorans, who increase the national debt by over $50,000 over 30 years, followed by the largest immigrant group, Mexicans, who, on average, increase the national debt by $10,000 each over 30 years," the study says

"Behind Indian immigrants are the Chinese, who reduce the debt by over $800,000 over 30 years. Next, Filipinos reduce the debt by over $600,000. Colombians and Venezuelans reduce the debt by $500,000 and $400,000, respectively. The most fiscally burdensome immigrants are Salvadorans, who increase the national debt by over $50,000 over 30 years, followed by the largest immigrant group, Mexicans, who, on average, increase the national debt by $10,000 each over 30 years," the study says

Interestingly, his study finds that by legal status, H-1B visa holders expand GDP the most. An H-1B visa today will likely increase GDP by $500,000 after 30 years and reduce the debt by $2.3 million. Trump has tried to restrict the number of H1B visa workers, most of whom are Indians.

The study also reveals that illegal immigrants are a big burden on the US economy. It says that the average illegal immigrant living in America today is expected to cost the federal government over $200,000 while letting new illegals in costs nearly $100,000. "But deportations cost money. Most estimates put it between $12,000 and $13,000 each. So over 10 years, the average deportation will cost us tax dollars net of any savings, in addition to shrinking the economy. But over 30 years, mass deportations pay for themselves," Di Martino said.

"Fiscal impact shouldn't be the sole criterion for immigration policy, but it is a crucial and quantifiable measure of long-term national interest. A well-designed policy mix can simultaneously strengthen the federal balance sheet, boost economic growth, and ease assimilation," he said

He proposes reduction in total legal immigration by 10% and increase in high skilled immigration (such as through H1B visas) by nearly 200%.

The study also suggests granting more green cards to Indians, limiting visa issuances to people from other countries for at least 10 years so that the backlog of Indian immigrants clears up first. It said Indian immigrants now wait for decades to get a green card while in other countries, the waiting period is a maximum of two years.

Kent Smetters of the University of Pennsylvania’s Penn Wharton Budget Model, who served in President George W. Bush’s Treasury Department, told AP that a growing debt load over time leads ultimately to higher inflation, eroding Americans’ purchasing power. The Government Accountability Office outlines some of the impacts of rising government debt on Americans — including higher borrowing costs for things like mortgages and cars, lower wages from businesses having less money available to invest, and more expensive goods and services.

“I think a lot of people want to know that their kids and grandkids are going to be in good, decent shape in the future — that they will be able to afford a house,” Smetters said. “That additional inflation compounds” and erodes consumers’ purchasing power, he said, making it less possible for future generations to achieve home ownership goals.

The Trump administration says its policies are helping to slow government spending and will shrink the nation’s massive deficit. A new analysis by Treasury Department officials states that from April to September, the cumulative deficit totaled $468 billion. In a post on X Wednesday, Treasury Secretary Scott Bessent said that’s the lowest reading since 2019.

The U.S. hit $34 trillion in debt in January 2024, $35 trillion in July 2024 and $36 trillion in November 2024.

This fact was brought forth by recent research by an American economist. Amid anti-Indian rhetoric on social media triggered by Diwali celebrations in the US and the recent California crash caused by an Indian driver, Daniel Di Martino, a researcher of the Manhattan Institute, claimed that Indians are the best major country of origin group of immigrants. "Crazy people on X are bashing Indian immigrants, but my new research published today finds that Indians are the best major country of origin group of immigrants," he wrote on X. "The average Indian immigrant and his or her descendants will save the federal government $1.7 million over 30 years," the researcher said.

"The much-discussed H-1B visa is the best single visa type in terms of economic impact, with an average H-1B visa holder reducing the debt by $2.3 million over 30 years and expanding GDP by $500,000," Di Martino said.

How Indian Americans can help bring down America's national debt

The research by Di Martino estimates the deficit, GDP and population impact of immigrants by legal status, education, age, race and origin. He proposes reforming immigration to select better immigrants which can reduce the debt by $20 trillion over 30 years.(Join our ETNRI WhatsApp channel for all the latest updates)

His research shows South Asians are the most economically positive immigrant group, followed by Western Europeans who are also better than East Asians. Only Mexicans and Central Americans are net negative.

Estimating the fiscal impact specific by major countries, he found that Indians are the most economically positive major immigrant group. "Looking at specific national origin fiscal impact estimates, it becomes clear that among large immigrant groups, Indian immigrants are the most economically beneficial immigrant group in the U.S., with an average Indian immigrant reducing the national debt by over $1.6 million over 30 years and increasing GDP more than immigrants from any other country," the study says.

Interestingly, his study finds that by legal status, H-1B visa holders expand GDP the most. An H-1B visa today will likely increase GDP by $500,000 after 30 years and reduce the debt by $2.3 million. Trump has tried to restrict the number of H1B visa workers, most of whom are Indians.

The study also reveals that illegal immigrants are a big burden on the US economy. It says that the average illegal immigrant living in America today is expected to cost the federal government over $200,000 while letting new illegals in costs nearly $100,000. "But deportations cost money. Most estimates put it between $12,000 and $13,000 each. So over 10 years, the average deportation will cost us tax dollars net of any savings, in addition to shrinking the economy. But over 30 years, mass deportations pay for themselves," Di Martino said.

"Fiscal impact shouldn't be the sole criterion for immigration policy, but it is a crucial and quantifiable measure of long-term national interest. A well-designed policy mix can simultaneously strengthen the federal balance sheet, boost economic growth, and ease assimilation," he said

He proposes reduction in total legal immigration by 10% and increase in high skilled immigration (such as through H1B visas) by nearly 200%.

The study also suggests granting more green cards to Indians, limiting visa issuances to people from other countries for at least 10 years so that the backlog of Indian immigrants clears up first. It said Indian immigrants now wait for decades to get a green card while in other countries, the waiting period is a maximum of two years.

Trump promised to cut debt but it's mounting fast

In the midst of a federal government shutdown, the U.S. government’s gross national debt surpassed $38 trillion Wednesday, a record number that highlights the accelerating accumulation of debt on America’s balance sheet. It’s also the fastest accumulation of a trillion dollars in debt outside of the COVID-19 pandemic — the U.S. hit $37 trillion in gross national debt in August this year, The Associated Press reported. The $38 trillion update is found in the latest Treasury Department report, which logs the nation’s daily finances.Kent Smetters of the University of Pennsylvania’s Penn Wharton Budget Model, who served in President George W. Bush’s Treasury Department, told AP that a growing debt load over time leads ultimately to higher inflation, eroding Americans’ purchasing power. The Government Accountability Office outlines some of the impacts of rising government debt on Americans — including higher borrowing costs for things like mortgages and cars, lower wages from businesses having less money available to invest, and more expensive goods and services.

“I think a lot of people want to know that their kids and grandkids are going to be in good, decent shape in the future — that they will be able to afford a house,” Smetters said. “That additional inflation compounds” and erodes consumers’ purchasing power, he said, making it less possible for future generations to achieve home ownership goals.

The Trump administration says its policies are helping to slow government spending and will shrink the nation’s massive deficit. A new analysis by Treasury Department officials states that from April to September, the cumulative deficit totaled $468 billion. In a post on X Wednesday, Treasury Secretary Scott Bessent said that’s the lowest reading since 2019.

The U.S. hit $34 trillion in debt in January 2024, $35 trillion in July 2024 and $36 trillion in November 2024.