Cava Group, Inc.’s shares declined 9.8% in the after-market session on Tuesday, after the restaurant chain reported third-quarter results below expectations and lowered its annual same-store sales forecast.

High inflation, job losses, and economic uncertainty driven by U.S. tariffs are discouraging consumers from eating out, weighing on both fast-food chains and specialty restaurants. Last week, Chipotle Mexican Grill reported disappointing results and a subdued outlook, sending its shares to their steepest single-day drop in a decade.

Cava’s management said it saw weak consumer uptake among 25- to 35-year-olds, a warning similar to Chipotle’s. “You’ve seen middle-income earners’ wage growth stagnate in recent months… That part of the consumer segment have more headwinds this year than they had tailwinds last year,” CEO Brett Schulman said.

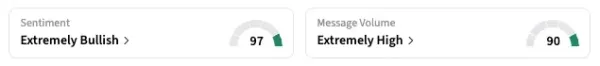

However, retail investors were upbeat about Cava, arguing that its financial performance is still better than its rivals' and that the stock is oversold. On Stocktwits, the retail sentiment for the ticker shifted multiple points higher in the ‘extremely bullish’ zone (97/100), with 24-hour message volume rising over 300%.

“(The stock is) going to be bought up from here, (the company is) still growing revenues and locations. Still had positive SSS (same store sales) growth while everyone else posting negatives.”

Another said: “Considering a massive earnings miss was already priced in...I would consider this very bullish for the stock.”

Notably, the relative strength index, or RSI for CAVA was 24.6, according to Koyfin. A value below 30 indicates the stock is oversold and may be due for a rebound.

Revenue at the Mediterranean food chain jumped 20% to $289.8 million, helped by new restaurant openings. However, the figure was below the $291.9 million analysts' estimate from FactSet. Same-store sales growth of 1.9% also missed the 2.8% growth target.

Earnings per share came in at $0.12, a cent below expectations. Cava subsequently lowered its full-year comparable sales growth forecast to 3% to 4%, down from its earlier view of 4% to 6%.

The stock pressure adds to the already poor run. As of the last close, CAVA shares have declined 54.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<