New Delhi: The sixteenth Finance Commission led by Arvind Panagariya Monday submitted its recommendations to President Droupadi Murmu on how the tax pool will be divided between the Centre and states for the next five years beginning April 1, 2026. The team also met finance minister Nirmala Sitharaman.

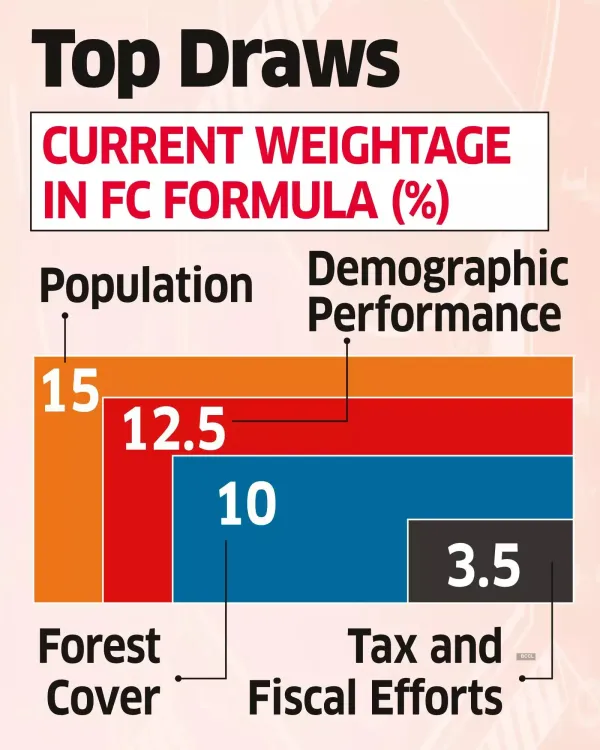

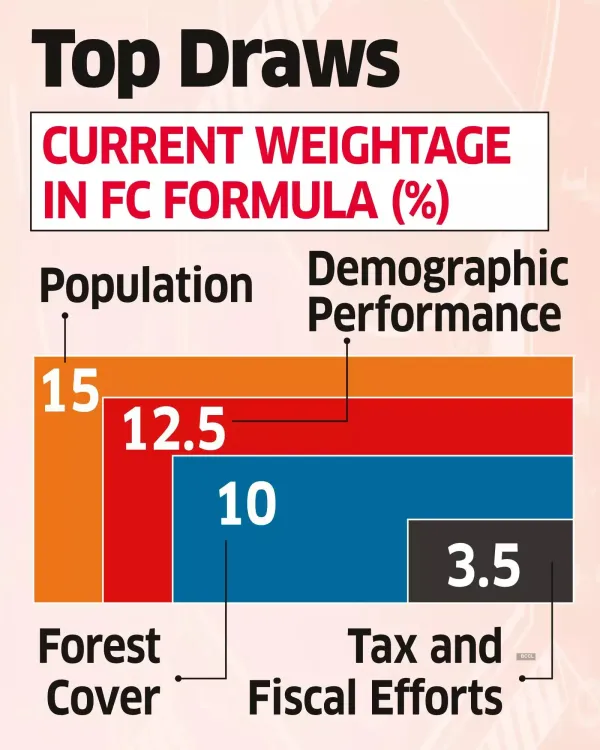

The report in two volumes also lay down formula in how tax is divided among states based on a weighted sum of population, area, demographic performance, fiscal effort, income distance and forest cover.

As per the broad terms of reference given by the centre, the report will also specify revenue augmentation measures, will present arrangements for financing disaster management initiatives with reference to the funds constituted under the Disaster Management Act, 2005 and will determine financing of municipal bodies.

The report will be tabled to the parliament before making it public.

It will be separately reviewed by the finance ministry, which may accept the suggestion partially or fully.

The report remains crucial amid the state's demand of higher tax share and recent tax reforms.

The southern states have objected to the use of population as a criterion for devolution, arguing that it penalises them despite their success in controlling population growth. They also demanded to increase the state's share in tax devolution to 50%.

The sixteenth Finance Commission was set up on December 31, 2023.

The commission which was was mandated to submit its report by October 31, was given an extension of one month till November 30.

The commission has visited all states and Union Territories as a precursor to firming up its views on states' share in grants in aid and taxes.

The other members of the commission were former senior finance ministry official Annie George Mathew, economist Manoj Panda as full time members and SBI Group Chief Economic Advisor Soumya Kanti Ghosh and RBI Deputy Governor T Rabi Sankar are part-time members.

The report in two volumes also lay down formula in how tax is divided among states based on a weighted sum of population, area, demographic performance, fiscal effort, income distance and forest cover.

As per the broad terms of reference given by the centre, the report will also specify revenue augmentation measures, will present arrangements for financing disaster management initiatives with reference to the funds constituted under the Disaster Management Act, 2005 and will determine financing of municipal bodies.

Report to be tabled in Parliament and separately undergo review by Finmin

The report will be tabled to the parliament before making it public.

It will be separately reviewed by the finance ministry, which may accept the suggestion partially or fully.

The report remains crucial amid the state's demand of higher tax share and recent tax reforms.

The southern states have objected to the use of population as a criterion for devolution, arguing that it penalises them despite their success in controlling population growth. They also demanded to increase the state's share in tax devolution to 50%.

The sixteenth Finance Commission was set up on December 31, 2023.

The commission which was was mandated to submit its report by October 31, was given an extension of one month till November 30.

The commission has visited all states and Union Territories as a precursor to firming up its views on states' share in grants in aid and taxes.

The other members of the commission were former senior finance ministry official Annie George Mathew, economist Manoj Panda as full time members and SBI Group Chief Economic Advisor Soumya Kanti Ghosh and RBI Deputy Governor T Rabi Sankar are part-time members.