Shares of Sadot Group (SDOT) slumped 21% on Tuesday to a record low after the company said it expects a sharp decline in revenue and income for the third quarter.

In an SEC filing, the company said it expects preliminary unaudited revenue for the quarter ended Sept. 30, 2025, to be $0.3 million, a sharp decline from the $200.9 million reported a year earlier. Sadot attributed the decline to insufficient working capital.

The company expects a loss of $14.3 million, compared with an operating income of $2.5 million in the prior-year period.

Sadot cited delays in collecting major receivables within its LATAM (Latin America) division, which further strained liquidity. Management is seeking additional financing to stabilize operations, the filing read.

The company had posted a weak second-quarter print with revenue declining 34% to $114.4 million. While gross margin rose to 4.4% from 3.3% last year, the improvement did not translate into stronger overall profitability. Net income fell to $0.4 million from $2.4 million a year earlier, while earnings before interest, taxes, depreciation, and amortization (EBITDA) declined to $1.7 million from $3.4 million.

In September, Sadot executed a 1-for-10 reverse stock split, a move intended to restore compliance with Nasdaq’s $1.00 minimum bid requirement. The split reduced outstanding shares from about 9.9 million to roughly one million and authorized shares from 20 million to two million.

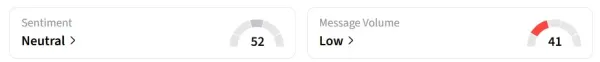

Retail sentiment on Stocktwits has remained in the ‘neutral’ territory over the past 24 hours.

One user stated that they were looking to buy the dip.

Year-to-date, SDOT stock has declined 90%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<