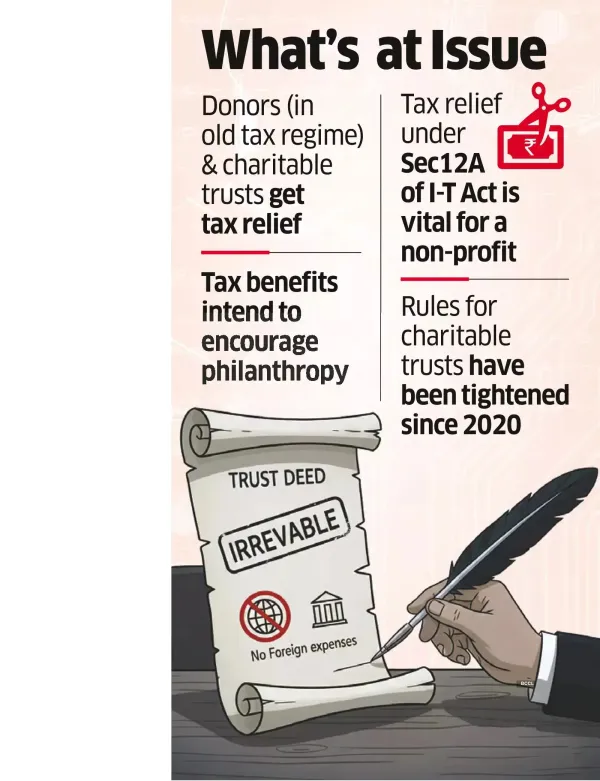

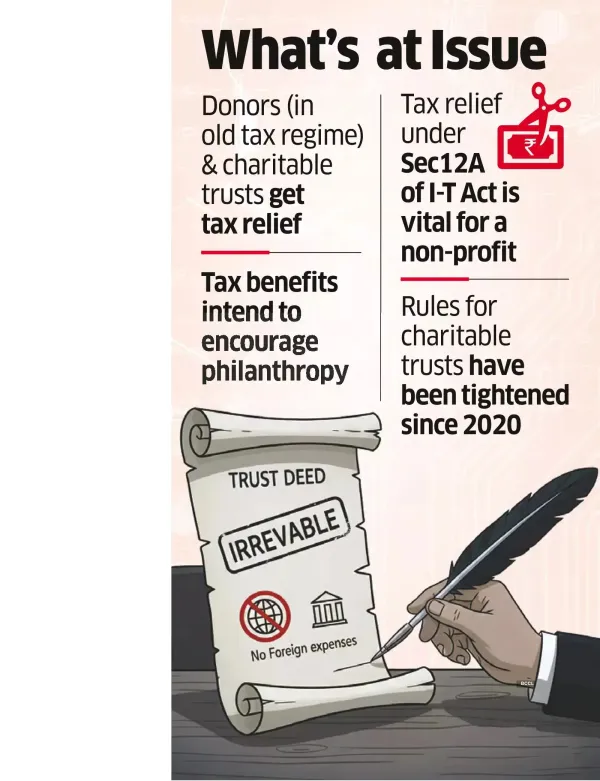

Public charitable Trusts are being told by the Income Tax (I-T) department that their trust deeds must state that they are 'irrevocable' and make no expenses to foreign companies.

A trust that fails to unambiguously put down these conditions would not receive tax benefits offered to donors as well as charitable trusts.

The tax office has rejected some trust applications to renew the tax benefits which are vital for the survival of a charitable trust, two persons aware of the development told ET. A charitable trust must apply for renewals to claim tax relief every five years. The tax department could be driven by fears that a settlor of a trust may take the liberty at some point to dismantle the organisation and distribute assets to trustees; or, some trusts could book bogus expenses to move money abroad. But, practitioners feel this ultra-cautious stance could impact the functioning of several trusts.

The tax department could be driven by fears that a settlor of a trust may take the liberty at some point to dismantle the organisation and distribute assets to trustees; or, some trusts could book bogus expenses to move money abroad. But, practitioners feel this ultra-cautious stance could impact the functioning of several trusts.

"The absence of an irrevocability clause is being confused with the requirement of a clause stating what happens to the trust assets on dissolution of the trust. Here too, the trust funds can only be used for the objects of the trust, which could include donation made to another trust for the objects. Unfortunately, there's an apprehension that funds may be distributed to the trustees or given back to the settlor, which in law is not permissible, unless the settlor has a revocability clause in the trust deed. Therefore, the absence of such a clause cannot be a ground to deny registration," said senior chartered accountant Gautam Nayak, who advises many trusts.

Under Section 80G of the I-T Act, 1961, individuals, Hindu Undivided Families (HUFs), companies, and firms, including Non-Resident Indians, opting for the old tax regime, can claim deductions on donations to eligible charitable institutions and relief funds. Once constituted, a trust or a Section 8 company (a non-profit under the Companies Act) must be registered under Sec 12A of the law to claim tax exemption on generated incomes used for charitable or religious purposes.

According to Isha Sekhri, partner at Isha Sekhri Advisory LLP, the 'irrevocability' clause is to ensure that charitable assets remain permanently dedicated to public benefit, without any possibility of reverting to private hands, while money collected under India's tax exemptions for charitable use must be spent within the country. "Funds meant for Indian public benefit should not be diverted abroad," she said.

However, in law, unless the settlor has retained the right of revocation in the trust deed, a trust would be irrevocable. So, there may not be a need to explicitly state that it is irrevocable. "On the contrary, the question that should be raised is whether there is any clause for revocability of the trust in the trust deed. If not, it is automatically irrevocable," said Nayak.

As regards spending outside India, there have been conflicting High Court decisions as to whether prior approval of the Central Board of Direct Taxes (CBDT) is required if the charitable purpose is outside India or if the spending is outside India for charitable purposes in India.

Nayak thinks that registration cannot be denied merely because the trust deed permits spending outside India. "In fact, if the trust deed does not permit the trust to spend outside India, the trust will never be able to spend outside India even with prior CBDT approval. Courts and tribunals have held that the existence of such a clause permitting spending outside India cannot be a ground for denial of registration, but that only if there is actual spending without CBDT's approval, the spending would not be allowable as an application of income. Denial of registration under section 12A is like a death sentence to a trust," he said.

Such denials, it's felt, should only be in exceptional cases where there is an outright violation of law.

Since 2020, non-profits have had to comply with new rules - particularly, share more information when they renew and apply for the licence to obtain foreign donations. For instance, they have to submit the year-wise activity report to the authorities instead of presenting a general report, besides sharing receipt and payment accounts with the government, along with the audited accounts.

A trust that fails to unambiguously put down these conditions would not receive tax benefits offered to donors as well as charitable trusts.

The tax office has rejected some trust applications to renew the tax benefits which are vital for the survival of a charitable trust, two persons aware of the development told ET. A charitable trust must apply for renewals to claim tax relief every five years.

"The absence of an irrevocability clause is being confused with the requirement of a clause stating what happens to the trust assets on dissolution of the trust. Here too, the trust funds can only be used for the objects of the trust, which could include donation made to another trust for the objects. Unfortunately, there's an apprehension that funds may be distributed to the trustees or given back to the settlor, which in law is not permissible, unless the settlor has a revocability clause in the trust deed. Therefore, the absence of such a clause cannot be a ground to deny registration," said senior chartered accountant Gautam Nayak, who advises many trusts.

Under Section 80G of the I-T Act, 1961, individuals, Hindu Undivided Families (HUFs), companies, and firms, including Non-Resident Indians, opting for the old tax regime, can claim deductions on donations to eligible charitable institutions and relief funds. Once constituted, a trust or a Section 8 company (a non-profit under the Companies Act) must be registered under Sec 12A of the law to claim tax exemption on generated incomes used for charitable or religious purposes.

According to Isha Sekhri, partner at Isha Sekhri Advisory LLP, the 'irrevocability' clause is to ensure that charitable assets remain permanently dedicated to public benefit, without any possibility of reverting to private hands, while money collected under India's tax exemptions for charitable use must be spent within the country. "Funds meant for Indian public benefit should not be diverted abroad," she said.

However, in law, unless the settlor has retained the right of revocation in the trust deed, a trust would be irrevocable. So, there may not be a need to explicitly state that it is irrevocable. "On the contrary, the question that should be raised is whether there is any clause for revocability of the trust in the trust deed. If not, it is automatically irrevocable," said Nayak.

As regards spending outside India, there have been conflicting High Court decisions as to whether prior approval of the Central Board of Direct Taxes (CBDT) is required if the charitable purpose is outside India or if the spending is outside India for charitable purposes in India.

Nayak thinks that registration cannot be denied merely because the trust deed permits spending outside India. "In fact, if the trust deed does not permit the trust to spend outside India, the trust will never be able to spend outside India even with prior CBDT approval. Courts and tribunals have held that the existence of such a clause permitting spending outside India cannot be a ground for denial of registration, but that only if there is actual spending without CBDT's approval, the spending would not be allowable as an application of income. Denial of registration under section 12A is like a death sentence to a trust," he said.

Such denials, it's felt, should only be in exceptional cases where there is an outright violation of law.

Since 2020, non-profits have had to comply with new rules - particularly, share more information when they renew and apply for the licence to obtain foreign donations. For instance, they have to submit the year-wise activity report to the authorities instead of presenting a general report, besides sharing receipt and payment accounts with the government, along with the audited accounts.