Virendra Pandit

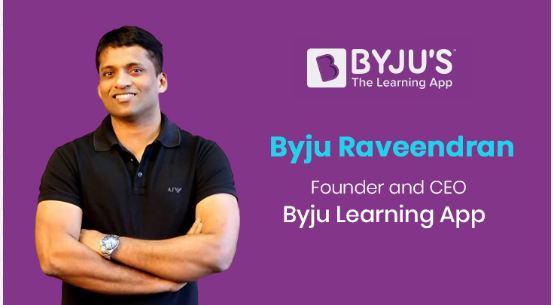

New Delhi: A US court has issued a default judgment making Indian entrepreneur, educator, and investor Byju Raveendran liable to personally pay back over USD 1 billion based on the petition filed by BYJU’s Alpha and US-based lender GLAS Trust Company LLC.

Byju’s representatives said the US court’s ruling was based on a default judgment rather than a trial on the merits, adding that the founders would appeal and contest the order.

According to the November 20 judgment, the Delaware Bankruptcy Court found that Raveendran failed to comply with its discovery order and continued to be evasive on several occasions, the media reported on Saturday.

“The court will enter default judgment against Defendant Raveendran… of USD 533,000,000, and on Counts II, V, and VI in the amount of USD 540,647,109.29,” the judgment said.

The court directed Raveendran to provide a full and accurate accounting of the Alpha Funds and any proceeds thereof, such as the Camshaft LP Interest, including every subsequent transfer and any proceeds thereof.

BYJU’s Alpha was incorporated when Raveendran was running the management of edtech firm Think and Learn Private Limited (TLPL), which operated under Byju’s brand name.

TLPL had secured USD 1 billion Term Loan B from US-based lenders, who later alleged that BYJU’s Alpha has violated terms of the loan and USD 533 million out of the total debt has been moved out of the US illegitimately.

The GLASS Trust moved Delaware court and received a favorable order to take control of BYJU’s Alpha.

Both BYJU’s Alpha and GLAS Trust moved the Delaware Bankruptcy Court for the discovery of USD 533 million and transactions.

According to the latest judgment, the court found that Raveendran had knowledge of the discovery order but had simply refused to comply.

The court had also issued contempt order in the matter but noted that Raveendran continues to refuse to respond to the discovery requests or pay the sanctions he owes.

“The facts and circumstances of this case indicate that Raveendran’s continuing failure to adequately respond to the pending discovery requests is a personal decision by Raveendran, himself,” the judgment noted.

The court rejected Raveendran’s argument that the GLAS Trust has access to documents through the books of BYJU’S Alpha on the information they are looking for. It noted that there is nothing in the record to support the assertion GLAS has access to relevant documents.

“The court has also found that Raveendran’s behavior has been a strategic pattern of willful failure to comply with discovery,” the judgment said.

The court has already determined that Raveendran is in contempt of the previous discovery orders and has imposed sanctions of USD 10,000 per day until he purges his contempt.

“The monetary sanctions, however, remain unpaid and have been ineffective. Raveendran lives abroad and apparently has no intention of satisfying his financial penalties or complying with the discovery orders. Accordingly, the monetary sanctions have not provided an effective remedy, making a harsher sanction such as default judgment appropriate in this instance,” the judgment said.

In a statement, Byju’s representatives said the US court’s ruling was based on a default judgment rather than a trial on merits, adding that the founders would appeal and contest the order.

“We consider that the US court erred in its judgment… it ignored relevant facts,” the statement said. It argued that the expedited process deprived Raveendran of the chance to present a defence, and reiterated that the loan proceeds were not used for personal gain, but for the benefit of Think & Learn Pvt Ltd.

The founders also alleged that GLAS Trust — which controls BYJU’s Alpha — had not provided full disclosures on fund utilization and said applications were pending in Indian courts to compel such explanations from GLAS and the company’s Resolution Professional.

They added that claims seeking at least USD 2.5 billion in damages are being prepared against GLAS Trust and other parties in multiple jurisdictions, expected to be filed before the end of 2025.

The escalating legal battle adds a new layer of uncertainty for the once high-flying edtech firm, already undergoing insolvency proceedings in India.