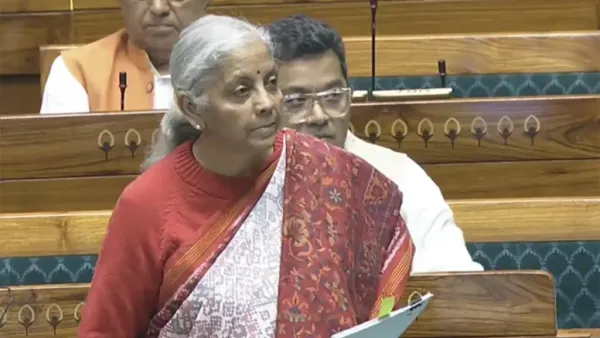

Sabka Bima Sabki Raksha Bill 2025: The central government has passed the “Insurance for All, Security for All (Insurance Laws Amendment) Bill, 2025” to bring health insurance coverage to the common people. The Insurance for All, Security for All Bill aims to bring about major reforms in India’s insurance sector so that insurance services are provided to urban and (…)

Sabka Bima Sabki Raksha Bill 2025: The Central Government has passed the “Insurance for All, Protection for All (Insurance Laws Amendment) Bill, 2025” to bring health insurance coverage to the common people. Insurance for All, Security for All Bill aims to bring about major reforms in India’s insurance sector so that insurance services reach every citizen living in urban and rural areas. Under these changes, the foreign direct investment (FDI) limit in India’s insurance sector has been increased from 74% to 100%.

The main objective of allowing 100% FDI is to make insurance services better and more affordable. After the new bill on insurance was passed by the central government, the question arises whether the people living in villages will also benefit from it? If yes, how much premium will the people living in rural areas have to pay for the insurance?

Will the people of the villages also be able to benefit from it?

Yes, the changes in the insurance bill will also benefit people living in rural areas. Earlier, due to lack of insurance companies or agents in rural areas, people were unable to purchase policies. After this bill, new companies will increase investment in the insurance sector and expand digital distribution. Villagers will be able to easily purchase policies in very small installments through mobile apps, websites, Common Service Centers (CSCs) etc. Thanks to digital payments, insurance policies can now be purchased from the comfort of one’s home.

How much premium will the villagers have to pay?

Financial expert Rakesh Jain says the new bill does not mean that people living in villages will get free insurance. The bill passed in Parliament does not make insurance free, nor has the government decided that everyone will get insurance without paying a premium. The aim is to make insurance more affordable, more accessible and more acceptable so that the coverage of insurance expands and covers more people. How much premium the villagers will have to pay for the insurance will be decided by the company.

On what basis is the insurance premium amount determined?

When a person buys insurance, companies determine the premium by considering several factors. Let’s know about them:

You can understand it like this: if you are 30 years old and take life insurance, the premium can range from a few hundred to a few thousand rupees per year. In health insurance, the premium can be up to ₹15,000 depending on age and coverage. Additionally, accident insurance or small risk insurance can be between ₹300 and ₹2,000 per year during the life insurance term.