When Prada announced its acquisition of Versace , the fashion world did what it always does when giants collide: speculate, panic and meme. But beneath the noise sits a serious question – what happens when Prada’s intellectual minimalism takes charge of Versace’s unapologetic glamour? Prada insists this is no quick flip. “We’ll be fully engaged with Versace for at least three years,” CEO Andrea Guerra said, calling Versace “the brand that invented fashion as we know it – the one that created glamour, introduced supermodels and brought music into fashion.”

The challenge, however, is formidable. Prada’s past acquisitions – Jil Sander, Helmut Lang and Church’s – offer little reassurance that reviving heritage brands comes easily. Versace, meanwhile, has been losing momentum for more than two decades. Luxury turnarounds are rarely straightforward.

Still, this time may be different. With a streamlined structure, renewed leadership and a longterm mindset, Prada appears better prepared – provided it builds on Versace’s DNA rather than taming it. Discipline meets spectacle. The next three years will reveal whether discipline can sharpen spectacle – or dull it beyond repair.

‘AIM IS TO CONTINUE VERSACE’S LEGACY’

Prada has promised not to dilute Versace’s voice. Prada Group chairman Patrizio Bertelli emphasised in a release, “We aim to continue Versace’s legacy – celebrating and reinterpreting its bold and timeless aesthetic. At the same time, we will provide it with a strong platform, reinforced by years of ongoing investments. Our organisation is ready and well positioned to write a new page in Versace’s history.”

Industry insiders see the logic. Luca Solca, an analyst at Bernstein Group consulting firm, told AP , “Versace is long past its heyday. The challenge and the opportunity is to make it relevant again... They are going to have to invent something which is going to make the brand attractive, desirable and interesting again. ” This means loud, glamorous, logoheavy Versace remains untouched – but is now backed by Prada’s efficiency.

WHERE VERSACE’S CULTURAL POWER BECOMES PRADA’S BIGGEST ASSET

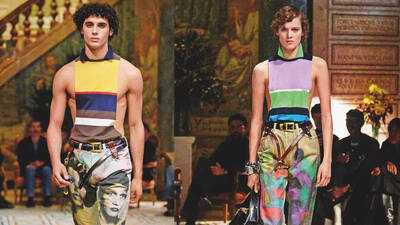

Versace’s strength has always been its popcultural resonance. Guerra observed, “It’s a brand that was born in culture. It’s a brand that was born in classic, historic, Greek, Mediterranean, ancient roots. And on the other side, let’s not forget that Versace has created what we’re seeing every day, this glam, this pop, music, models, supermodels.”

Expect Prada to lean heavily on this cultural capital: red-carpet ubiquity, high-profile celebrity collaborations, content-heavy campaigns and bolder digital storytelling. Analyst Luca Solca suggests to Vogue Business , “Prada will endeavour to take Versace back to its roots, but in an up-to-date way.”

That could mean a renewed focus on haute couture, a space where Versace once flourished. Fashion critic Osama Chabbi told Vogue Business , “When the couture was there, I could easily associate it with the rich and famous.” This is a territory where Versace already dominates and now has Prada’s global machinery behind it.

‘VERSACE HAS HUGE POTENTIAL BUT REQUIRES DISCIPLINED EXECUTION’

Versace has a glittering past but a recent Versace has a glittering past but a recent shaky present. Under Capri Holdings, the brand shaky present. Under Capri Holdings, the brand struggled to meet revenue targets, posting an struggled to meet revenue targets, posting an operating loss in its last fiscal year. Guerra sees operating loss in its last fiscal year. Guerra sees “huge potential” in Versace but he cautions, “huge potential” in Versace but he cautions, “The journey will be long and will require “The journey will be long and will require disciplined execution and patience.” disciplined execution and patience.”

Prada’s machinery – streamlined supply Prada’s machinery – streamlined supply chains, in-house manufacturing, and a chains, in-house manufacturing, and a verticalised global network – can provide the verticalised global network – can provide the structure Versace lacked. Lorenzo Bertelli, structure Versace lacked. Lorenzo Bertelli, Prada heir and now Versace Executive Prada heir and now Versace Executive Chairman, said, “It was the right time to seize a Chairman, said, “It was the right time to seize agrowth opportunity for the group.” growth opportunity for the group.”

Analysts believe it won’t be easy. HSBC’s Analysts believe it won’t be easy. HSBC’s Erwan Rambourg explained to Erwan Rambourg explained to Business of Business of Fashion Fashion , “They should reestablish Versace as , “They should reestablish Versace as a premium brand, rather than one dependent a premium brand, rather than one dependent on outlet malls, which was always at the risk on outlet malls, which was always at the risk of being run by Capri. But getting out of outlets of being run by Capri. But getting out of outlets isn’t going to be good initially for sales or isn’t going to be good initially for sales or margins. The next 12 months will be rough.” margins. The next 12 months will be rough.”

Prada’s advantage? Ownership patience. Prada’s advantage? Ownership patience. The Prada-Bertelli family still controls 80% of The Prada-Bertelli family still controls 80% of the group, giving time for careful recalibration. the group, giving time for careful recalibration.

VERSACE ON ITS WAY TO GLOBAL GROWTH?

Versace now has access to Prada’s worldwide Versace now has access to Prada’s worldwide network. The brand’s base is sure to shift from network. The brand’s base is sure to shift from Capri’s New York to Milan. Guerra highlighted, Capri’s New York to Milan. Guerra highlighted, “We are adding Versace and we will have “We are adding Versace and we will have another vertical asset.” another vertical asset.”

Versace’s revenue is well diversified Versace’s revenue is well diversified (42% EMEA, 31% Americas, 27% APAC) and (42% EMEA, 31% Americas, 27% APAC) and supported by 227 retail stores globally. With supported by 227 retail stores globally. With this, Prada can expand Versace’s footprint, this, Prada can expand Versace’s footprint, particularly in underpenetrated markets particularly in underpenetrated markets like Southeast Asia and the Middle East. like Southeast Asia and the Middle East. Prada Group CFO Andrea Bonini added, Prada Group CFO Andrea Bonini added, “Its (Versace’s) revenue contribution is very “Its (Versace’s) revenue contribution is very balanced in terms of geographical areas but balanced in terms of geographical areas but also in terms of product categories between also in terms of product categories between ready-to-wear and leather goods.” ready-to-wear and leather goods.”

The plan is clear: maintain Versace’s bold The plan is clear: maintain Versace’s bold identity while improving operational execution, identity while improving operational execution, retail experience, and product consistency. retail experience, and product consistency.

DARIO VITALE’S SUDDEN EXIT COMPLICATES PRADA’S PROMISE OF STABILITY

Luca Solca admitted to NYT, “It’s a pity. Vitale’s first step was good. I don’t understand why this happens.” Intriguingly, Vitale’s exit came after Prada had promised stability.

“Especially at the beginning, stability is a very important word. This is what we are going to do. We are going to care about everyone working in Versace. And we are going to care about everything that is happening in Versace. The only thing I don’t want to happen is I don’t want to kill the patient while we cure it,” Andrea Guerra had said at an event.

Prada has promised not to dilute Versace’s voice. Prada Group chairman Patrizio Bertelli emphasised in a release, “We aim to continue Versace’s legacy – celebrating and reinterpreting its bold and timeless aesthetic. At the same time, we will provide it with a strong platform, reinforced by years of ongoing investments. Our organisation is ready and well positioned to write a new page in Versace’s history.”

Prada has promised not to dilute Versace’s voice. Prada Group chairman Patrizio Bertelli emphasised in a release, “We aim to continue Versace’s legacy – celebrating and reinterpreting its bold and timeless aesthetic. At the same time, we will provide it with a strong platform, reinforced by years of ongoing investments. Our organisation is ready and well positioned to write a new page in Versace’s history.”

Versace’s strength has always been its popcultural resonance. Guerra observed, “It’s a brand that was born in culture. It’s a brand that was born in classic, historic, Greek, Mediterranean, ancient roots. And on the other side, let’s not forget that Versace has created what we’re seeing every day, this glam, this pop, music, models, supermodels.”

Versace’s strength has always been its popcultural resonance. Guerra observed, “It’s a brand that was born in culture. It’s a brand that was born in classic, historic, Greek, Mediterranean, ancient roots. And on the other side, let’s not forget that Versace has created what we’re seeing every day, this glam, this pop, music, models, supermodels.”

Versace now has access to Prada’s worldwide Versace now has access to Prada’s worldwide network. The brand’s base is sure to shift from network. The brand’s base is sure to shift from Capri’s New York to Milan. Guerra highlighted, Capri’s New York to Milan. Guerra highlighted, “We are adding Versace and we will have “We are adding Versace and we will have another vertical asset.” another vertical asset.”

Versace now has access to Prada’s worldwide Versace now has access to Prada’s worldwide network. The brand’s base is sure to shift from network. The brand’s base is sure to shift from Capri’s New York to Milan. Guerra highlighted, Capri’s New York to Milan. Guerra highlighted, “We are adding Versace and we will have “We are adding Versace and we will have another vertical asset.” another vertical asset.”