The centre’s new draft rules want gig and platform workers to clock at least 90 days with an employer in a year before they can tap key social security benefits like compensation-linked payouts and some statutory protections.

The move sits under the Social Security Code and is pitched as a way to distinguish regular work from fly-by-night gigs, making it easier to administer benefits and reduce disputes. And it comes amid a revival of a massive debate around the nature of gig work, safety and pay, particularly in the context of quick commerce.

For workers, it means continuity of work will matter much more than before when it comes to accessing any safety net. For companies — especially startups and small businesses that lean on flexible staffing — it raises the bar on record-keeping, digital registrations, and compliance, adding to costs and tightening oversight under the newly operational labour codes.

The Blinkit Flashpoint: Against this policy backdrop, Eternal-owned Blinkit and Zomato found themselves in the eye of a New Year’s Eve storm. Eternal founder Deepinder Goyal posted that both platforms were “unaffected” by a gig workers’ strike and had clocked record orders on December 31.

His subsequent defence of the gig model — calling it one of India’s largest organised job engines — split social media, with critics flagging low pay, safety risks, and pressure-cooker delivery timelines, and supporters citing flexible earning opportunities.

The clash over one night of record orders captures a larger tension: India is simultaneously formalising gig work on paper while arguing over what fairness, dignity, and ambition should look like for the people powering its 10-minute economy.

Labour Codes Finally Bite: These draft rules land just weeks after India’s long-discussed labour codes kicked in nationally on November 21, 2025, folding 29 legacy laws into four broad codes on wages, social security, industrial relations, and workplace safety.

Gig and platform work now has formal recognition in this framework, with aggregators expected to contribute a small share of annual turnover towards social security for these workers.

In theory, this could nudge the gig economy closer to a more structured job market, with clearer entitlements around health insurance, accident cover, and possibly pensions over time. In practice, the real test will be how states implement these norms, how platforms adapt their models, and whether workers actually see tangible improvements on the ground.

Will the proposed rules change anything?

From The Editor’s Desk Weekly Funding Numbers Rebound

Weekly Funding Numbers Rebound

Pilgrim’s Mixed FY25 Show

Pilgrim’s Mixed FY25 Show

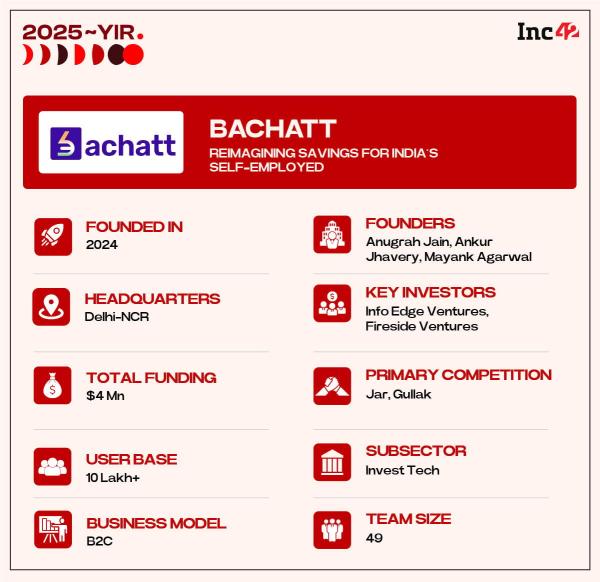

India’s self-employed workforce (58% of the total) earns in irregular bursts, not predictable monthly cycles. Yet every savings product in the market demands the steady cash flow of a salaried job. This structural mismatch leaves millions locked out of wealth creation because the system was not built for how they earn.

Built For Erratic Earnings: Founded in 2024, Bachatt addresses this exclusion with a daily savings platform tailored for the self-employed. Users can invest as little as INR 51 a day or INR 1,001 a week via UPI. Registered with AMFI, Bachatt channels low-ticket investments into low-risk debt products, prioritising consistency and habit-building over yield.

Early Validation: Backed by Lightspeed India and InfoEdge Ventures, Bachatt claims to have so far onboarded 10 Lakh users on its platform. It currently boasts INR 50 Cr in assets under management. With an eye on helping India’s ‘unbankable’ workforce save, the startup is eyeing a piece of the broader homegrown fintech market, which is projected to reach $2.1 Tn by 2030.

But can Bachatt’s micro-savings model scale into a sustainable business model, or will unit economics demand a pivot to cross-selling credit and insurance?

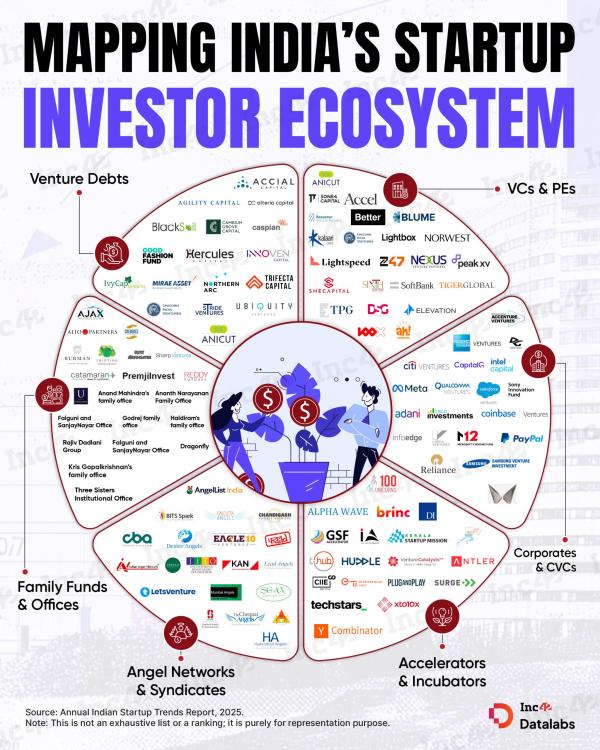

India’s investor ecosystem is deeper and more diverse than ever. Here are the key investor groups shaping India’s startup journey…

The post Gig Economy In The Spotlight, Funding On The Mend & More appeared first on Inc42 Media.