Global Capability Centres which are looking at expanding into tier-II cities are facing significant compliance hurdles from India’s state-specific labour laws, forcing companies to rework HR policies and operating models as they scale across multiple locations.

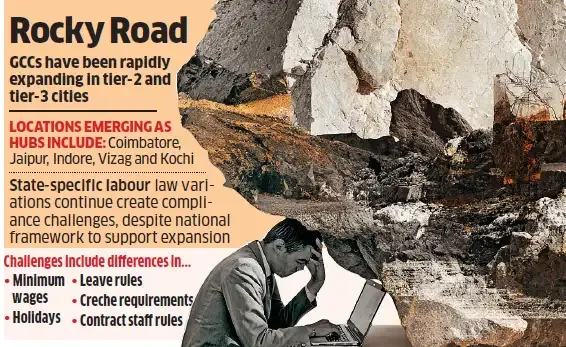

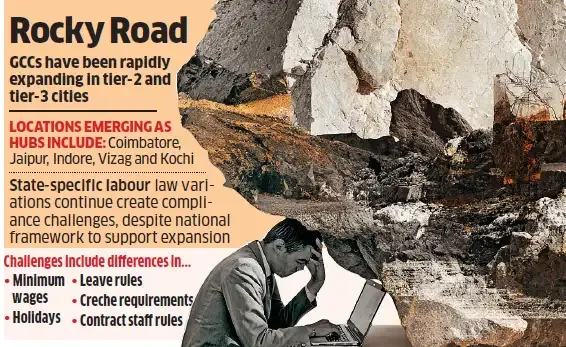

GCCs have been rapidly expanding into tier-II and tier-III cities, as ET reported earlier, with locations like Coimbatore, Jaipur, Indore, Vizag, and Kochi emerging as new hubs. While the Union Budget 2025 announced a national framework to support this expansion, state-specific labour law variations continue to create compliance challenges.

Differences in minimum wages, holidays, leave rules, creche requirements, and contract labour regulations across states are disrupting standard templates used in metros and increasing execution effort during rapid headcount expansion, industry experts said.

Platform firms helping companies set up GCCs say execution complexity remains higher in newer locations. Vikram Ahuja, cofounder of Accenture backed ANSR, said a typical GCC navigates hundreds of legal obligations each year, and in tier-II cities, many processes remain manual and relationship-driven. This increases setup lead time by about 30% compared with metros.

Ahuja added that data protection risks are also higher, as finding local vendors who meet global cybersecurity and audit standards can be difficult. “Companies often need to bring in metro-based partners at a higher cost to meet compliance and security expectations,” he said.

“When companies apply unchanged metro templates to tier-II sites, rework becomes unavoidable especially at scale,” said Rishi Agrawal, CEO and co-founder of TeamLease RegTech. Minimum wages, holidays and social security rules vary widely across states, requiring localised policies to avoid penalties and operational delays.

Agrawal said the challenge intensifies during rapid scale-ups. Recent enforcement tightening around Aadhaar-UAN verification has made payroll sensitive to identity and KYC completion. “If KYC is not clean, statutory filing gets blocked, which cascades into employee queries and HR rework,” he said. Fast hiring of security, housekeeping, facility and cafeteria staff creates immediate compliance risks unless contractors are fully licensed and documented from the start.

Kapil Joshi, CEO of Quess Corp, said managing statutory obligations like provident fund (PF), Employees’ State Insurance Corporation (ESIC) and contract labour documentation can be operationally demanding as headcount grows rapidly. The challenge, he added, is about scale and process readiness rather than city tier distinctions.

Legal experts warn that compliance gaps tend to surface during early expansion. “The most frequent compliance gaps arise from inadequate registrations, misclassification of contract labour and inconsistent wage and social security compliance,” said Hardeep Sachdeva, senior partner at AZB & Partners. He said district-level enforcement varies widely, creating uncertainty and slowing expansion in smaller cities.

Ankita Ray, partner at Cyril Amarchand Mangaldas, said while the labour codes have simplified central laws, state shops and establishment laws continue to apply alongside them. “GCCs need to adapt global and metro policies to local rules on working hours, leave and benefits to avoid scrutiny,” she said.

Despite these challenges, tier-II cities continue to attract GCC investments due to significantly lower operating costs and the ready availability of entry-level talent. The compliance friction, experts say, is manageable but requires companies to factor in longer lead times and higher initial setup costs when planning expansion beyond metros.

GCCs have been rapidly expanding into tier-II and tier-III cities, as ET reported earlier, with locations like Coimbatore, Jaipur, Indore, Vizag, and Kochi emerging as new hubs. While the Union Budget 2025 announced a national framework to support this expansion, state-specific labour law variations continue to create compliance challenges.

Differences in minimum wages, holidays, leave rules, creche requirements, and contract labour regulations across states are disrupting standard templates used in metros and increasing execution effort during rapid headcount expansion, industry experts said.

Platform firms helping companies set up GCCs say execution complexity remains higher in newer locations. Vikram Ahuja, cofounder of Accenture backed ANSR, said a typical GCC navigates hundreds of legal obligations each year, and in tier-II cities, many processes remain manual and relationship-driven. This increases setup lead time by about 30% compared with metros.

Ahuja added that data protection risks are also higher, as finding local vendors who meet global cybersecurity and audit standards can be difficult. “Companies often need to bring in metro-based partners at a higher cost to meet compliance and security expectations,” he said.

“When companies apply unchanged metro templates to tier-II sites, rework becomes unavoidable especially at scale,” said Rishi Agrawal, CEO and co-founder of TeamLease RegTech. Minimum wages, holidays and social security rules vary widely across states, requiring localised policies to avoid penalties and operational delays.

Agrawal said the challenge intensifies during rapid scale-ups. Recent enforcement tightening around Aadhaar-UAN verification has made payroll sensitive to identity and KYC completion. “If KYC is not clean, statutory filing gets blocked, which cascades into employee queries and HR rework,” he said. Fast hiring of security, housekeeping, facility and cafeteria staff creates immediate compliance risks unless contractors are fully licensed and documented from the start.

Kapil Joshi, CEO of Quess Corp, said managing statutory obligations like provident fund (PF), Employees’ State Insurance Corporation (ESIC) and contract labour documentation can be operationally demanding as headcount grows rapidly. The challenge, he added, is about scale and process readiness rather than city tier distinctions.

Legal experts warn that compliance gaps tend to surface during early expansion. “The most frequent compliance gaps arise from inadequate registrations, misclassification of contract labour and inconsistent wage and social security compliance,” said Hardeep Sachdeva, senior partner at AZB & Partners. He said district-level enforcement varies widely, creating uncertainty and slowing expansion in smaller cities.

Ankita Ray, partner at Cyril Amarchand Mangaldas, said while the labour codes have simplified central laws, state shops and establishment laws continue to apply alongside them. “GCCs need to adapt global and metro policies to local rules on working hours, leave and benefits to avoid scrutiny,” she said.

Despite these challenges, tier-II cities continue to attract GCC investments due to significantly lower operating costs and the ready availability of entry-level talent. The compliance friction, experts say, is manageable but requires companies to factor in longer lead times and higher initial setup costs when planning expansion beyond metros.