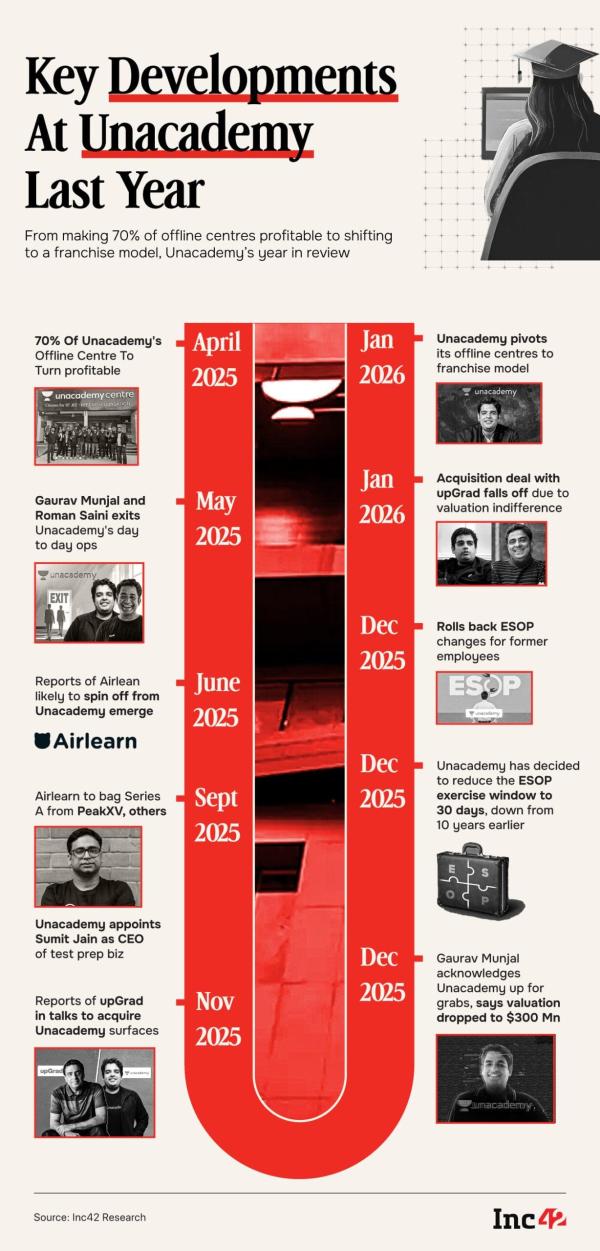

Just over nine months ago, in April 2025, Unacademy CEO Gaurav Munjal proclaimed that nearly 70% of the company’s offline coaching centres would turn profitable by the end of the year. At the time, it felt as if Unacademy’s long-pursued hybrid strategy, marrying online scale with offline monetisation, was about to pay off.

Cut to January 2026, Unacademy has changed its tune yet again.

In a recent internal communication marked to his employees, Munjal announced that Unacademy would now transition to a franchise model.

Under the new regime, franchise owners will manage day-to-day operations, while Unacademy will supply academic content, technology infrastructure, and brand reach.

The company, Munjal emphasised, will remain asset-light and capital-efficient. The transition, he said, is expected to be completed by April this year.

While the email does not explicitly outline the rationale behind the move, the new narrative seems to be a deliberate cost-containment exercise.

The timing of the announcement also tells us something important. The internal mail was circulated shortly after Unacademy’s acquisition talks with upGrad fell through, reportedly over valuation differences. This context matters because it frames the franchise pivot not merely as a strategic evolution but also as a recalibration following failed external rescue attempts.

Against this background, let’s revisit how the past few years have unravelled for Unacademy, which seems to be quietly rewriting its playbook.

The Bengaluru-based edtech firm was once the second most valuable startup in the sector after BYJU’s, commanding a peak valuation of $3.5 Bn during its last private round. However, after 2022, soon after pandemic-led demand tapered off and venture funding tightened, Unacademy went into the cost-correction mode — multiple rounds of layoffs, reductions in employee incentives, and the pruning of non-core business lines.

Importantly, this has been a continuous process and persists even today.

In a post on X last year, Munjal claimed that Unacademy planned to reduce the cash burn of its core business to below INR 200 Cr in 2025, nearly half of the previous year’s level and a dramatic reduction from over INR 1,000 Cr burned annually three years ago. How much of this target has been met remains unclear.

While aggressive cost-cutting exercises did help Unacademy reduce its loss to INR 435 Cr in the financial year 2024-25 (FY25) from INR 1,678 Cr in FY23, it came at a cost to growth. Operating revenue declined from INR 907 Cr in FY23 to INR 701 Cr in FY25. The company also shut down Relevel, its job classifieds and upskilling platform.

Compounding the operational stress has been a steady churn at the senior leadership level. Between 2023 and 2025, Unacademy witnessed the exit of several key executives, including a cofounder and multiple C-suite leaders.

Key exits at Unacademy at a glance:

With fresh capital proving elusive after the pandemic boom, Unacademy was pushed to explore consolidation. Acquisition conversations began as early as 2023, when investors, including General Atlantic, pushed for a merger with BYJU’S-owned Aakash. General Atlantic’s presence on the cap tables of both companies added momentum to the idea, but talks failed to materialise.

Subsequently, Unacademy held discussions with Allen Career Institute and even with PhysicsWallah, though the talks could not be closed.

Last year, Unacademy also explored an acquisition by K-12 Techno Services, the operator of Orchids International Schools, but to no avail. The strategic logic was clear — Unacademy’s B2C test prep offerings could be integrated into Orchids’ school network, alongside B2B edtech services.

The most recent, and publicly acknowledged, attempt came when reports of upGrad exploring an acquisition emerged. For the first time, Munjal openly conceded that Unacademy was evaluating a sale. But the outcome mirrored previous attempts. This was despite Unacademy reportedly seeking a valuation of $300-$400 Mn, a near-90% markdown from its peak. upGrad is unwilling to meet this figure.

With no deals forthcoming, Munjal now appears focussed on stabilising and rebuilding Unacademy from within.

Back To Its Online RootsAt its core, Unacademy has always been an online-first company. Founded in 2015 as a YouTube channel by Munjal, Roman Saini and Hemesh Singh, the platform built its early success on K-12 and competitive exam preparation. The pandemic accelerated its growth, enabling it to raise large funding rounds and scale rapidly.

The offline expansion was launched in 2022 to diversify revenue streams as online demand softened. By 2024, offline centres reportedly contributed nearly 40% to Unacademy’s top line.

However, offline education is inherently cost-heavy, with high fixed expenses related to real estate, faculty, and local marketing. These high costs, along with aggressive pricing by PhysicsWallah and the poor economics seen at players like FIITJEE, Allen and Aakash, seem to have forced Unacademy’s hand.

The franchise pivot is expected to allow the company to retain its presence without carrying operational risk on its balance sheet.

Post the failed acquisition talks, Munjal’s strategy now appears to be a return to fundamentals, doubling down on online verticals with clearer contribution margins. In his internal note, Munjal claimed that Unacademy’s UPSC, NEET PG, and CAT offerings have turned contribution-margin positive.

He also noted that PrepLadder and Graphy were cash-flow positive over the past year. These claims, however, could not be independently verified.

A New Bet On AirlearnBeyond test prep, Munjal is placing a sizable bet on Airlearn, a relatively new language-learning platform positioned against Duolingo. According to Munjal, Airlearn’s annual recurring revenue grew from roughly $200K at the start of 2025 to nearly $3 Mn by the year-end.

Yet, the timing is far from ideal. Duolingo itself recently saw a significant valuation correction amid rising competition from AI-driven learning tools. If reports of Airlearn spinning off from Unacademy are accurate, the language-learning platform will need to independently raise capital in an increasingly sceptical market.

For Unacademy, the franchise pivot, online refocus, and selective new bets together signal a company still searching for its post-pandemic identity. Can Unacademy mark a real comeback?

Edited By Shishir Parasher

The post Unacademy Hits Reset, Again appeared first on Inc42 Media.