As gold punched through the $5,000 mark, one on-chain trader skipped traditional markets and moved over $4 million into tokenized gold using stablecoins.

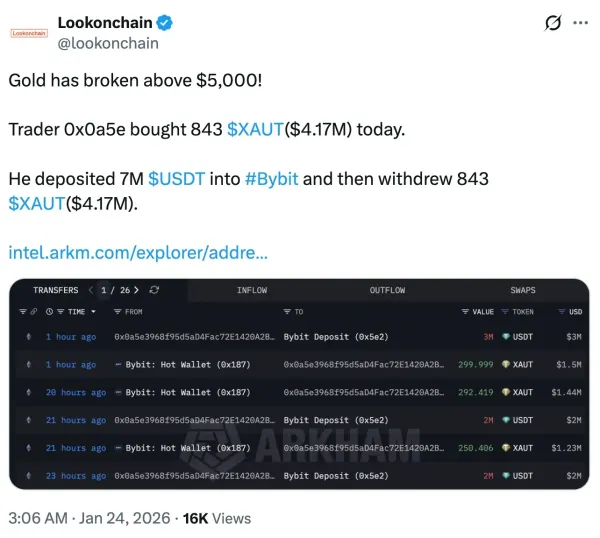

An on-chain address purchased 843 Tether Gold (XAUT), worth about $4.17 million, Lookonchain, an on-chain analysis account, reported on Friday.

On X, Lookonchain shared that a trader, identified as 0x0a5e, deposited roughly $7 million in USDT to the Bybit exchange before withdrawing the XAUT tokens, effectively converting stablecoins directly into gold-backed digital assets. The transaction demonstrates how stablecoins can be used to facilitate on-chain access to gold-backed tokens.

Tether Gold (XAUT) is a gold-backed token issued by Tether, with each token representing one troy ounce of physical gold held in reserve. On Stocktwits, retail sentiment around Tether Gold improved from ‘neutral’ to ‘bullish’ territory, as chatter levels rose from ‘high’ to ‘extremely high’ levels over the past day.

Gold prices rose sharply in 2025, marking one of the metal’s strongest annual performances in decades. This trend continued into 2026. Supported by heightened macroeconomic uncertainty and strong demand from institutional buyers, Gold reached an all-time high of $4,966 per ounce on Friday.

Gold accumulation, reserve diversification, and monetary stability were recurring topics at this year’s World Economic Forum in Davos, where policymakers and financial leaders discussed the role of gold amid global economic shifts.

Goldman Sachs Research noted that the price of gold is forecast to rise about 6% through the middle of 2026, supported by continued demand from financial institutions. Gold rose more than 40% in 2025 and is on pace for its third consecutive “year of double-digit gains,” according to the firm.

Central bank demand also remained strong. According to the World Gold Council’s 2025 Central Bank Gold Reserves Survey, 95% of surveyed central banks said they expect global gold reserves to increase or remain unchanged over the next 12 months, reinforcing gold’s role as a reserve asset.

The XAUT purchase shows how stablecoins are increasingly used as a bridge between crypto liquidity and traditional stores of value, enabling on-chain access to assets like gold during periods of market volatility.

Read also: GOP’s French Hill: Crypto Bill Headed To Trump’s Desk ‘Very Soon’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<