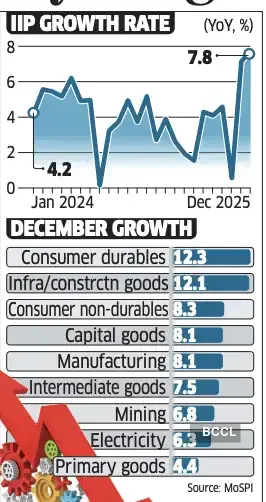

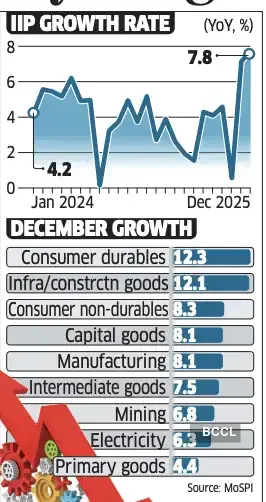

New Delhi: India's industrial output climbed to a 26-month high of 7.8% year-on-year in December, driven by manufacturing activity, goods and services tax (GST) rationalisation and a low-base effect, official data released Wednesday showed.

Strong performance of manufacturing companies during the October-December period will be reflected in gross domestic product (GDP) numbers, economists said. The Index of Industrial Production (IIP) had expanded 7.2% in November 2025 and 3.7% in December 2024.

“The growth was largely driven by the manufacturing output, likely aided by restocking post the festive season, even as the growth in India’s non-oil exports was sluggish in the month,” said Aditi Nayar, chief economist at ICRA.

Manufacturing output rose 8.1% in December, easing slightly from 8.5% in November.

In September, the GST Council approved a two-slab structure of 5% and 18%, lowering rates on several household items.

The strong performance of manufacturing companies in the third quarter will be reflected in the GDP, said Bank of Baroda chief economist Madan Sabnavis.

Factory output hit a six-quarter high of 5.2% in the October-December period.

“This, along with a deflationary wholesale price index (WPI), implies a strong industrial GVA (gross value added) during Q3FY26, boosting GDP growth,” said Paras Jasrai, associate director, India Ratings and Research (Ind-Ra).

Official GDP data for the third quarter is scheduled to be released on February 27.

Among other sectors, electricity generation surged to a nine-month high of 6.3% in December, while mining output touched an 18-month high of 6.8%.

“Revival in mining and electricity is a positive sign as it goes along with a buoyant business environment,” noted Sabnavis.

Within the manufacturing sector, the fastest-growing industries were computers, electronic and optical products (34.9%), motor vehicles, trailers and semi-trailers (33.5%) and other transport equipment (25.1%).

All six use-based sectors grew in December. Consumer durables posted the strongest expansion, rising to a 13-month high of 12.3%, followed by infrastructure/construction goods at 12.1%, and consumer non-durables increasing to a 26-month high of 8.3%.

“The growth in consumer durables suggest that inventories both with wholesaler and manufacturer have exhausted and according to the manufacturer’s assessment, the demand is likely to continue,” said Jasrai.

Capital goods output rose 8.1%, while intermediate and primary goods recorded growth of 7.5% and 4.4%, respectively.

“It does look like that the industrial sector is on a positive trajectory with momentum being maintained which was observed in November,” said Sabnavis.

Bank of Baroda expects IIP growth to average around 4.5-5% for FY26 if the trend is maintained. For the first nine months, it was 3.9%. Jasrai, however, cautioned that factory output growth has been observed to grow more than 5% for a few quarters before fizzling out, and added that the new IIP series with FY23 as the base year will provide a truer picture of industrial production.

Strong performance of manufacturing companies during the October-December period will be reflected in gross domestic product (GDP) numbers, economists said. The Index of Industrial Production (IIP) had expanded 7.2% in November 2025 and 3.7% in December 2024.

Surge in power generation

It expanded 0.5% in October last year.“The growth was largely driven by the manufacturing output, likely aided by restocking post the festive season, even as the growth in India’s non-oil exports was sluggish in the month,” said Aditi Nayar, chief economist at ICRA.

Manufacturing output rose 8.1% in December, easing slightly from 8.5% in November.

In September, the GST Council approved a two-slab structure of 5% and 18%, lowering rates on several household items.

The strong performance of manufacturing companies in the third quarter will be reflected in the GDP, said Bank of Baroda chief economist Madan Sabnavis.

Factory output hit a six-quarter high of 5.2% in the October-December period.

“This, along with a deflationary wholesale price index (WPI), implies a strong industrial GVA (gross value added) during Q3FY26, boosting GDP growth,” said Paras Jasrai, associate director, India Ratings and Research (Ind-Ra).

Official GDP data for the third quarter is scheduled to be released on February 27.

Among other sectors, electricity generation surged to a nine-month high of 6.3% in December, while mining output touched an 18-month high of 6.8%.

“Revival in mining and electricity is a positive sign as it goes along with a buoyant business environment,” noted Sabnavis.

Within the manufacturing sector, the fastest-growing industries were computers, electronic and optical products (34.9%), motor vehicles, trailers and semi-trailers (33.5%) and other transport equipment (25.1%).

All six use-based sectors grew in December. Consumer durables posted the strongest expansion, rising to a 13-month high of 12.3%, followed by infrastructure/construction goods at 12.1%, and consumer non-durables increasing to a 26-month high of 8.3%.

“The growth in consumer durables suggest that inventories both with wholesaler and manufacturer have exhausted and according to the manufacturer’s assessment, the demand is likely to continue,” said Jasrai.

Capital goods output rose 8.1%, while intermediate and primary goods recorded growth of 7.5% and 4.4%, respectively.

Outlook

Ind-Ra expects IIP growth to moderate to around 5% in January, due to a high base effect, while ICRA projects 6-7%.“It does look like that the industrial sector is on a positive trajectory with momentum being maintained which was observed in November,” said Sabnavis.

Bank of Baroda expects IIP growth to average around 4.5-5% for FY26 if the trend is maintained. For the first nine months, it was 3.9%. Jasrai, however, cautioned that factory output growth has been observed to grow more than 5% for a few quarters before fizzling out, and added that the new IIP series with FY23 as the base year will provide a truer picture of industrial production.