Budget 2026 For Indian Startups

Budget 2026 For Indian Startups

The Union Budget 2026 introduces a series of transformative measures aimed at positioning India as a global hub for manufacturing, services, and deeptech innovation.

Finance Minister Nirmala Sitharaman’s 90-minute long address did not specifically call out Indian startups as a key focus area (mentioned just twice), but there was a clear emphasis on AI, data centre economy and manufacturing, which will undoubtedly have a ripple effect on the Indian startup ecosystem.

Cloud, Semiconductors And New Tech Thrust: Union Budget 2026-27 positions India as a deeptech and services hub, even though startups are not explicitly foregrounded in the speech. Key measures include India Semiconductor Mission (ISM) 2.0 with a higher outlay and a stronger push towards an IP-led fabless and OSAT ecosystem, aimed at reducing supply chain dependence and boosting domestic hardware design.

A major tax holiday for foreign cloud companies operating Indian data centres, along with a 15% safe harbour on data centre services, is expected to lower cloud costs, improve tax certainty for SaaS/IT startups, and attract more Global Capability Centres.

AI Across The Board: AI is framed as a governance “force multiplier”, with higher safe harbour thresholds for IT services, accelerated Advance Pricing Agreements, and tax exemptions on global income for non-resident experts staying up to five years, easing hiring of top-tier global tech talent.

Beyond core tech, Bharat-VISTAAR, a multilingual AI platform for farmers, opens collaboration opportunities for agritech startups on AgriStack, while also raising questions about their ability to build defensible moats if the state owns the main interface.

Biopharma Shakti, backed by INR 10,000 Cr, and a clear clean-energy mandate—CCUS with INR 20,000 Cr outlay, lithium-ion and critical mineral BCD exemptions, and new Rare Earth Corridors—signal long-term support for biotech, climate tech, EV and battery startups.

Dive into the key takeaways beyond these headlines

From The Editor’s Desk

Weekly Funding Numbers Cool

- Indian startups cumulatively raised $95.6 Mn across 18 deals last week, down 68% from $302.8 Mn in the previous week. This came as investors and founders paused funding decisions ahead of Union Budget 2026.

- Fintech emerged as the most funded sector, driven by Easy Home Finance’s $30 Mn Series C round. On the other hand, advanced hardware and technology led the deal count with four transactions totaling $17 Mn.

- Seed-stage funding slipped 40% week-on-week to $12.9 Mn across three deals, while ace angel investor Ashish Kacholia remained the most active backer this week with two investments (4baseCare and 1Buy.AI).

Delhivery’s Q3 Profitable Show

- The logistics major swung back to the black in Q3 FY26 with profit of INR 39.6 Cr, reversing an INR 50.4 Cr loss in Q2 and improving 59% YoY from INR 24.9 Cr.

- The profitable show came on the back of revenue from customer contracts rising 18% YoY to INR 2,804.9 Cr and adjusted EBITDA improving 227% YoY to a record INR 147 Cr.

- However, the company claimed that its PAT would have been INR 110 Cr if not for the integration costs pertaining to Ecom Express acquisition. The management estimates another INR 100–110 Cr of such costs over the next two quarters.

Groww Eyes A New Trade

- The investment tech unicorn has placed a bid to acquire PGIM India Asset Management, signalling it wants to move from a distribution-led platform to owning the manufacturing layer of mutual funds.

- If it goes through, the deal would instantly expand Groww’s footprint with a ready AMC platform, regulatory licences and an existing product shelf.

- The listed company has been steadily building its AMC arm. Earlier this month, State Street Investment Management announced plans to buy a 23% stake in Groww AMC for INR 580.02 Cr, signalling the latter’s ambition in passive investing.

Spring Marketing Floats INR 500 Cr Fund

- The VC firm has launched its second fund, with a target corpus of INR 500 Cr. Spring Marketing Capital is looking to mark the first close of the fund at INR 150 Cr by March this year.

- With the second fund, the investment firm will look to back startups that are post-PMF and three to five years away from meaningful liquidity events. The latest fund will look to back ventures across fintech, health, lifestyle, and retail.

- Spring Capital claims to have fully deployed its INR 150 Cr first fund, which was launched in 2019. The VC firm’s portfolio includes names like Purplle, Mosaic Wellness, Jar, GIVA, Agilitas and Shree Anandhaas.

TVS Widens Lead In E2W Race

- The auto giant clocked 33,296 electric two-wheeler registrations in January, up 32% month-on-month (MoM), reinforcing its position as the biggest player in the segment. Bajaj sold 24,211 units (+28% MoM), while Ather sold 20,786 units (+21% MoM).

- The broader category also rebounded. Total E2W registrations rose 19% MoM to 1.17 Lakh, a sharp reversal from much of 2025 when demand remained almost flat.

- Meanwhile, Ola Electric’s decline continued as the EV maker registered just 7,221 units in January, down 20% MoM. It slipped to fifth place on the E2W sales charts, staying below 10,000 units for a third straight month.

JJG Aero Nets $ 30 Mn

- The aerospace components manufacturer has raised INR 275 Cr in its Series B round led by Norwest to fund a new facility in Bengaluru and deepen vertical integration. With this, JJG Aero has bagged $42 Mn to date.

- Founded in 2008, JJG Aero manufactures aircraft seating, cargo systems, landing gear, air management systems and electrical systems. Its client list includes aerospace giants like Boeing, Pratt & Whitney, Collins and Safran.

- The round lands amid a broader regulatory push for localisation and to make India an aerospace hub. On the back of this momentum, rival Jeh Aerospace raised $11 Mn in August last year, while Aequs listed on the bourses in December 2025.

Inc42 Markets

Inc42 Startup Spotlight

What’s Salt Oral Care’s Premium D2C Pitch?

The Indian oral care segment has long been a category built on familiarity, taste and marketing. Options exist, but they’re often inaccessible or poorly understood. Salt Oral Care is trying to disrupt this space by solving for efficacy, ingredient transparency and sustainability.

The Product Engine: Founded in 2022, Salt Care is a D2C brand that sells a range of oral care products, including toothpaste, mouthwash, electric brushes, and mouth sprays. A couple of hero SKUs drive a 30% repeat customer rate, with toothpastes and mouthwashes contributing nearly half of revenue.

The Sustainability Pitch: To entice consumers, the startup swapped plastic-heavy packaging for aluminium tubes and glass bottles, framing sustainability as a design choice. It claims to have built its range on compliant manufacturing, ethical sourcing and ingredient-led positioning to win trust in a high-frequency category.

The Next Markets: The brand currently clocks INR 1.4 Cr+ in monthly GMV and an INR 1 Cr+ monthly run rate. It plans to enter the UAE, Saudi Arabia, the US and the UK, targeting 2–3X revenue growth over the next 12–18 months through a tighter product pipeline and scalable operations. So, can Salt build a premium, clean oral care brand from India?

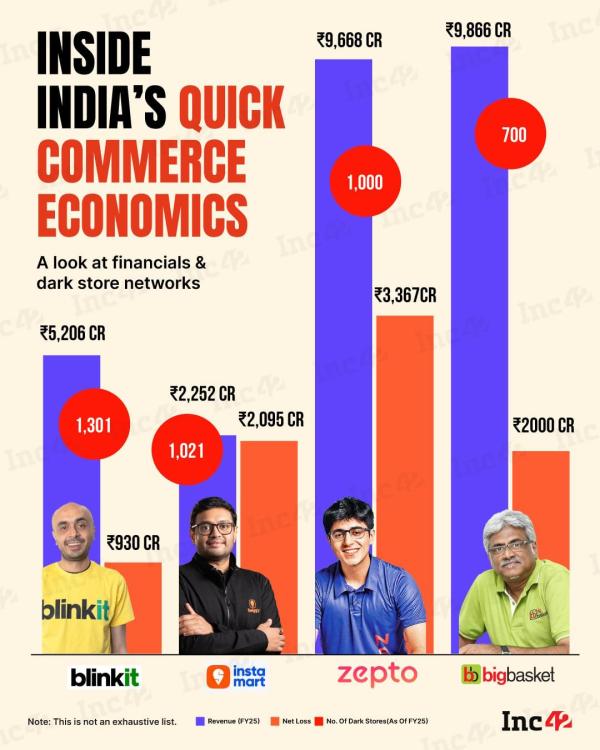

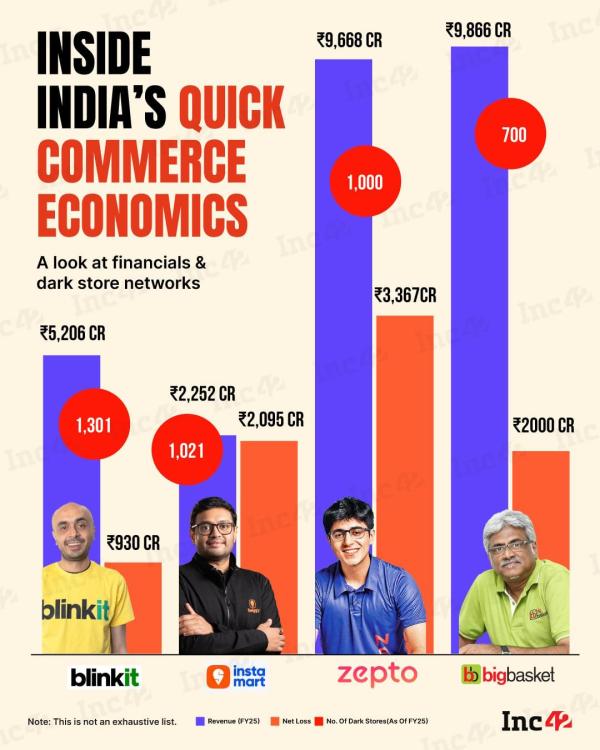

Infographic Of The Day

Quick commerce has scaled at breakneck speed in India but the big question remains – is the model finally inching towards profitability? Here is the breakdown…

The post Decoding Budget 2026, Weekly Funding Rundown & More appeared first on Inc42 Media.

Budget 2026 For Indian Startups

Budget 2026 For Indian Startups

Weekly Funding Numbers Cool

Weekly Funding Numbers Cool

TVS Widens Lead In E2W Race

TVS Widens Lead In E2W Race

JJG Aero Nets $ 30 Mn

JJG Aero Nets $ 30 Mn