William Blair analyst Louie DiPalma has upgraded Palantir Technologies Inc. (PLTR) stock to ‘Outperform’ from ‘Market Perform’ ahead of the company’s fourth-quarter earnings to be reported after the closing bell on Monday.

The firm cited valuation as the key reason for the upgrade, noting that the stock recently dropped roughly 30%, according to TheFly.

According to William Blair, Palantir’s commercial operations are maintaining strong growth, and the company continues to see substantial engagement from U.S. government agencies, including ongoing commitments from the Trump administration.

Businesses are expanding Palantir’s platform into new workflows, signaling rising adoption, the firm added. While Palantir’s stock is still considered pricey, William Blair noted that it is comparatively more reasonable relative to recent private funding rounds in AI-focused companies.

DiPalma anticipates the stock could surpass $200 within the next 12 months if Palantir continues its trajectory of growth and operational efficiency.

Palantir stock traded over 2% higher on Monday morning.

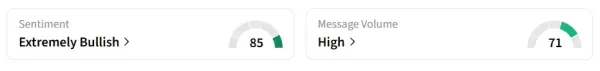

On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

The stock saw a 92% increase in retail chatter over 24 hours as of Monday morning.

A Stocktwits user said that the reason Palantir, Nvidia, and Broadcom can pull the broader market higher together is structural, not emotional.

Another bullish user said they are looking to buy more of the stock.

Analysts expect the company to report a fourth-quarter (Q4) revenue of $1.34 billion and earnings per share (EPS) of $0.23, according to Fiscal AI data. Also, 16 of 27 analysts covering the stock recommend a ‘Hold’ on the shares, seven rate it ‘Buy’ or higher, and four rate it ‘Sell’ or lower, according to Koyfin data.

In December, Palantir launched Chain Reaction, an operating system that will work with energy companies, grid operators, data center developers, and infrastructure builders to modernize power plants to speed up new energy and computing projects.

PLTR stock has gained over 80% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<