Amazon was once the upstart running ahead of Walmart with its revolutionary e-commerce business. It now finds itself betting on the kind of mega-store typically associated with its Bentonville, Arkansas, rival.

Analysts expect Amazon's fourth-quarter physical store revenue, which includes Whole Foods, Amazon Fresh and Amazon Go sales, to increase 5.4% from a year ago to $5.9 billion when it reports results on Thursday, according to estimates from LSEG. Overall earnings are expected at $1.97 a share.

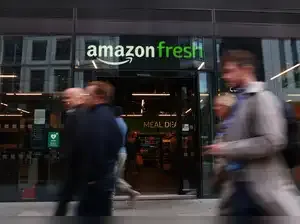

The company's retail operations are still a key part of the business, even as it sees fast growth from its technology division, Amazon Web Services, which accounts for 18% of its revenue. Its decision last month to close all of its Amazon Fresh and Amazon Go locations and convert them into Whole Foods Market stores was a signal of a changing strategy.

Its newest bet is a 225,000-square-foot mega-store outside Chicago, its first ever, meant to compete with Walmart or Costco. The planned store will sell produce, household essentials and general merchandise while also serving as a distribution center for same-day deliveries.

"Amazon knows that it needs to win in grocery because shoppers that tend to buy grocery and fast-moving consumer goods items tend to have the highest customer lifetime value," said Amazon seller consultant Martin Heubel, whose clients send merchandise directly to Amazon to be sold in stores and online.

The company said its previous strategy failed to create a distinctive shopping experience that would allow for large-scale expansion. Amazon did not comment.

"I think to go all-in on brick-and-mortar is probably not the long-term strategy for Amazon," S&P Global analyst Bea Chiem said. "It's going to take some time for them to catch up."

WALMART'S FOOTPRINT

Walmart lagged behind Amazon in e-commerce for years, but the introduction of its Walmart+ membership program in September 2020 turned the tide. The program had 26.5 million members as of 2025, according to Morgan Stanley research, and its e-commerce sales are still growing, with a 28% increase in its most recent quarter from the year-ago period.

Walmart's advantage stems in part from a massive physical footprint of 4,600 stores that fulfill pick-up orders and same-day deliveries. The company says that 90% of the U.S. population lives within 10 miles (16.1 km) of one of its stores. This helps the retailer save on last-mile delivery costs - a benefit that Amazon would like to achieve, said Asit Sharma, senior investment analyst at financial services firm The Motley Fool.

Walmart posted $177.8 billion in retail sales in the third quarter, while Amazon's combined online and physical store sales were nearly $80 billion. Walmart did not comment.

Amazon has pursued a physical footprint since it opened its first Amazon Go store in 2016, followed by its $13.7 billion acquisition of Whole Foods Market in 2017 and its 2020 introduction of Amazon Fresh. Only Whole Foods appears set to survive the reorganization.

"Amazon would love to also play in a world where customers come into a store and take care of that last-mile problem by themselves," Sharma said.

Analysts expect Amazon's fourth-quarter physical store revenue, which includes Whole Foods, Amazon Fresh and Amazon Go sales, to increase 5.4% from a year ago to $5.9 billion when it reports results on Thursday, according to estimates from LSEG. Overall earnings are expected at $1.97 a share.

The company's retail operations are still a key part of the business, even as it sees fast growth from its technology division, Amazon Web Services, which accounts for 18% of its revenue. Its decision last month to close all of its Amazon Fresh and Amazon Go locations and convert them into Whole Foods Market stores was a signal of a changing strategy.

Its newest bet is a 225,000-square-foot mega-store outside Chicago, its first ever, meant to compete with Walmart or Costco. The planned store will sell produce, household essentials and general merchandise while also serving as a distribution center for same-day deliveries.

"Amazon knows that it needs to win in grocery because shoppers that tend to buy grocery and fast-moving consumer goods items tend to have the highest customer lifetime value," said Amazon seller consultant Martin Heubel, whose clients send merchandise directly to Amazon to be sold in stores and online.

The company said its previous strategy failed to create a distinctive shopping experience that would allow for large-scale expansion. Amazon did not comment.

"I think to go all-in on brick-and-mortar is probably not the long-term strategy for Amazon," S&P Global analyst Bea Chiem said. "It's going to take some time for them to catch up."

WALMART'S FOOTPRINT

Walmart lagged behind Amazon in e-commerce for years, but the introduction of its Walmart+ membership program in September 2020 turned the tide. The program had 26.5 million members as of 2025, according to Morgan Stanley research, and its e-commerce sales are still growing, with a 28% increase in its most recent quarter from the year-ago period.

Walmart's advantage stems in part from a massive physical footprint of 4,600 stores that fulfill pick-up orders and same-day deliveries. The company says that 90% of the U.S. population lives within 10 miles (16.1 km) of one of its stores. This helps the retailer save on last-mile delivery costs - a benefit that Amazon would like to achieve, said Asit Sharma, senior investment analyst at financial services firm The Motley Fool.

Walmart posted $177.8 billion in retail sales in the third quarter, while Amazon's combined online and physical store sales were nearly $80 billion. Walmart did not comment.

Amazon has pursued a physical footprint since it opened its first Amazon Go store in 2016, followed by its $13.7 billion acquisition of Whole Foods Market in 2017 and its 2020 introduction of Amazon Fresh. Only Whole Foods appears set to survive the reorganization.

"Amazon would love to also play in a world where customers come into a store and take care of that last-mile problem by themselves," Sharma said.