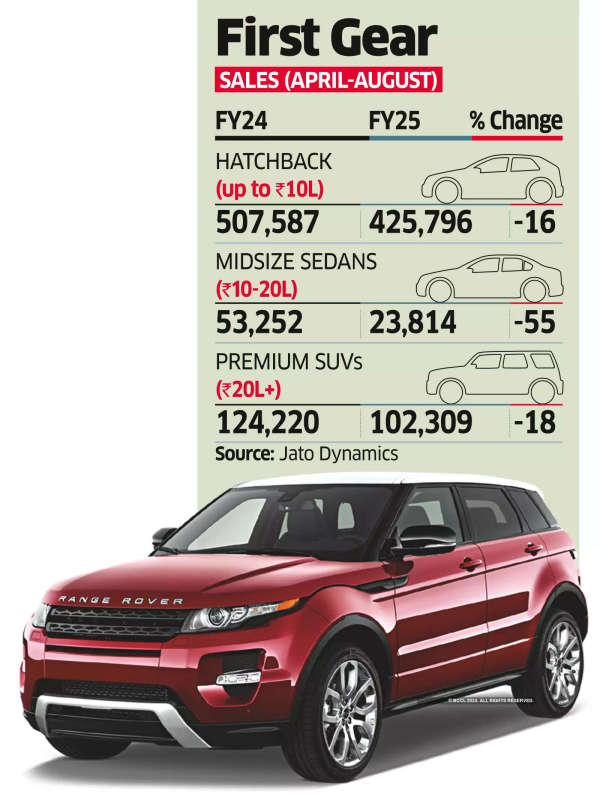

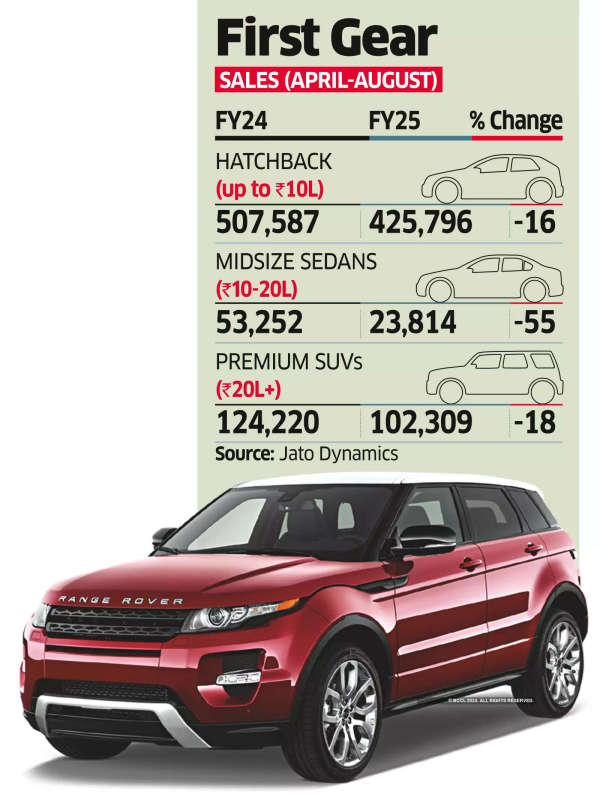

Consumer fatigue for large sport-utility vehicles (SUVs) seems to be setting in, with sales of premium models priced upwards of Rs 20 lakh such as Hyundai Tucson, Toyota Fortuner and Jeep Meridian falling by 18% in the first five months of this fiscal year.

The blazing post-pandemic growth of the Indian car industry in the past two fiscal years was fuelled by SUVs of all sizes, which helped catapult local passenger vehicle sales to a record 4.22 million units in FY24.

However, starting this fiscal, the car industry has slowed, growing under 2% to 1.75 million units during April to August. While sales of entry and midsize SUVs have grown by 65% and 6.3%, respectively, those of larger SUVs fell by almost a fifth. All segment-wise data is from Jato Dynamics.

Several senior industry executives ET spoke to said while SUVs dominated the premium segment for several years, there is shift in consumer preference with the market maturing and buyers seeking diverse options. More launches and better availability of midsize SUVs like Hyundai Creta, Kia Seltos and Maruti Suzuki Grand Vitara has led some customers to opt for vehicles in the sub-Rs 20 lakh category, they said.

To be sure, top-end variants of some of these midsize SUVs such as Tata Harrier and Safari, Hyundai Creta and Alcazar, and Mahindra Scorpio N and XUV700 breach the Rs 20-lakh mark.

A senior industry expert said, "Earlier, due to supply constraints and long waiting periods, some customers were even moving up price bands and buying bigger vehicles. Now that the pent-up demand we saw post Covid is gone, consumers are not discovering the value equation (in these products) anymore. Additionally, the number of models in the sub-Rs 20 lakh category is much more...all new launches have happened in this space in the last few months." There are currently about 48 SUV models in the local market but less than a dozen of these are in the premium segment priced above Rs 20 lakh. At the higher end of this market, fresh innovative feature-rich multipurpose vehicles (MPVs) too are drawing away buyers from larger SUVs.

"As urban professionals return to offices, and intercity travel for both business and leisure increases, we're seeing a surge in demand for versatile, comfortable vehicles in the ₹20 lakh-plus category," Ravi Bhatia, president at automotive consultancy firm Jato Dynamics said, adding, "This trend is particularly evident in the MPV segment, which offers a compelling blend of space, luxury and practicality for discerning customers."

Sabari Manohar, vice-president (sales, service, used car business) at Toyota Kirloskar Motor (TKM) said, "The biggest selling points of MPVs are space, design elements and comfort. Changing travelling style is also an important factor, people are now spending more time traveling, which is driving demand for more spacious and comfortable MPVs."

According to Manohar, enquires and demand for Toyota MPVs is not just limited to major urban centres but also extends into tier-II and tier-III markets. This August, the company posted a 39% year-on-year surge in MPV sales.

The blazing post-pandemic growth of the Indian car industry in the past two fiscal years was fuelled by SUVs of all sizes, which helped catapult local passenger vehicle sales to a record 4.22 million units in FY24.

However, starting this fiscal, the car industry has slowed, growing under 2% to 1.75 million units during April to August. While sales of entry and midsize SUVs have grown by 65% and 6.3%, respectively, those of larger SUVs fell by almost a fifth. All segment-wise data is from Jato Dynamics.

Several senior industry executives ET spoke to said while SUVs dominated the premium segment for several years, there is shift in consumer preference with the market maturing and buyers seeking diverse options. More launches and better availability of midsize SUVs like Hyundai Creta, Kia Seltos and Maruti Suzuki Grand Vitara has led some customers to opt for vehicles in the sub-Rs 20 lakh category, they said.

To be sure, top-end variants of some of these midsize SUVs such as Tata Harrier and Safari, Hyundai Creta and Alcazar, and Mahindra Scorpio N and XUV700 breach the Rs 20-lakh mark.

A senior industry expert said, "Earlier, due to supply constraints and long waiting periods, some customers were even moving up price bands and buying bigger vehicles. Now that the pent-up demand we saw post Covid is gone, consumers are not discovering the value equation (in these products) anymore. Additionally, the number of models in the sub-Rs 20 lakh category is much more...all new launches have happened in this space in the last few months." There are currently about 48 SUV models in the local market but less than a dozen of these are in the premium segment priced above Rs 20 lakh. At the higher end of this market, fresh innovative feature-rich multipurpose vehicles (MPVs) too are drawing away buyers from larger SUVs.

"As urban professionals return to offices, and intercity travel for both business and leisure increases, we're seeing a surge in demand for versatile, comfortable vehicles in the ₹20 lakh-plus category," Ravi Bhatia, president at automotive consultancy firm Jato Dynamics said, adding, "This trend is particularly evident in the MPV segment, which offers a compelling blend of space, luxury and practicality for discerning customers."

Sabari Manohar, vice-president (sales, service, used car business) at Toyota Kirloskar Motor (TKM) said, "The biggest selling points of MPVs are space, design elements and comfort. Changing travelling style is also an important factor, people are now spending more time traveling, which is driving demand for more spacious and comfortable MPVs."

According to Manohar, enquires and demand for Toyota MPVs is not just limited to major urban centres but also extends into tier-II and tier-III markets. This August, the company posted a 39% year-on-year surge in MPV sales.