Public Provident Fund (PPF): The PPF scheme offers a way to secure a tax-free monthly pension of ₹60,989 after retirement. This government-backed scheme is popular for its safe returns and tax benefits, making it a suitable choice for those looking to save consistently over time.

The Public Provident Fund (PPF) is a long-term savings option supported by the Central Government, offering a tax-free interest rate of 7.1% (subject to quarterly changes). By investing up to ₹1,50,000 each year, you can grow your savings substantially while enjoying full tax exemption on your contributions, interest, and maturity amount.

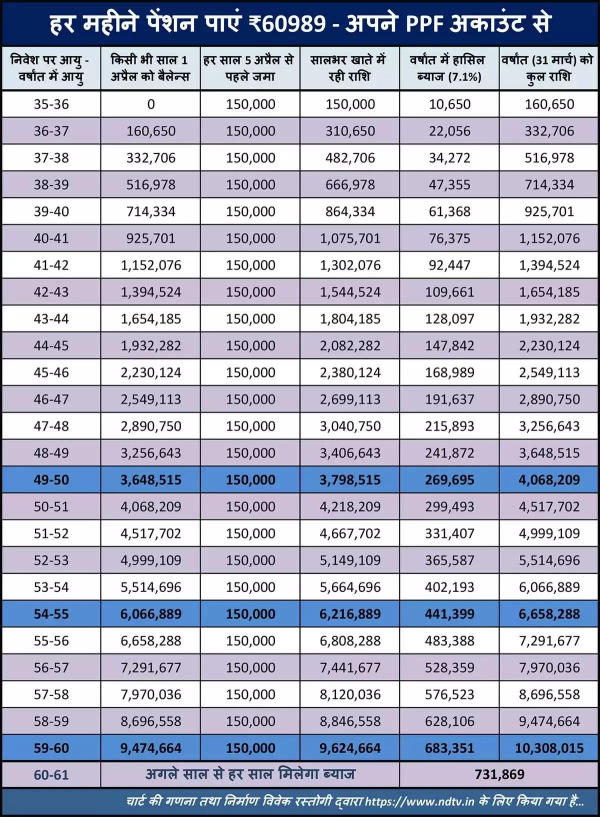

A disciplined approach to saving in a PPF account can turn your investment into a significant retirement fund. For example, if you invest ₹1,50,000 annually starting at age 35, you could accumulate ₹40,68,209 over 15 years—of which ₹18,18,209 will be interest, and ₹22,50,000 your principal.

At age 50, you can extend your account in 5-year increments without additional deposits, letting your investment grow even further. By the time you reach 60, your PPF balance could exceed ₹1 crore, with the government contributing over ₹65,58,015 in interest alone.

Once you reach retirement, you have the option to extend your PPF account without adding new funds. This means you can withdraw the annual interest (currently ₹7,31,869) as your pension. Dividing this amount over 12 months gives you a tax-free pension of approximately ₹60,989 every month, while your principal remains untouched in the account for future earnings.

The PPF scheme is particularly advantageous due to its tax-exempt status on contributions, interest, and maturity amounts, making it an ideal retirement solution for disciplined, long-term savers.