Weak financials of companies in the second quarter of the fiscal year 2024-25 (FY25) and continuing FII outflow resulted in the Indian equities market ending in the red this week as well.

In line with this, shares of new-age tech stocks under Inc42’s coverage also declined. Twenty four new-age tech stocks fell in a range of 0.08% to about 17% this week.

The companies listed on the SME platforms were the worst hit this week within the new-age tech stocks universe. Yudiz, which reported a to INR 5K in H1 FY25, emerged as the biggest loser this week. The blockchain and IT development company’s shares plummeted 16.56% to end the week at INR 70.30 on NSE SME.

The second biggest loser this week was DroneAcharya, which reported a to INR 1.50 Cr in H1 FY25 from INR 3.96 Cr in the year-ago period.

Shares of the BSE SME-listed company fell 16.48% to end the week at INR 112.25, recovering slightly from a it touched earlier in the week.

Other losers of the week included , , , , N, all of which reported their Q2 numbers this week – many of them after the close of market on the last trading day of the week.

The markets were closed on November 15 (Friday) on account of Guru Nanak Jayanti.

Despite the gloomy investor sentiment, shares of four new-age tech companies ended in the green this week. The biggest gainer was NSE Emerge-listed Macobs Technologies, the parent of D2C men’s grooming brand Menhood.

Shares of Macobs went up 10.94% to end the week at INR 175.90 after touching an all-time high of INR 178 on November 12 (Tuesday). On November 14 (Thursday), the company reported a 190% year-on-year (YoY) increase in its PAT to .

Fintech SaaS company Zaggle also posted a 167.67% YoY to INR 20.29 Cr in Q2 FY25 on November 13 (Wednesday). Its shares ended the week 2.43% higher at INR 426 on the BSE.

The other two gainers of the week were Zomato and PB Fintech.

Amid the bloodbath, the much-anticipated listing of foodtech major Swiggy took place this week. After to its issue price, shares of the company zoomed about 17% in the first trading session. However, the stock fell in the second trading session to end the week at INR 429.85 on the BSE.

Brokerage JM Financial with a ‘Buy’ rating and a price target of INR 470.

Meanwhile, in the broader market, Sensex ended the week 2.49% lower at 77,580.31 and Nifty 50 fell 2.35% to close at 23,532.70.

With this, both the benchmark indices have gone down about 5% in the past month. Observing that the Indian domestic markets are in a “correction terrain”, Geojit Financial Services’ head of research Vinod Nair said that the trigger for this has been the weakness in Q2 FY25 results, which has forced foreign investors to look away.

“Consolidation may continue in the near term; however, the beaten-down value stocks may witness bottom fishing due to their potential outlook,” he said.

Asit C. Mehta Investment Intermediates’ AVP of technical and derivatives research Hrishikesh Yedve pointed out that the market volatility cooled down in the last trading session of the week.

“Overall, the short-term trend is down but as long as Nifty holds above 23,500, a pullback rally could be possible,” he said.

With that said, let’s take a deeper look at the performance of the new-age tech stocks this week.

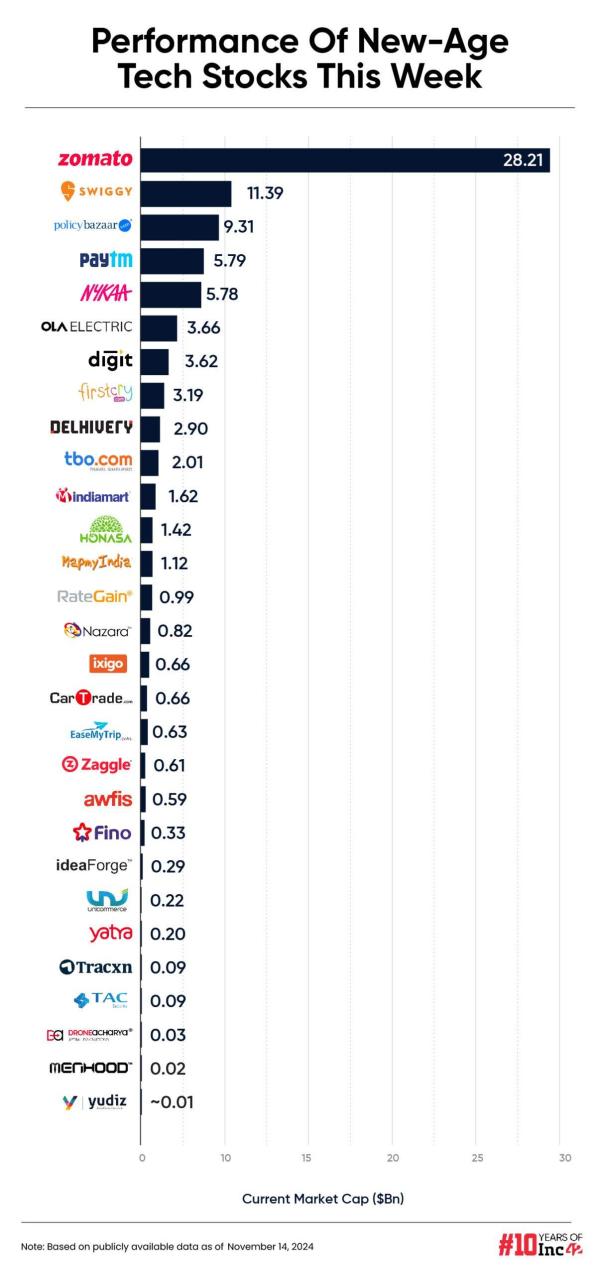

Post the addition of Swiggy, the total market capitalisation of the 29 new-age tech stocks ended the week at $85.6 Bn. Minus Swiggy’s $11.39 Bn market cap, overall market cap of the 28 new-age tech stocks ended the week at $74.21 down from last week’s $75.03 Bn.

Investors turned extremely bearish towards DroneAcharya on the back of a poor performance in the first half of the fiscal. The company’s shares hit a 52-week low of INR 110 on November 13, a day after it reported a significant dent in its bottom line for the first half of the year.

The drone company reported a 62.1% drop in consolidated PAT to INR 1.50 Cr in H1 FY25, compared to INR 3.96 Cr in the same period last year.

Revenue from operations, however, rose 28.8% to INR 26.90 Cr from INR 20.88 Cr in H1 FY24. Including other income of INR 75.86 Lakh, total revenue for H1 FY25 amounted to INR 27.66 Cr.

Total expenses increased 51.8% to INR 25.23 Cr from INR 16.62 Cr in the previous year.

The decline in PAT was in contrast with the company’s earlier projections. In September, DroneAcharya said it was targeting a 200% growth in revenue, EBITDA, and PAT in FY25. The company had reported a consolidated PAT of INR 6.2 Cr in FY24.

Later in the week, DroneAcharya said that it has secured a from US-based American Blast Systems (ABS).

Shares of MapmyIndia fell 15.36% to end the week at INR 1,740.10, after the company reported a to INR 30.35 Cr in Q2 FY25 from INR 33.09 Cr in the previous fiscal year.

Revenue from operations rose 14% to INR 103.67 Cr from INR 91.08 Cr in Q2 FY24.

MapmyIndia chairman and managing director Rakesh Verma attributed the decline in the margin to continuous investment in the consumer business for future growth. He also noted that the company’s Mappls app downloads reached 25 Mn at the end of H1 FY25 as against 10 Mn at the end of H1 FY24.

“The overall market we serve faced challenges in Q2 FY25, but we managed to perform reasonably well thanks to our open orders and strong teamwork,” MapmyIndia COO Sapna Ahuja said.

MapmyIndia also announced a , a wholly owned subsidiary of Hyundai Motor, in Indonesia. MapmyIndia will invest $4 Mn for a 40% stake in the new entity, PT Terra Link Technologies, with Hyundai controlling the remaining stake.

The joint venture will allow MapmyIndia to expand into the Indonesian market and map the entire country. Verma and Hyundai’s Asia Pacific president Jin Ho Kim have been nominated as directors of the company

Shares of Varun and Ghazal Alagh-led Honasa Consumers fell 3.17% to INR 369.75 this week, with its market cap ending at $1.42 Bn.

The company also reported on Thursday after market hours. It slipped into the red and posted a consolidated net loss of INR 18.6 Cr during the quarter compared to a profit of INR 29.4 Cr in Q2 FY24.

Revenue from operations also declined nearly 7% to INR 461.8 Cr from INR 496.1 Cr in the same quarter last year.

The company attributed the loss and revenue decline to its ongoing transition from a super-stockist-led distribution model to a direct distributor model as part of its “Project Neev”.

This shift, aimed at optimising the distribution network, impacted both revenue and profitability, with Honasa posting a negative EBITDA margin of 6.6% as against a positive 8.1% in Q2 FY24.

Cofounder Varun Alagh indicated the need to adjust the product mix and refine investment strategies. The company plans to focus on a narrower range of categories and strengthen its offerings in hero SKUs to drive future growth.

The post appeared first on .