Honda shares surged more than 15% on Monday, marking their best day since October 2008, following the announcement of a massive share buyback plan worth up to 1.1 trillion yen ($7 billion). The Japanese automaker also revealed ongoing merger discussions with Nissan, which could position the duo as the world’s third-largest carmaker by sales.

Honda’s buyback plan, set to repurchase 24% of its issued shares by December 23, 2025, buoyed investor confidence, pushing its stock to record highs. In contrast, Nissan shares fell over 1% despite the merger talks. Analysts attribute the potential merger to Nissan’s financial challenges and the restructuring of its long-standing alliance with France’s Renault.

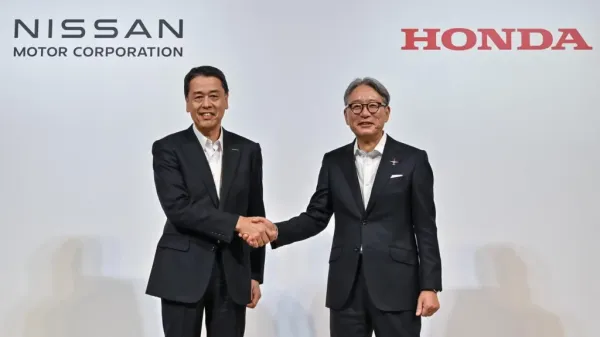

The proposed Honda-Nissan merger aims to leverage shared resources, achieve economies of scale, and foster synergies. Honda CEO Toshihiro Mibe announced plans to establish a holding company as the parent organization for both automakers, which will be listed on the Tokyo Stock Exchange. “These two companies operate in the same market, share similar brand images, and offer comparable products,” noted Hakan Dogu, chairman of Alagan Mobility Solutions, in a CNBC interview on Tuesday. However, he emphasized the challenges for the new management to differentiate product ranges and expand the business.

The discussions, set to conclude in June 2025, also include Nissan’s strategic partner Mitsubishi, which has been invited to join the new group. Mitsubishi is expected to make its decision by the end of January 2025.

Honda reported an operating profit of 1.382 trillion yen for the fiscal year ending March 2024, significantly outpacing Nissan’s 568.7 billion yen. The combined value of the two automakers is estimated at nearly $54 billion, with Honda contributing a market capitalization of $43 billion.

Analysts view the merger as a strategic move to address Nissan’s financial struggles while solidifying Honda’s market position. The collaboration is expected to streamline operations, boost innovation, and strengthen the competitive edge of both automakers in the global market.

As investors react positively to Honda’s buyback plan and the potential merger’s growth prospects, the automakers face the challenge of navigating integration while maintaining their individual brand identities. The developments mark a pivotal moment for the Japanese automotive industry as Honda and Nissan seek to redefine their futures in a rapidly evolving market.

The post appeared first on .