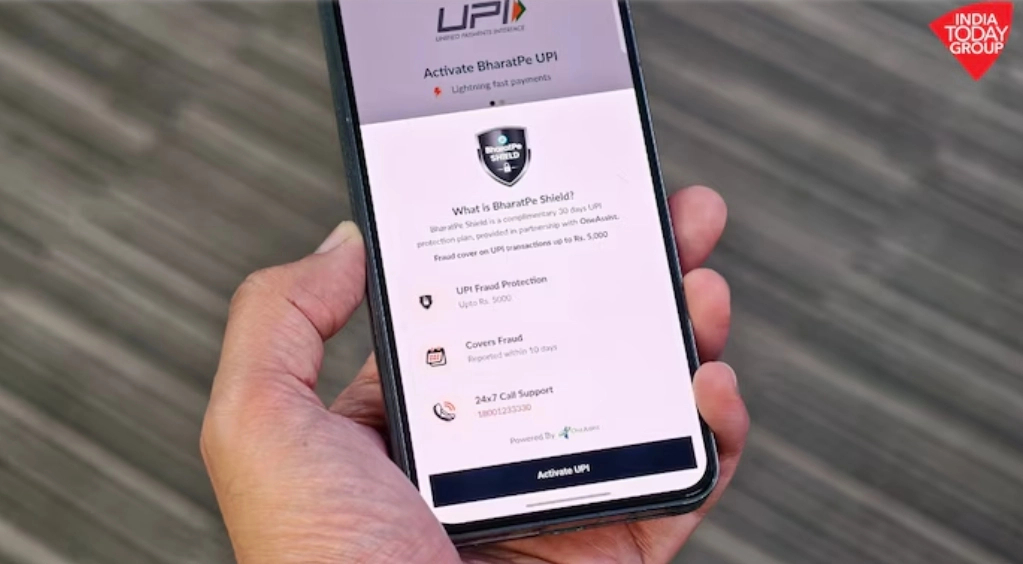

Earlier this month, BharatPe rolled out a new service called "Shield" to protect its users from the growing threat of UPI fraud. With online scams becoming more frequent, this initiative is a step toward ensuring safer digital transactions for everyone. Shield offers a comprehensive protection plan that safeguards users from fraud, phishing attempts, and unauthorised transactions, even if the user loses their phone.

What makes Shield appealing is its accessibility and affordability. For the first 30 days, users can enjoy the service for free. After the trial period, it costs just Rs 19 per month, which is a small price to pay for peace of mind. The plan provides coverage of up to Rs 5,000 against fraudulent activities.

Getting started with Shield is easy. The service is available on the BharatPe app, which can be downloaded on both Android and iOS devices. Users can activate Shield directly from the app’s homepage by clicking on the relevant banner. However, first-time users must make a payment of at least Rs 1 to any contact or business to activate the feature.

If a user faces a fraudulent situation, registering a claim is also straightforward. BharatPe has partnered with OneAssist to streamline the process. Users can either download the OneAssist app or call their toll-free number, 1800-123-3330, to report the incident.

However, there’s a crucial requirement — users must report the fraud within 10 days of it happening to be eligible for a claim. Depending on the situation, certain documents may need to be submitted, such as a UPI transaction statement, a copy of the police report or FIR, a claim form, and proof of blocking the UPI account. Additional documents might be required, depending on the nature of the fraud.

In today’s world, where digital payments have become a part of daily life, initiatives like Shield are a much-needed safety net. While this service provides valuable protection, users must still stay vigilant. Avoid clicking on unknown links, downloading apps from unverified sources, or sharing sensitive payment information with strangers. BharatPe’s Shield is a timely and thoughtful addition to the digital payment ecosystem. With an increasing number of people like you and me relying on UPI for everything from grocery shopping to bill payments, having a safety net like Shield is reassuring. While it can’t eliminate the risk, it’s a practical step toward making digital transactions safer for everyone.