Kotak Mahindra Bank reported a 10% rise in December quarter net profit to ₹3,305 crore from the year earlier on the back of steady interest income growth. Analysts tracked by Bloomberg had estimated profit after tax of ₹3,338 crore. The private lender had reported a profit of ₹3,005 crore in the same period last year.

Growth in loans and deposits exceeded those of banks that have announced their earnings thus far.

“Despite facing economic headwinds, we have achieved a 15% growth in advances and 16% growth in deposits,” said Ashok Vaswani, MD, Kotak Mahindra Bank. “We have maintained our margins and kept a very tight control on our expenses. Credit costs are beginning to show signs of plateauing, which is a positive indicator for us. In terms of macroeconomic activity, there is heightened volatility and evidence of a potential slowdown.”

Net interest income also grew 10% to ₹7,196 crore from ₹6,554 crore in the year-ago period. Net interest margin (NIM) was 4.93% for the December quarter.

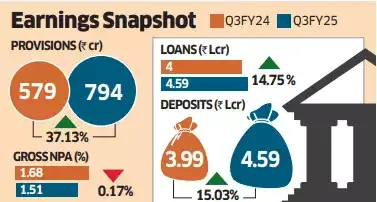

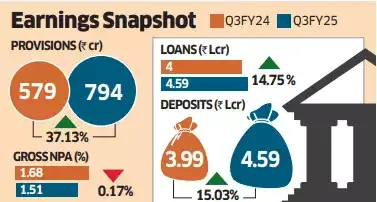

The gross non-performing asset (NPA) ratio was 1.51% at the end of the December quarter compared with 1.68% in the year before.

The net NPA ratio was 0.44% versus 0.36% in the year-ago quarter. Fresh slippages during the quarter came in at Rs 1,657 crore versus Rs 1,177 crore in the year ago. The lender wrote off loans worth Rs 662 crore versus a write-off of Rs 132 crore in the year-ago period.

Provisions and contingencies rose 37% on year to Rs 794 crore for the quarter. Customer assets rose 15% to Rs 4.59 lakh crore from Rs 4 lakh crore. Average total deposits grew 15% to Rs 4.59 lakh crore from Rs 3.99 lakh crore.

“Kotak reported a decent set of numbers as EPS (earnings per share) growth improved and credit and deposit growth stayed solid,” said Pranav Gundlapalle, India head for financials at Bernstein. “Loan and deposit growth at 15% and 16% year-on-year, respectively, were the key positives and sharply above the banks that have reported so far, especially in a quarter which saw system credit and deposit growth slow

The net NPA ratio was 0.44% versus 0.36% in the year-ago quarter. Fresh slippages during the quarter came in at ₹1,657 crore versus ₹1,177 crore in the year ago. The lender wrote off loans worth ₹662 crore versus a write-off of ₹132 crore in the year-ago period. Provisions and contingencies rose 37% on year to ₹794 crore for the quarter. Customer assets rose 15% to ₹4.59 lakh crore from ₹4 lakh crore. Average total deposits grew 15% to ₹4.59 lakh crore from ₹3.99 lakh crore. The bank management said that it continues to see stress in the credit card, microfinance and personal loan portfolio.

Budget with ET

Before Budget, Raghuram Rajan is worried about the big Indian middle class

How cities can drive India's sustainable urban development goal forward

Budget 2025 needs to help global electronic makers plan life outside China

“Despite facing economic headwinds, we have achieved a 15% growth in advances and 16% growth in deposits,” said Ashok Vaswani, MD, Kotak Mahindra Bank. “We have maintained our margins and kept a very tight control on our expenses. Credit costs are beginning to show signs of plateauing, which is a positive indicator for us. In terms of macroeconomic activity, there is heightened volatility and evidence of a potential slowdown.”

Net interest income also grew 10% to ₹7,196 crore from ₹6,554 crore in the year-ago period. Net interest margin (NIM) was 4.93% for the December quarter.

The gross non-performing asset (NPA) ratio was 1.51% at the end of the December quarter compared with 1.68% in the year before.

The net NPA ratio was 0.44% versus 0.36% in the year-ago quarter. Fresh slippages during the quarter came in at Rs 1,657 crore versus Rs 1,177 crore in the year ago. The lender wrote off loans worth Rs 662 crore versus a write-off of Rs 132 crore in the year-ago period.

Provisions and contingencies rose 37% on year to Rs 794 crore for the quarter. Customer assets rose 15% to Rs 4.59 lakh crore from Rs 4 lakh crore. Average total deposits grew 15% to Rs 4.59 lakh crore from Rs 3.99 lakh crore.

“Kotak reported a decent set of numbers as EPS (earnings per share) growth improved and credit and deposit growth stayed solid,” said Pranav Gundlapalle, India head for financials at Bernstein. “Loan and deposit growth at 15% and 16% year-on-year, respectively, were the key positives and sharply above the banks that have reported so far, especially in a quarter which saw system credit and deposit growth slow

The net NPA ratio was 0.44% versus 0.36% in the year-ago quarter. Fresh slippages during the quarter came in at ₹1,657 crore versus ₹1,177 crore in the year ago. The lender wrote off loans worth ₹662 crore versus a write-off of ₹132 crore in the year-ago period. Provisions and contingencies rose 37% on year to ₹794 crore for the quarter. Customer assets rose 15% to ₹4.59 lakh crore from ₹4 lakh crore. Average total deposits grew 15% to ₹4.59 lakh crore from ₹3.99 lakh crore. The bank management said that it continues to see stress in the credit card, microfinance and personal loan portfolio.