The state administration is putting in a lot of effort to reach income goals and deal with economic issues before the next fiscal year starts on April 1st, with just two months left in the current fiscal year 2024–2025.

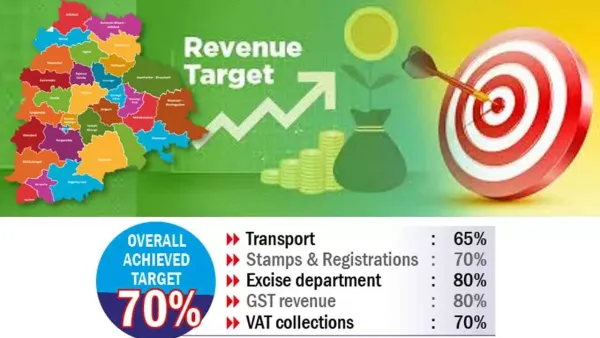

Only over 70% of the revenue objectives outlined in the budget outlay have been met by the government so far. State GST and liquor sales made major contributions among the five main revenue-generating sectors. However, a number of factors caused the state-owned tax revenue (SOTR) from property registrations, vehicle taxes, and VAT to fall short of expectations.

Officials clarified that although the revenue-generating agencies’ efforts produced results, they were not satisfactory because of a number of issues. The Commercial Taxes department’s capacity to reach revenue targets was impacted by problems including administrative roadblocks and a lack of employees. The government’s goal was to collect Rs 30,000 crore in VAT and Rs 39,300 crore in state GST. VAT collections barely hit roughly 70% of the goal, although GST income reached almost 80%. In order to fulfill expectations, efforts are being made to examine the reasons why the anticipated 80% objective has not been met and to rectify any weaknesses. Authorities said they were hopeful that outstanding GST payments from merchants would be paid by the end of March, bringing total income to more than 80% before the start of the next fiscal year.

Just 65% of the Rs 8,500 crore goal was met by the Transport department, which is in charge of collecting car taxes. According to officials, the growing popularity of electric cars, which result in fewer tax receipts, is partially to blame for the shortage.

In a similar vein, the Stamps & Registrations division, which also contributed significantly to income, had trouble reaching its goals. Collections were severely impacted by a downturn in the real estate market at the beginning of the fiscal year. The department has only made around 70% of its income goal of Rs 18,300 crore, even though there has been a resurgence in the last four months.

The Excise department proved to be a reliable performer, meeting 80% of its monthly goals. The government may, however, lower income projections by at least 30% if the other four main revenue-generating agencies fall short of 70% of their goals, according to authorities. The state’s financial situation in the next fiscal year would suffer as a result of such a change. In order to lessen the financial burden, authorities are nevertheless dedicated to increasing income collections in the next two months.