Mumbai: Aggressive investors in mutual funds eyeing a thematic bet could put money in banking sector funds as cheaper valuations provide a higher margin of safety in an uncertain market. Wealth managers recommend investors allocate 5-10% of their overall portfolio to banking funds.

"The Nifty Bank Index is trading below its historical P/B (Price to Book) average, with a trailing P/B of 2.2 times and a forward P/B of 1.9 times. These levels indicate attractive valuations, offering a potential entry point for long-term investors," said Milind Agrawal, fund manager at SBI Mutual Fund.

The price-to-earnings (PE) ratio of the Nifty Bank Index is at a 32% discount to that of the Nifty Index, which is below the long-term average of 13%. The Nifty Bank Index is also currently trading below its historical average PE levels.

Banking stocks have been underperformers in the past year with the Bank Nifty gaining 5.79% as against the 7.2% gains in the Nifty. In the past three years, the Nifty 50 gained 31.27% versus the bank Nifty 29.67%

The Nifty Bank Index has ended higher in 18 out of 25 calendar years, according to SBI Mutual Fund.

Fund managers said a recovery in the economy and improvement in liquidity will be key to the revival of banks' profitability.

"We expect system-level liquidity to improve, which could reduce pressure on the cost of money," said Agrawal. "Assuming the mix of assets doesn't change, the pressure on bank margins should start easing off."

Banking stocks have been under pressure because of slowing credit growth, asset quality concerns and pressure on margins. Investors are worried about lenders' exposures in the microfinance segment and unsecured loans. The third-quarter results of most large banks showed higher bad loans, rising credit costs and slower deposit growth.

Fund managers are hoping for a revival in demand soon.

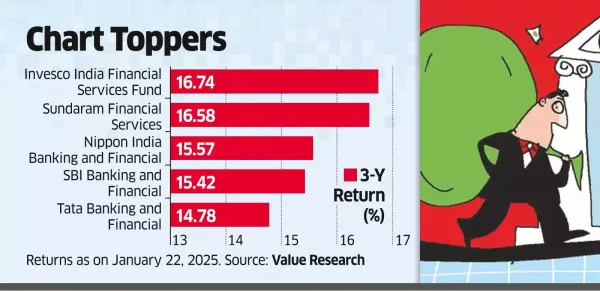

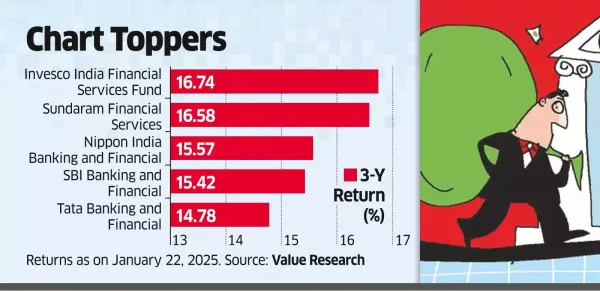

"Credit growth has bottomed out and we expect it to improve going forward," said Hiten Jain, fund manager at Invesco Mutual Fund. "Non-lending financial sector will continue to benefit from superior digital infrastructure."

Financial planners believe long-term investors could opt for actively managed banking funds, while those with a higher risk appetite could opt for a banking index fund.

"Diversified funds give exposure to the entire financialisation of the economy that includes banking, NBFC, insurance and capital markets plays, compared to the bank index fund that is tilted in favour of just private sector banks," said Harshvardhan Roongta, CFP at Roongta Securities.

Budget with ET

Rising Bharat may need to take center stage for India’s game-changing plans

Will Indian Railways accelerate to global standards with govt’s budgetary allocation?

Budget 2025 to catapult India's domestic manufacturing to a global scale

The price-to-earnings (PE) ratio of the Nifty Bank Index is at a 32% discount to that of the Nifty Index, which is below the long-term average of 13%. The Nifty Bank Index is also currently trading below its historical average PE levels.

Best MF to invest

Looking for the best mutual funds to invest? Here are our recommendations.

Banking stocks have been underperformers in the past year with the Bank Nifty gaining 5.79% as against the 7.2% gains in the Nifty. In the past three years, the Nifty 50 gained 31.27% versus the bank Nifty 29.67%

The Nifty Bank Index has ended higher in 18 out of 25 calendar years, according to SBI Mutual Fund.

Fund managers said a recovery in the economy and improvement in liquidity will be key to the revival of banks' profitability.

"We expect system-level liquidity to improve, which could reduce pressure on the cost of money," said Agrawal. "Assuming the mix of assets doesn't change, the pressure on bank margins should start easing off."

Banking stocks have been under pressure because of slowing credit growth, asset quality concerns and pressure on margins. Investors are worried about lenders' exposures in the microfinance segment and unsecured loans. The third-quarter results of most large banks showed higher bad loans, rising credit costs and slower deposit growth.

Fund managers are hoping for a revival in demand soon.

"Credit growth has bottomed out and we expect it to improve going forward," said Hiten Jain, fund manager at Invesco Mutual Fund. "Non-lending financial sector will continue to benefit from superior digital infrastructure."

Financial planners believe long-term investors could opt for actively managed banking funds, while those with a higher risk appetite could opt for a banking index fund.

"Diversified funds give exposure to the entire financialisation of the economy that includes banking, NBFC, insurance and capital markets plays, compared to the bank index fund that is tilted in favour of just private sector banks," said Harshvardhan Roongta, CFP at Roongta Securities.