The Enforcement Directorate will issue notices to buyers of Dubai properties to scan if they have violated foreign exchange laws and indulged in money laundering to acquire these offshore assets.

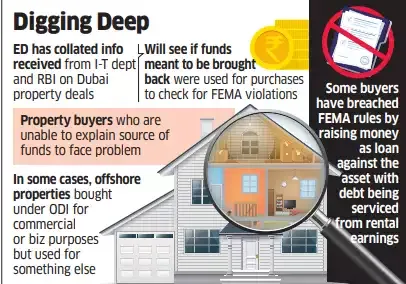

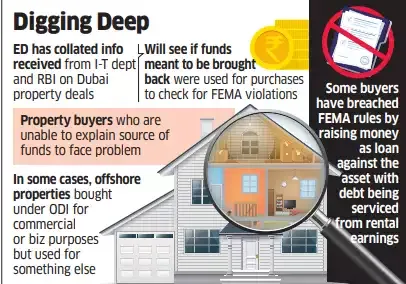

The central agency has collated information gathered from its sources with the data received from the Income Tax (I-T) department and the Reserve Bank of India. A probe has begun, official sources told ET.

Many Indian high net worth families have been swept up in the frenzy of the Dubai realty market where developers threw in lucrative offers like insignificant down payments with the balance to be paid out over a period of time. In the process many, and some unwittingly, have breached the foreign exchange currency regulations.

The ED would invoke the Prevention of Money Laundering Act (PMLA) in cases where the I-T department believes that there has been a violation of the black money law. In such instances, the latter would serve as the predicate offence for the ED to pursue a matter under PMLA.

There could be various transactions that could amount to flouting the Foreign Exchange Management Act: using export proceeds to buy properties instead of bringing the money back to India; investing funds received as gift from a non-resident relative to buy properties abroad; tapping the hawala channel (or irregular means to transfer foreign currency) to acquire overseas assets instead of using local banks to transfer funds abroad under the RBI’s liberalised remittance scheme (LRS).

LRS permits a resident individual to invest $250,000 a year to buy foreign securities and properties.

FEMA rules could have been flouted by utilising cryptocurrencies — either purchased on an overseas exchange or moved through the blockchain network to pay a UAE developer, many of whom accept cryptos with Dubai being positioned as a crypto hub.

Some buyers, probably ill-advised, are understood to have violated FEMA by entering into deals where part of the money has been raised as loan against the property with the debt being serviced from rental earnings.

“Clearly, the data relating to overseas assets has been shared with the ED office which will now ask for information from people in question. The ED has been given the power to call for information under section 37 read with section 133(6) of the Income-tax Act. Time will tell when the ED would take action against such parties who have contravened the provisions of FEMA,” said Rajesh P Shah, partner, at CA firm Jayantilal Thakkar and Company.

Besides targeting secret foreign assets, violations under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, commonly known as the black money Act, would include evading tax on income from unreported foreign sources.

Thus, buyers who are unable to demonstrate their source of funds used to buy Dubai properties would face the glare of the tax department as well as the ED.

Besides LRS, property acquisitions can also be under overseas direct investments by local companies buying a commercial space to carry out business activity or a residential apartment to house a director.

However, it would be a violation if the property is not used for the purpose it is meant for.

Budget with ET

Budget 2025: A CFO’s playbook for operational excellence and long-term growth

Rising Bharat may need to take center stage for India’s game-changing plans

Will Indian Railways accelerate to global standards with govt’s budgetary allocation?

Many Indian high net worth families have been swept up in the frenzy of the Dubai realty market where developers threw in lucrative offers like insignificant down payments with the balance to be paid out over a period of time. In the process many, and some unwittingly, have breached the foreign exchange currency regulations.

The ED would invoke the Prevention of Money Laundering Act (PMLA) in cases where the I-T department believes that there has been a violation of the black money law. In such instances, the latter would serve as the predicate offence for the ED to pursue a matter under PMLA.

There could be various transactions that could amount to flouting the Foreign Exchange Management Act: using export proceeds to buy properties instead of bringing the money back to India; investing funds received as gift from a non-resident relative to buy properties abroad; tapping the hawala channel (or irregular means to transfer foreign currency) to acquire overseas assets instead of using local banks to transfer funds abroad under the RBI’s liberalised remittance scheme (LRS).

LRS permits a resident individual to invest $250,000 a year to buy foreign securities and properties.

FEMA rules could have been flouted by utilising cryptocurrencies — either purchased on an overseas exchange or moved through the blockchain network to pay a UAE developer, many of whom accept cryptos with Dubai being positioned as a crypto hub.

Some buyers, probably ill-advised, are understood to have violated FEMA by entering into deals where part of the money has been raised as loan against the property with the debt being serviced from rental earnings.

“Clearly, the data relating to overseas assets has been shared with the ED office which will now ask for information from people in question. The ED has been given the power to call for information under section 37 read with section 133(6) of the Income-tax Act. Time will tell when the ED would take action against such parties who have contravened the provisions of FEMA,” said Rajesh P Shah, partner, at CA firm Jayantilal Thakkar and Company.

Besides targeting secret foreign assets, violations under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, commonly known as the black money Act, would include evading tax on income from unreported foreign sources.

Thus, buyers who are unable to demonstrate their source of funds used to buy Dubai properties would face the glare of the tax department as well as the ED.

Besides LRS, property acquisitions can also be under overseas direct investments by local companies buying a commercial space to carry out business activity or a residential apartment to house a director.

However, it would be a violation if the property is not used for the purpose it is meant for.