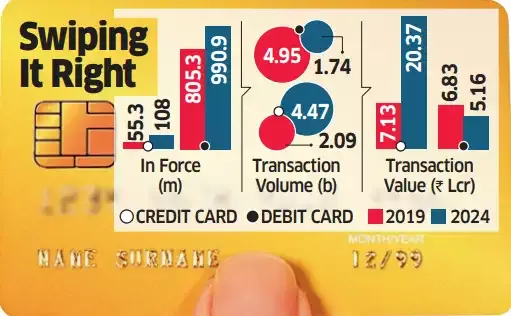

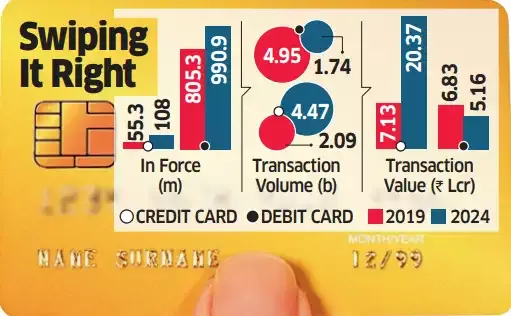

Mumbai: The number of credit cards in use in India has doubled in the past five years, with the value of transactions nearly tripling, according to the Payments System Report from the Reserve Bank of India.

The number of active credit cards in the market rose to 108 million by end of December 2024, from 55.3 million at the end of 2019, show RBI data.

The volume of credit card transactions rose to 4.47 billion, from about 2.09 billion in 2019, while the value of these transactions increased to ₹20.37 lakh crore, from ₹7.13 lakh crore.

The number of debit cards grew at a more modest pace, to 990.9 million from 805.3 million over the period. Debit card transaction volumes, meanwhile, shrank to nearly a third at 1.74 billion, from 4.95 billion.

Credit and debit cards have evolved at different paces to serve distinct financial needs of Indian consumers, the central bank noted. "Credit cards have become the go-to option for online spending, while debit cards are primarily used for cash withdrawals and everyday transactions. However, both are increasingly facing competition from emerging digital payment methods," the report stated. Despite the rise of the Unified Payments Interface (UPI), credit card usage has continued to grow at a steady pace of 15% annually in recent years.

“The marked increase in credit card spending highlights its growing acceptance among consumers, not just for transactions but also as a tool to access credit,” said Bhavesh Jain, managing director of TransUnion Cibil. “This presents an opportunity for lenders to identify consumers who need additional credit for aspirations, and offer customised, affordable solutions.”

By end of last year, outstanding personal loans totalled ₹57.34 lakh crore, reflecting 13.3% year-on-year growth, compared with a 30% increase in the prior period.

Meanwhile, outstanding credit card debt rose to ₹28.9 lakh crore, growing by more than 19%, although growth rate slowed from 34.2% in the previous year.

Debit card transaction values dropped from ₹6.83 lakh crore to ₹5.16 lakh crore during the same period.

Public sector banks saw their share of the debit card market decline from 69.7% — with 561 million cards in December 2019 — to 64.5%, with 639 million cards at the end of 2024. Private sector banks increased their market share from 21.3% with 171.2 million cards to 25% with 247.6 million cards in five years.

The number of credit cards issued by public sector banks more than doubled to 25.76 million, from 12.26 million as of December-end 2019. Private sector banks, who held a 71% market share with 76.6 million cards by end of 2024, have leaned on to digital solutions and co-branded cards to cater to urban and affluent customers, RBI said.

Budget with ET

India, get ready for the modern warfare of tomorrow

Women, youth, farmers and poor can continue to be Budget 2025's ‘roti, kapda aur makan’

Modi govt has a key task in Budget 2025: Unlocking the PLI goldmine

The volume of credit card transactions rose to 4.47 billion, from about 2.09 billion in 2019, while the value of these transactions increased to ₹20.37 lakh crore, from ₹7.13 lakh crore.

The number of debit cards grew at a more modest pace, to 990.9 million from 805.3 million over the period. Debit card transaction volumes, meanwhile, shrank to nearly a third at 1.74 billion, from 4.95 billion.

Credit and debit cards have evolved at different paces to serve distinct financial needs of Indian consumers, the central bank noted. "Credit cards have become the go-to option for online spending, while debit cards are primarily used for cash withdrawals and everyday transactions. However, both are increasingly facing competition from emerging digital payment methods," the report stated. Despite the rise of the Unified Payments Interface (UPI), credit card usage has continued to grow at a steady pace of 15% annually in recent years.

Credit Card Debt Up 19%

According to credit bureau TransUnion Cibil, there has been a slowdown in new originations for personal and consumer durable loans since March last year. This may have driven consumers to rely more on existing credit cards to meet consumption needs.“The marked increase in credit card spending highlights its growing acceptance among consumers, not just for transactions but also as a tool to access credit,” said Bhavesh Jain, managing director of TransUnion Cibil. “This presents an opportunity for lenders to identify consumers who need additional credit for aspirations, and offer customised, affordable solutions.”

By end of last year, outstanding personal loans totalled ₹57.34 lakh crore, reflecting 13.3% year-on-year growth, compared with a 30% increase in the prior period.

Meanwhile, outstanding credit card debt rose to ₹28.9 lakh crore, growing by more than 19%, although growth rate slowed from 34.2% in the previous year.

Debit card transaction values dropped from ₹6.83 lakh crore to ₹5.16 lakh crore during the same period.

Public sector banks saw their share of the debit card market decline from 69.7% — with 561 million cards in December 2019 — to 64.5%, with 639 million cards at the end of 2024. Private sector banks increased their market share from 21.3% with 171.2 million cards to 25% with 247.6 million cards in five years.

The number of credit cards issued by public sector banks more than doubled to 25.76 million, from 12.26 million as of December-end 2019. Private sector banks, who held a 71% market share with 76.6 million cards by end of 2024, have leaned on to digital solutions and co-branded cards to cater to urban and affluent customers, RBI said.